In the dynamic lending landscape, CRM for lending has emerged as a transformative tool, enabling lenders to foster stronger customer relationships, streamline operations, and make data-driven decisions. This comprehensive guide delves into the intricacies of CRM for lending, exploring its features, implementation strategies, and the myriad benefits it offers.

By harnessing the power of CRM, lenders can gain a holistic view of their customers, automate processes, and personalize communications, ultimately enhancing the overall lending experience.

Understanding CRM for Lending

Customer Relationship Management (CRM) plays a pivotal role in the lending industry, enabling lenders to foster stronger relationships with customers throughout the loan lifecycle. A CRM system serves as a centralized platform that captures, organizes, and analyzes customer data, providing lenders with valuable insights into customer behavior, preferences, and financial needs.

How CRM Enhances the Lending Process

- Lead Management:CRM systems streamline lead generation and qualification, allowing lenders to identify and prioritize potential borrowers.

- Loan Application Processing:CRM can automate loan application processing, reducing errors and expediting approvals.

- Customer Onboarding:CRM facilitates seamless customer onboarding by providing a personalized experience and ensuring compliance with regulations.

- Loan Servicing:CRM enables lenders to monitor loan performance, track payments, and provide timely support to borrowers.

Benefits of CRM for Lenders

- Improved Customer Satisfaction:CRM empowers lenders to deliver personalized and proactive customer service, enhancing customer satisfaction.

- Increased Efficiency:Automated processes and centralized data management streamline operations, reducing costs and improving efficiency.

- Enhanced Risk Management:CRM provides lenders with a comprehensive view of customer financial history, enabling them to assess risk more effectively.

- Data-Driven Decision Making:CRM analytics provide valuable insights into customer behavior and market trends, supporting data-driven decision making.

Features of a CRM for Lending

Customer relationship management (CRM) software is an essential tool for lending institutions. A CRM system can help lenders track and manage their relationships with customers, streamline operations, and improve customer experiences.

There are a number of essential features that a CRM for lending should have. These features include:

Contact Management, Crm for lending

- Centralized storage of customer data, including contact information, loan history, and other relevant information.

- Ability to track and manage customer interactions, such as phone calls, emails, and meetings.

- Tools for segmenting and targeting customers based on their needs and preferences.

Loan Management

- Tracking of loan applications, approvals, and disbursements.

- Management of loan payments, including scheduling and processing.

- Reporting on loan performance and delinquency.

Marketing Automation

- Tools for creating and sending marketing campaigns.

- Tracking of campaign performance and lead generation.

- Integration with social media and other marketing channels.

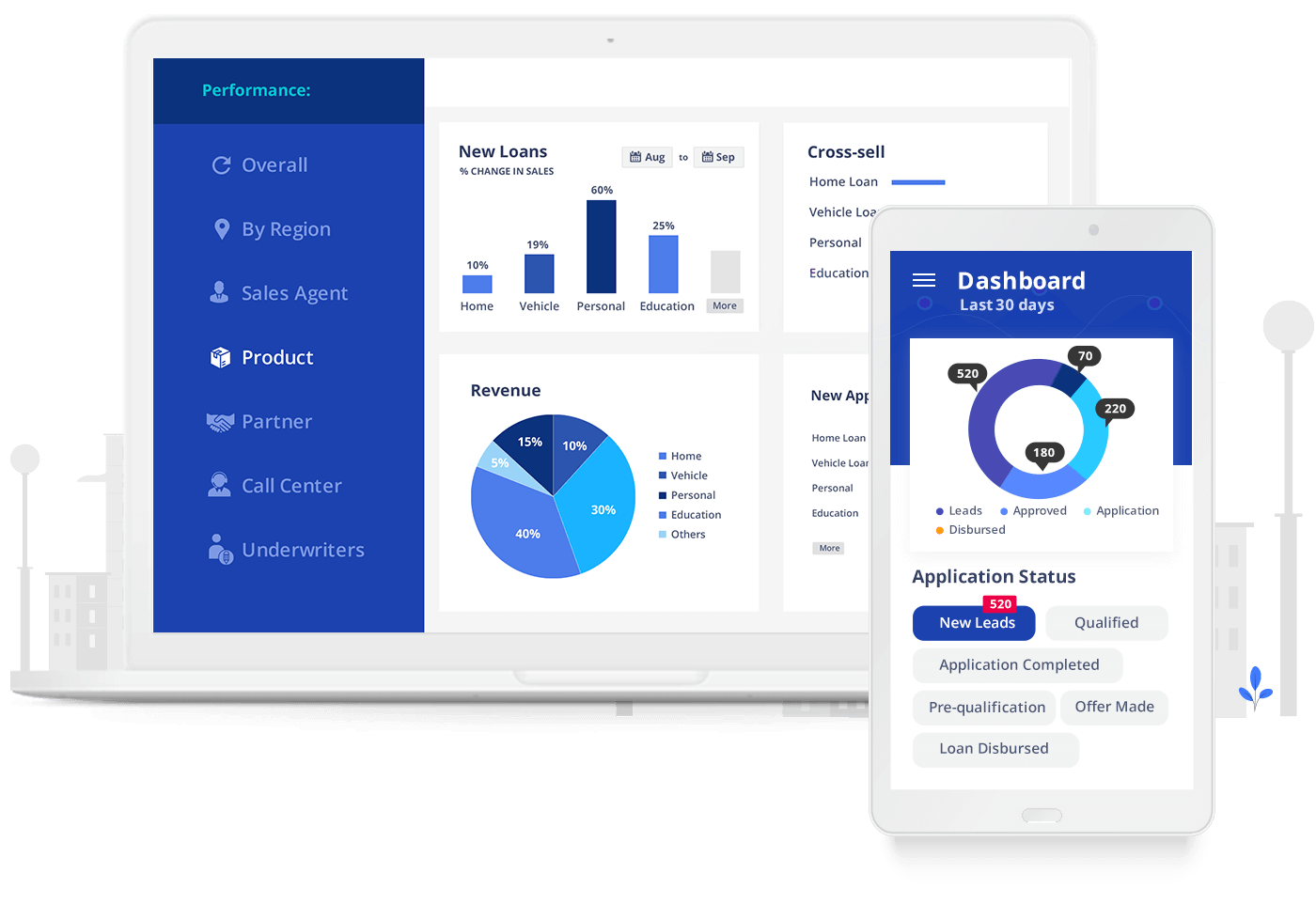

Reporting and Analytics

- Reporting on key metrics, such as loan volume, customer acquisition cost, and customer satisfaction.

- Ability to drill down into data to identify trends and opportunities.

- Use of data to make informed decisions about marketing, sales, and operations.

Integrating a CRM system with other lending systems, such as loan origination systems and core banking systems, is essential for streamlining operations and improving data accuracy. Integration allows data to flow seamlessly between systems, eliminating the need for manual data entry and reducing the risk of errors.

Implementation and Adoption

Effective implementation and adoption of a CRM for lending is crucial for realizing its full benefits. Here are some best practices and insights to guide you through this process:

To ensure a successful implementation, it’s essential to plan thoroughly, engage stakeholders, and establish clear goals and objectives. During implementation, lenders may encounter challenges such as data migration, process changes, and user resistance. Addressing these challenges proactively and communicating effectively throughout the process can help mitigate potential obstacles.

Training and User Adoption

Training staff on the CRM’s functionality and best practices is vital for user adoption. Provide comprehensive training programs, including hands-on exercises and role-based scenarios. Encourage user feedback and support to foster a positive experience. Consider implementing gamification or incentives to drive engagement and promote ongoing adoption.

Data Management and Analytics

Data management is crucial for CRM in lending as it provides a comprehensive view of customer interactions, loan applications, and repayment history. This data enables lenders to make informed decisions, improve customer service, and optimize lending operations.

Data that should be collected includes customer demographics, financial information, loan details, and communication history. Maintaining data quality is essential, ensuring accuracy, completeness, and consistency. Regular data cleansing and validation processes help eliminate errors and improve data reliability.

Analytics for Lending Insights

Analytics play a vital role in CRM for lending. By analyzing data, lenders can gain valuable insights into lending operations, identify trends, and make better decisions. Analytics can help:

- Predict loan defaults and identify high-risk borrowers

- Optimize loan pricing and terms to maximize profitability

- Identify cross-selling opportunities and offer personalized products/services

- Improve customer segmentation and target marketing campaigns

Customer Engagement and Communication

In the lending industry, building and maintaining strong customer relationships is crucial. A CRM system plays a pivotal role in enhancing customer engagement by providing a centralized platform to manage customer interactions, track communication history, and tailor personalized experiences.

Effective Communication Strategies

Effective communication is essential for building rapport with customers and fostering long-term relationships. A CRM system enables lenders to:

- Personalized communications:Send targeted emails, text messages, or letters based on customer preferences, loan status, or other relevant criteria.

- Automated outreach:Set up automated email sequences or reminders to nurture leads, provide updates on loan applications, or offer additional products and services.

- Multi-channel communication:Engage with customers through multiple channels, such as phone, email, live chat, or social media, to provide seamless and convenient support.

Automation and Personalization

Automation and personalization are key features of a CRM system that enhance customer engagement:

- Automated workflows:Automate repetitive tasks, such as sending welcome emails, scheduling appointments, or generating loan documents, to save time and improve efficiency.

- Personalized content:Use customer data to tailor marketing messages, loan recommendations, or educational resources to meet individual needs and preferences.

Reporting and Compliance: Crm For Lending

A CRM system streamlines reporting and compliance processes for lenders. It provides comprehensive reporting capabilities that enable lenders to track and analyze key performance indicators (KPIs), such as loan origination volume, conversion rates, and customer satisfaction. These reports help lenders identify areas for improvement and make informed decisions.

Report Generation

- Loan origination reports: Track the number of loans originated, loan amounts, and approval rates.

- Conversion rate reports: Measure the effectiveness of marketing campaigns and sales efforts by tracking the percentage of leads that convert into customers.

- Customer satisfaction reports: Collect feedback from customers to gauge their satisfaction levels and identify areas for improvement.

- Compliance reports: Generate reports that demonstrate compliance with regulatory requirements, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Audit Trails and Data Security

CRMs maintain audit trails that record all user actions within the system. This provides a detailed history of changes made to customer data, ensuring transparency and accountability. Additionally, CRMs employ robust data security measures to protect sensitive customer information from unauthorized access or breaches.

Epilogue

In conclusion, CRM for lending is a strategic investment that empowers lenders to navigate the evolving financial landscape with confidence. By leveraging its capabilities, lenders can unlock new opportunities for growth, improve operational efficiency, and forge enduring customer relationships.

FAQ Insights

What are the key features of a CRM for lending?

Essential features include customer data management, loan tracking, workflow automation, reporting and analytics, and integration with other lending systems.

How can CRM improve customer engagement in lending?

CRM enables personalized communication, proactive outreach, and tailored marketing campaigns, fostering stronger relationships and enhancing customer satisfaction.

What are the benefits of data analytics in CRM for lending?

Analytics provide insights into customer behavior, lending trends, and risk assessment, empowering lenders to make informed decisions and optimize their lending strategies.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY