Business taxes giving away inventory – Navigating the complexities of business taxes on giving away inventory requires a comprehensive understanding of the implications, strategies, and legal considerations involved. This guide delves into the intricacies of inventory taxation, providing valuable insights for businesses seeking to optimize their tax liability while fulfilling their ethical and social responsibilities.

From exploring the various methods of inventory disposal to examining the tax consequences of donations and sales, this guide equips businesses with the knowledge necessary to make informed decisions regarding inventory management and tax compliance.

Overview of Business Taxes on Inventory

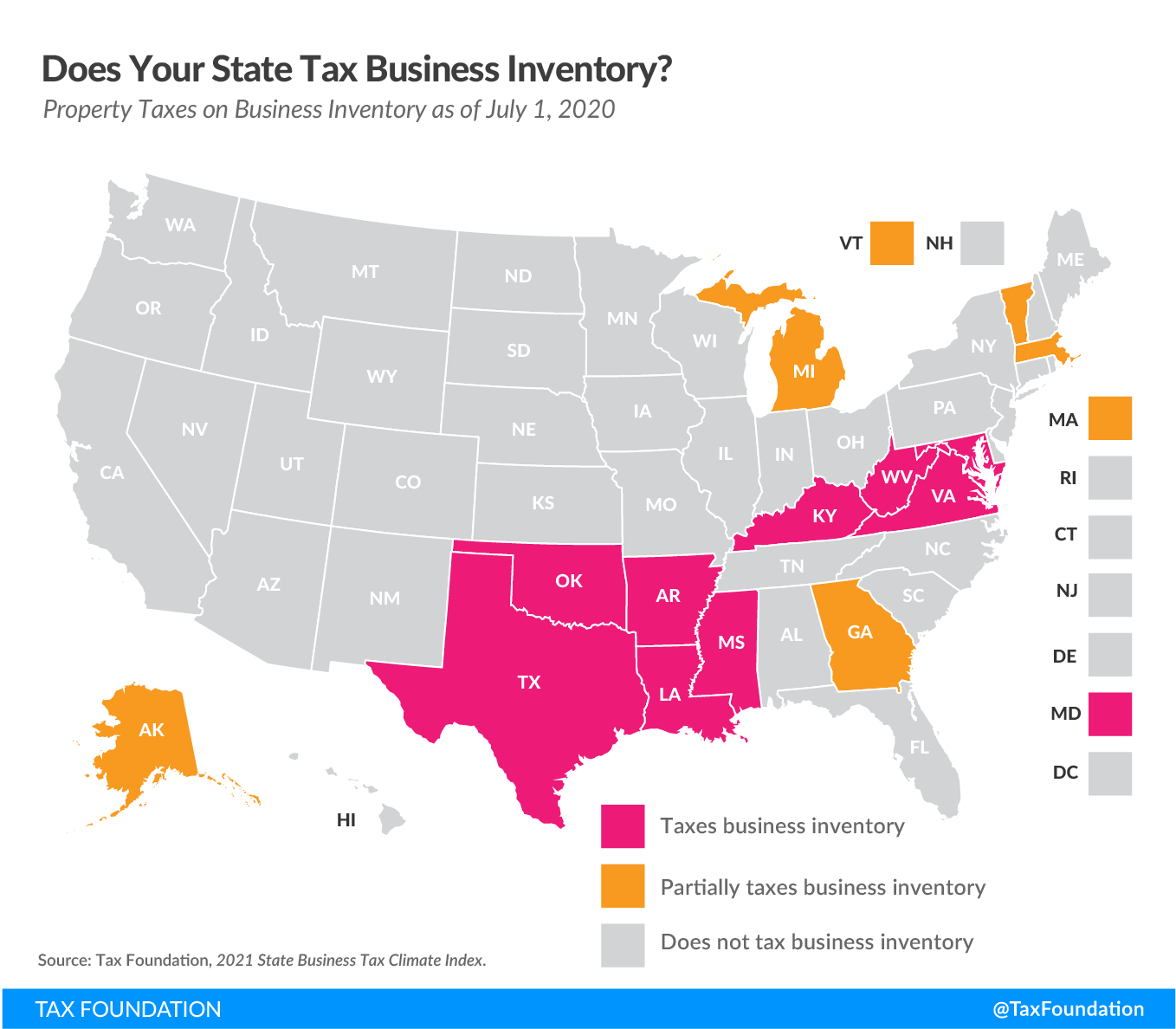

Businesses must pay taxes on the inventory they hold. Inventory taxes are a type of property tax that is levied on the value of goods that a business has on hand. The amount of tax owed is based on the assessed value of the inventory, which is typically determined by the cost of the goods plus any applicable sales tax.

There are several different types of inventory taxes, including:

- Ad valorem taxesare based on the value of the inventory.

- Specific taxesare based on the quantity of inventory.

- Use taxesare levied on inventory that is used in the production of goods or services.

Inventory taxes can have a significant impact on businesses. Businesses that hold large amounts of inventory may have to pay substantial taxes, which can reduce their profits. In addition, inventory taxes can make it more difficult for businesses to compete with businesses that are located in jurisdictions with lower tax rates.

Strategies for Giving Away Inventory

Businesses may choose to give away inventory for various reasons, such as clearing out excess stock, promoting their brand, or supporting charitable causes. Several methods are available for giving away inventory, each with its advantages and disadvantages.

Direct Donations

Direct donations involve giving inventory directly to charities, non-profit organizations, or individuals in need. This method allows businesses to make a positive social impact while reducing their inventory levels. However, it can be challenging to find suitable recipients and ensure that the inventory is distributed effectively.

Sales and Discounts

Businesses can offer sales or discounts on excess inventory to encourage customers to purchase it. This method helps generate revenue while clearing out stock. However, it may not be suitable for all types of inventory or may not generate enough revenue to cover storage and other costs.

Contests and Giveaways

Businesses can host contests or giveaways to generate excitement and attract new customers. This method can effectively promote the brand and build customer loyalty. However, it may require significant marketing efforts and can be challenging to ensure fair distribution of the inventory.

Partnerships and Collaborations

Businesses can partner with other organizations or influencers to give away inventory as part of joint promotions or charitable initiatives. This method can leverage the reach and credibility of the partners and enhance the impact of the giveaway. However, it requires careful coordination and may involve sharing profits or other benefits.

Examples of Successful Inventory Giveaways

Many businesses have successfully given away inventory to achieve various goals. For instance, Amazon has donated millions of books through its “Books for Kids” program. Coca-Cola has given away free samples of its new products through in-store promotions. TOMS Shoes has implemented a “One for One” model, giving away a pair of shoes for every pair purchased.

Tax Implications of Giving Away Inventory

Giving away inventory can have tax implications for businesses. It is important to understand these implications to avoid tax penalties.

When a business gives away inventory, it is considered a sale for tax purposes. This means that the business must report the fair market value of the inventory as income. The business can then deduct the cost of the inventory as a business expense.

Donating vs. Selling Inventory

If a business donates inventory to a qualified charity, it can deduct the fair market value of the inventory as a charitable contribution. This deduction is limited to 50% of the business’s taxable income. However, businesses can carry forward any unused charitable contribution deductions for up to five years.

If a business sells inventory to a charity for less than its fair market value, it can deduct the difference between the sale price and the fair market value as a charitable contribution. This deduction is also limited to 50% of the business’s taxable income.

Avoiding Tax Penalties, Business taxes giving away inventory

Businesses can avoid tax penalties by following these guidelines:

- Keep accurate records of all inventory donations, including the date of the donation, the fair market value of the inventory, and the name of the charity to which the donation was made.

- Get a written acknowledgment from the charity for each donation.

- File Form 8283, Noncash Charitable Contributions, with the business’s tax return.

Legal Considerations for Giving Away Inventory

When giving away inventory, it’s crucial to consider the legal implications to protect your business and avoid potential liabilities.

A written agreement is essential to clearly Artikel the terms of the giveaway, including the items being donated, the recipient’s responsibilities, and any conditions or restrictions. This agreement serves as legal documentation and helps prevent misunderstandings or disputes.

Protecting Your Business from Liability

- Due Diligence:Conduct thorough research on the recipient organization to ensure they are reputable and use the inventory responsibly.

- Liability Waivers:Include a liability waiver in the agreement to protect your business from any potential claims or damages arising from the use of the donated inventory.

- Proper Documentation:Keep detailed records of the giveaway, including the items donated, the recipient’s information, and the date of the donation.

- Compliance with Regulations:Ensure that the giveaway complies with all applicable laws and regulations, such as tax laws and environmental regulations.

Ethical and Social Responsibility

Businesses have an ethical and social responsibility to give back to the communities they operate in. Giving away inventory is one way businesses can fulfill this responsibility.

Donating inventory to charities or other non-profit organizations can help those in need. For example, a clothing store could donate unsold clothing to a homeless shelter or a food store could donate excess food to a food bank.

Benefits of Inventory Donations

- Help those in need

- Reduce waste

- Improve the community’s image

- Generate positive publicity

- Tax benefits

Examples of Businesses Using Inventory Donations

- Walmart has donated over $1 billion worth of food to food banks across the United States.

- Target has donated over $100 million worth of clothing and other household items to Goodwill.

- Amazon has donated over $100 million worth of books to schools and libraries.

Closure

In conclusion, understanding the intricacies of business taxes on giving away inventory empowers businesses to optimize their tax liability, fulfill their ethical obligations, and contribute positively to their communities. By carefully considering the strategies, tax implications, and legal considerations Artikeld in this guide, businesses can effectively manage their inventory and navigate the complexities of tax compliance.

Essential FAQs: Business Taxes Giving Away Inventory

What are the different methods of giving away inventory?

Businesses can give away inventory through donations to charities, sales at a reduced price, or scrapping and recycling.

What are the tax implications of donating inventory?

Donating inventory can result in a charitable deduction on business taxes, reducing the taxable income.

What legal considerations should businesses be aware of when giving away inventory?

Businesses should ensure they have a written agreement with the recipient and consider potential liability issues.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY