Navigating the complexities of business taxes can be a daunting task, especially when it comes to handling returned inventory. This comprehensive guide delves into the nuances of business taxes report returned inventory as sale, providing a roadmap for businesses to understand the accounting implications, tax liabilities, and best practices associated with this practice.

By exploring real-world case studies and industry insights, we aim to equip businesses with the knowledge and strategies to optimize their returned inventory management, minimize tax burdens, and enhance operational efficiency.

Returned Inventory as Sale

Returned inventory can be treated as a sale in certain circumstances. This occurs when the customer returns the product and receives a refund or exchange, and the business records the transaction as a sale rather than a return.

There are several reasons why a business might choose to treat returned inventory as a sale. One reason is to simplify the accounting process. By recording the transaction as a sale, the business can avoid having to create a separate entry for the return.

Additionally, treating returned inventory as a sale can help to boost the business’s sales figures, which can be beneficial for financial reporting purposes.

Accounting Implications

There are several accounting implications to consider when treating returned inventory as a sale. First, the business must determine the value of the returned inventory. This can be done using the original purchase price, the current market value, or a combination of the two.

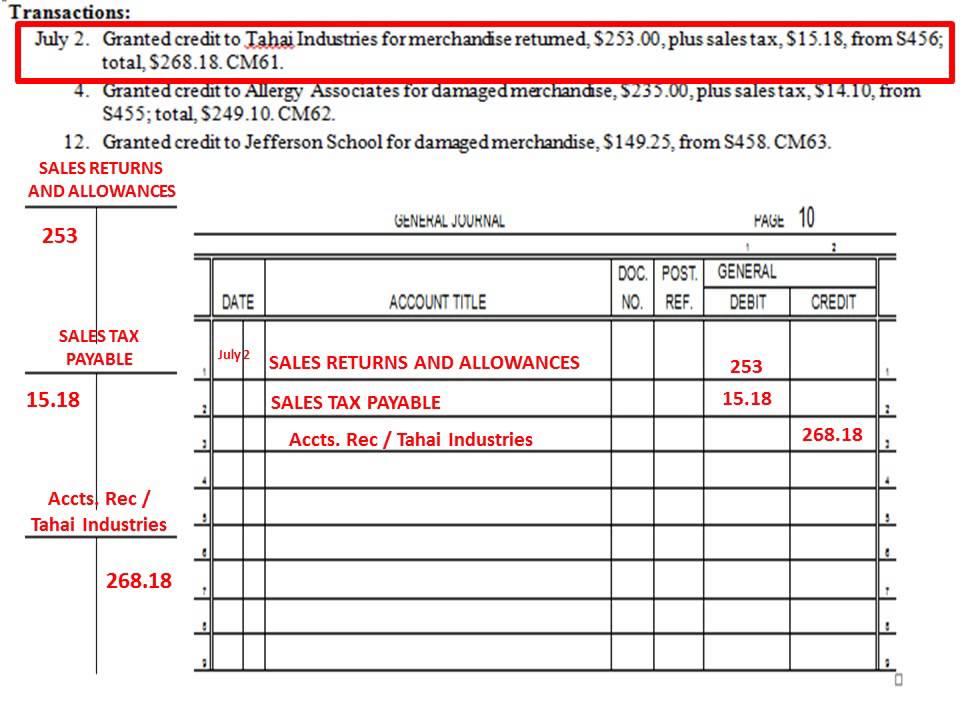

Once the value of the returned inventory has been determined, the business must record the transaction as a sale. This will involve creating a sales invoice and recording the transaction in the business’s accounting system.

The business must also consider the tax implications of treating returned inventory as a sale. In some cases, the business may be required to pay sales tax on the returned inventory. Additionally, the business may be able to claim a tax deduction for the returned inventory.

Examples

Here are a few examples of how returned inventory can be recorded as a sale:

- A customer returns a product to a store and receives a refund. The store records the transaction as a sale and returns the product to inventory.

- A customer exchanges a product for a different product. The store records the transaction as a sale and returns the original product to inventory.

- A customer returns a product to a store and receives a store credit. The store records the transaction as a sale and issues the customer a store credit.

Tax Implications of Returned Inventory

Reporting returned inventory as a sale can have significant tax implications. This practice can lead to potential tax liabilities and impact the overall financial position of a business. Understanding the tax consequences of this practice is crucial for businesses to mitigate risks and optimize their tax strategies.

Tax Liabilities

When returned inventory is reported as a sale, the business may recognize revenue that it has not ultimately earned. This can result in an overstatement of income and lead to higher tax liabilities. Additionally, the business may be liable for sales tax on the returned inventory, even if it is ultimately returned to the business.

If the returned inventory is not resold, the business may also be subject to inventory write-downs, which can further reduce its taxable income.

Minimizing Tax Impact, Business taxes report returned inventory as sale

Businesses can take steps to minimize the tax impact of returned inventory. One strategy is to establish a clear and consistent return policy that Artikels the conditions under which returns will be accepted. This policy should be communicated to customers to ensure transparency and minimize disputes.

Another strategy is to track returned inventory carefully and maintain accurate records of all returns. This will help the business identify patterns and trends in returns and make informed decisions about how to handle them. Businesses can also consider offering store credit or exchanges instead of cash refunds for returned items, which can reduce the potential tax liability.

Business Tax Reporting Considerations

Proper reporting of returned inventory on business tax returns is crucial for maintaining accuracy and compliance. Understanding the specific requirements and following best practices ensures businesses fulfill their tax obligations accurately and efficiently.

Specific Requirements for Reporting Returned Inventory

When inventory is returned by a customer, it must be accounted for in business tax reporting. The Internal Revenue Service (IRS) requires businesses to report returned inventory on their tax returns. This is done by reducing the amount of sales revenue and increasing the cost of goods sold.

The specific requirements for reporting returned inventory vary depending on the type of tax return being filed. For example, businesses that file Form 1040 must report returned inventory on Schedule C, while businesses that file Form 1120 must report returned inventory on Schedule D.

Completing Tax Forms Related to Returned Inventory

When completing tax forms related to returned inventory, it is important to be accurate and complete. This includes providing the following information:

- The date the inventory was returned

- The quantity of inventory returned

- The cost of the inventory returned

- The reason for the return

It is also important to keep records of all returned inventory transactions. This information can be used to support the information reported on tax returns.

Best Practices for Ensuring Accuracy and Compliance

There are a number of best practices that businesses can follow to ensure accuracy and compliance in business tax reporting. These include:

- Using a reliable accounting system to track inventory

- Reconciling inventory records regularly

- Training employees on how to handle returned inventory

- Reviewing tax returns carefully before filing them

By following these best practices, businesses can help to ensure that they are reporting returned inventory accurately and in compliance with tax laws.

Industry Standards and Best Practices: Business Taxes Report Returned Inventory As Sale

The handling of returned inventory as a sale is a crucial aspect of business tax reporting. To ensure compliance and optimize operations, it is essential to adhere to industry standards and best practices. These guidelines provide a framework for developing effective internal policies and procedures that streamline the management of returned inventory and minimize tax implications.

Key Factors for Policy Development

When establishing internal policies and procedures for returned inventory, several key factors should be considered:

- Return policy:Clearly define the conditions under which customers can return products, including the time frame, acceptable reasons, and any applicable restocking fees.

- Inventory tracking:Implement a robust system for tracking returned inventory, including the quantity, condition, and date of return.

- Tax implications:Understand the tax implications of returned inventory, including the potential for sales tax refunds or additional tax liability.

- Communication:Establish clear communication channels for customers to report returns and for internal departments to process and track them.

- Documentation:Maintain accurate records of all returned inventory transactions, including receipts, credit memos, and tax adjustments.

Recommendations for Optimizing Management

To optimize the management of returned inventory, consider implementing the following recommendations:

- Regular reviews:Conduct periodic reviews of returned inventory policies and procedures to ensure they are up-to-date and effective.

- Employee training:Provide training to employees on the proper handling of returned inventory, including tax implications and customer service.

- Automation:Utilize technology to automate the processing and tracking of returned inventory, reducing errors and improving efficiency.

- Collaboration:Foster collaboration between different departments, such as sales, customer service, and accounting, to ensure a smooth and coordinated approach to returned inventory management.

- Continuous improvement:Regularly evaluate the effectiveness of returned inventory management practices and make adjustments as needed to improve performance.

By adhering to industry standards and best practices, businesses can effectively handle returned inventory as a sale, minimize tax implications, and optimize their operations.

Case Studies and Examples

Various businesses have successfully navigated the challenges of returned inventory as a sale. These case studies provide valuable insights into the strategies and techniques used to minimize tax liabilities and improve operational efficiency.

Retail Sector

A leading retail chain implemented a comprehensive return policy that allowed customers to return items within a specified time frame, regardless of the reason. The company established clear guidelines for restocking returned inventory, including criteria for determining whether the items could be resold as new or had to be discounted or scrapped.

By carefully managing the returned inventory process, the retailer minimized losses and maximized the value of returned goods.

Manufacturing Industry

A manufacturing company faced challenges with returned inventory due to product defects. To address this issue, the company implemented a rigorous quality control process to reduce the number of defective products produced. Additionally, the company established a dedicated team to handle returned inventory, ensuring proper documentation and prompt resolution of customer complaints.

These measures significantly reduced the tax liability associated with returned inventory and improved customer satisfaction.

E-commerce Business

An e-commerce business experienced high return rates due to the nature of online shopping. To mitigate this, the company implemented a clear return policy that Artikeld the conditions for returns and the process for issuing refunds or exchanges. The company also partnered with a third-party logistics provider to streamline the return process and minimize shipping costs.

By optimizing the return process, the e-commerce business reduced the impact of returned inventory on its profitability.

Last Word

In the ever-evolving landscape of business taxation, staying abreast of the latest regulations and best practices is crucial. This guide serves as a valuable resource for businesses seeking to navigate the complexities of returned inventory reporting. By adhering to the principles Artikeld herein, businesses can ensure accuracy, compliance, and optimization in their tax reporting practices.

Clarifying Questions

What are the key accounting implications of treating returned inventory as a sale?

Treating returned inventory as a sale can impact the recognition of revenue, cost of goods sold, and inventory levels.

How can businesses minimize the tax impact of returned inventory?

Businesses can explore options such as negotiating return policies with customers, implementing restocking fees, or considering consignment arrangements.

What are some industry best practices for handling returned inventory as a sale?

Industry best practices include establishing clear return policies, implementing efficient inventory tracking systems, and partnering with reputable third-party logistics providers.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY