Business term inventory days, a crucial metric in business operations, provide valuable insights into a company’s efficiency and financial health. This comprehensive guide delves into the concept, calculation, interpretation, and management of inventory days, exploring its significance and impact on business performance.

Understanding inventory days is essential for optimizing supply chain management, reducing costs, and maximizing profitability. This guide offers a deep dive into this important business metric, providing practical strategies and industry benchmarks to empower businesses in making informed decisions.

Inventory Days Overview

Inventory days is a key financial metric that measures the average number of days it takes a business to sell its inventory.

It is a critical indicator of a company’s efficiency in managing its inventory and plays a significant role in determining its profitability and overall financial health.

Significance in Business Operations, Business term inventory days

Inventory days is important because it helps businesses understand how effectively they are managing their inventory.

A high number of inventory days can indicate that a business is holding onto inventory for too long, which can lead to increased storage costs, spoilage, and obsolescence. Conversely, a low number of inventory days can indicate that a business is not holding enough inventory, which can lead to stockouts and lost sales.

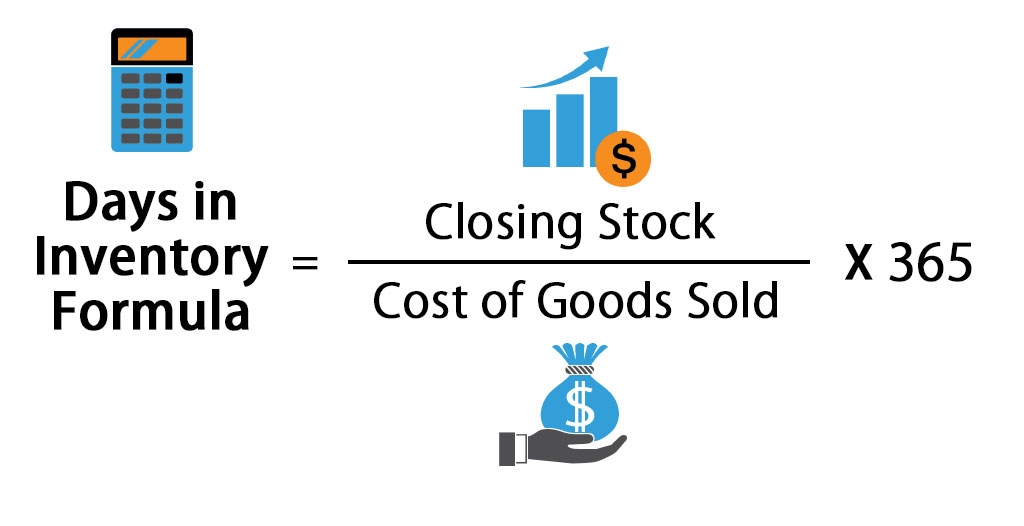

Calculation of Inventory Days

Inventory days, also known as days inventory outstanding (DIO), measure the average number of days a business holds inventory before selling it. A higher number of inventory days indicates that the business is holding inventory for a longer period, which can tie up cash flow and increase storage costs.

The formula for calculating inventory days is:

Inventory Days = (Average Inventory / Cost of Goods Sold) x 365

Where:

- Average Inventory = (Beginning Inventory + Ending Inventory) / 2

- Cost of Goods Sold (COGS) = The cost of the goods sold during the period

- 365 = The number of days in a year

The average inventory is used to smooth out fluctuations in inventory levels throughout the year. COGS represents the total cost of the goods sold during the period, which is directly related to the inventory turnover. The 365 factor converts the result into days.

Interpreting Inventory Days

Inventory days are a valuable metric for understanding how efficiently a business manages its inventory. High inventory days indicate that the business is holding on to inventory for an extended period, while low inventory days suggest that the business is quickly turning over its inventory.

High Inventory Days

High inventory days can be a sign of several issues, including:

- Overstocking: The business may have purchased more inventory than it can sell in a reasonable amount of time.

- Slow sales: The business may not be selling its inventory as quickly as it expected.

- Inefficient inventory management: The business may not have efficient processes in place for managing its inventory, leading to delays in inventory turnover.

Low Inventory Days

Low inventory days can also be a sign of several issues, including:

- Understocking: The business may not have enough inventory to meet customer demand.

- High sales: The business may be selling its inventory faster than it can replenish it.

- Efficient inventory management: The business may have efficient processes in place for managing its inventory, leading to a high inventory turnover rate.

Factors Influencing Inventory Days

Several factors can influence inventory days, including:

- Industry: Different industries have different inventory turnover rates. For example, businesses that sell perishable goods typically have lower inventory days than businesses that sell durable goods.

- Business model: Businesses that use a just-in-time inventory system typically have lower inventory days than businesses that use a traditional inventory system.

- Seasonality: Businesses that experience seasonal fluctuations in demand may have higher inventory days during off-season periods.

- Economic conditions: Economic downturns can lead to lower inventory days as businesses reduce their inventory levels to conserve cash.

Managing Inventory Days

Managing inventory days effectively is crucial for optimizing supply chain efficiency and minimizing costs. It involves striking a balance between holding too much or too little inventory.

Strategies for Optimizing Inventory Days

* Implement Just-in-Time (JIT) inventory management:JIT aims to minimize inventory levels by receiving and storing only the necessary inventory when needed, reducing carrying costs and improving cash flow.

Utilize inventory forecasting techniques

Accurate forecasting allows businesses to predict future demand and adjust inventory levels accordingly, preventing overstocking or stockouts.

Negotiate favorable supplier lead times

Shorter lead times enable businesses to respond quickly to changes in demand and reduce the need for holding large safety stocks.

Optimize inventory turnover rate

A higher inventory turnover rate indicates that inventory is being used efficiently and not sitting idle in warehouses.

Trade-offs of Holding Too Much or Too Little Inventory

* Holding too much inventory:

Increases carrying costs (storage, insurance, etc.)

Risk of obsolescence or damage

Reduced cash flow

Holding too little inventory

Potential for stockouts and lost sales

Higher ordering and transportation costs

Reduced customer satisfaction

Therefore, it is essential to find an optimal balance between these trade-offs to achieve efficient inventory management and maximize profitability.

Case Study Analysis

Let’s analyze the case study of ABC Company to understand how managing inventory days can impact operations.

ABC Company Case Study

ABC Company is a leading manufacturer of consumer electronics. The company faced challenges with high inventory levels, leading to increased storage costs and reduced cash flow.

To address this, ABC implemented strategies to reduce inventory days, including:

- Improved forecasting accuracy to reduce overstocking

- Optimized inventory levels through just-in-time (JIT) inventory management

- Implemented vendor-managed inventory (VMI) to streamline supply chain

As a result of these strategies, ABC Company significantly reduced its inventory days, resulting in:

- Lower storage costs

- Improved cash flow

- Increased operational efficiency

This case study demonstrates the positive impact of effective inventory days management on a company’s operations.

Industry Benchmarks

Inventory days can vary significantly across different industries, influenced by factors such as product type, production process, and customer demand.

Factors Contributing to Industry Variations

- Product Type:Durable goods, such as machinery and electronics, typically have longer inventory days than perishable goods like food and beverages.

- Production Process:Industries with complex or lengthy production processes, like manufacturing, tend to have higher inventory days to accommodate work-in-progress and finished goods.

- Customer Demand:Industries with highly seasonal or unpredictable demand patterns, such as retail, may require higher inventory days to meet fluctuating customer needs.

- Competition:In competitive markets, businesses may hold higher inventory levels to maintain market share and avoid stockouts.

Impact on Financial Statements: Business Term Inventory Days

Inventory days play a significant role in analyzing a company’s financial performance and liquidity. They are closely tied to several financial ratios, influencing profitability and liquidity ratios.

A high inventory days ratio indicates that a company is holding onto inventory for an extended period. This can lead to higher storage costs, obsolescence risks, and reduced inventory turnover. Consequently, it can negatively impact profitability and liquidity.

Profitability

- Inventory days affect profitability by influencing the cost of goods sold (COGS). A higher inventory days ratio means that the company incurs higher storage and financing costs for the inventory, which increases COGS and reduces profit margins.

- Furthermore, a high inventory days ratio can lead to obsolete or damaged inventory, resulting in write-offs and reduced profitability.

Liquidity

- Inventory days impact liquidity by tying up cash in inventory. A high inventory days ratio indicates that a company has a large portion of its assets invested in inventory, which reduces its liquidity and limits its ability to meet short-term obligations.

- This can lead to a cash crunch and financial distress if the company is unable to convert its inventory into cash quickly.

End of Discussion

In conclusion, business term inventory days serve as a valuable tool for businesses to assess their inventory management practices and make informed decisions. By effectively managing inventory days, companies can optimize their operations, reduce costs, and improve overall financial performance.

This guide provides a comprehensive understanding of this key metric, empowering businesses to leverage it for success.

FAQ Resource

What is the formula for calculating inventory days?

Inventory Days = (Average Inventory / Cost of Goods Sold) – 365

What do high inventory days indicate?

High inventory days may indicate excess inventory, inefficient inventory management, or slow sales.

How can I reduce inventory days?

Strategies to reduce inventory days include improving inventory forecasting, optimizing inventory levels, and negotiating better payment terms with suppliers.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY