Business spending on inventories is a crucial aspect of supply chain management, influencing everything from cash flow to customer satisfaction. This comprehensive guide delves into the intricacies of inventory management, providing businesses with the knowledge and strategies to optimize their inventory levels, reduce costs, and enhance overall efficiency.

From understanding the role of inventory management to exploring various inventory valuation methods, this guide covers all the essential aspects of inventory management. It provides practical insights into inventory optimization strategies, forecasting techniques, and the impact of inventory costing techniques on business spending.

Business Inventory Management

Inventory management is crucial for businesses to optimize their spending and ensure efficient operations. It involves tracking, managing, and controlling the flow of goods from suppliers to customers.

Effective inventory management helps businesses minimize waste, reduce carrying costs, and improve customer satisfaction by ensuring product availability. Various methods are employed for inventory management, including:

Inventory Tracking Methods

- Periodic Inventory System:Physical inventory is counted at specific intervals (e.g., monthly, quarterly).

- Perpetual Inventory System:Inventory levels are continuously updated based on transactions (e.g., sales, purchases).

- Just-in-Time (JIT) Inventory:Goods are ordered and received only when needed, minimizing inventory holding costs.

Inventory Management Software

Inventory management software simplifies inventory tracking and management processes. Some popular options include:

- SAP Business One:Comprehensive ERP system with inventory management capabilities.

- NetSuite:Cloud-based ERP system with real-time inventory tracking.

- QuickBooks Online:Accounting software with integrated inventory management features.

These software solutions offer benefits such as:

- Automated inventory tracking

- Reorder point alerts

- Inventory optimization

- Cost control

Types of Business Inventories

Business inventories encompass various categories of goods held by companies for future sale or production. Understanding the types of inventories is crucial for optimizing inventory levels and managing business spending.

Different inventory types impact business spending in distinct ways, as each category has unique characteristics and costs associated with it. Companies must consider factors such as storage, handling, and obsolescence when managing inventory levels.

Raw Materials Inventory

Raw materials inventory consists of basic materials used in the production process. These materials have not yet undergone any significant transformation or processing. Managing raw materials inventory effectively helps ensure smooth production operations and minimizes disruptions caused by shortages.

Work-in-Progress Inventory

Work-in-progress inventory refers to partially completed goods that are still undergoing production. These goods have been transformed from raw materials but are not yet ready for sale. Optimizing work-in-progress inventory levels helps balance production efficiency with inventory carrying costs.

Finished Goods Inventory

Finished goods inventory comprises products that have been fully produced and are ready for sale to customers. Managing finished goods inventory involves striking a balance between meeting customer demand and minimizing the risk of overstocking or obsolescence.

Maintenance, Repair, and Operations (MRO) Inventory

MRO inventory includes spare parts, supplies, and materials used for maintenance, repair, and operations of equipment and facilities. Effective MRO inventory management helps minimize downtime and ensure smooth business operations.

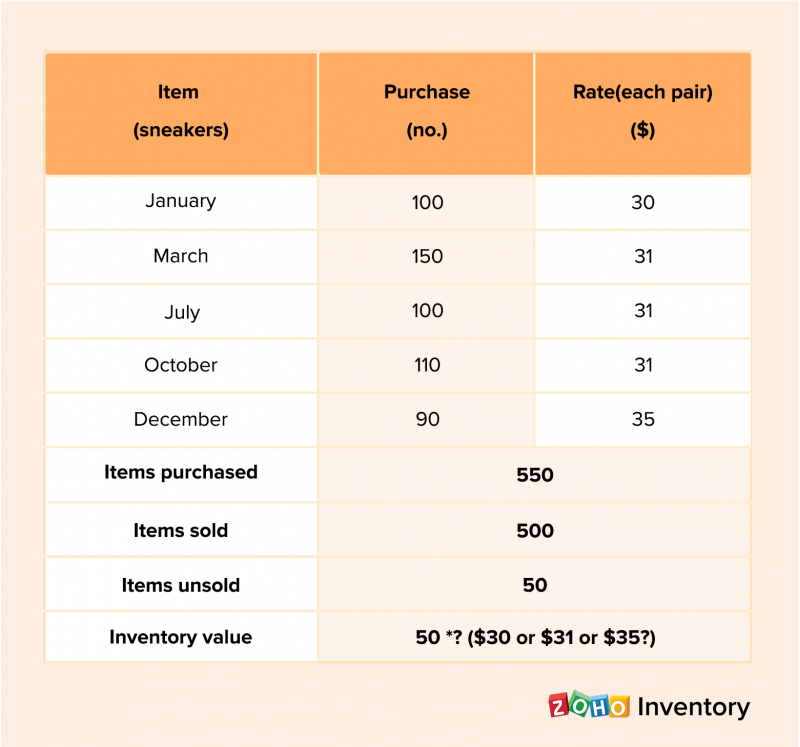

Inventory Valuation Methods

Inventory valuation methods are techniques used by businesses to determine the value of their inventory for accounting and financial reporting purposes. The choice of valuation method can significantly impact business spending, as it affects the cost of goods sold (COGS) and, consequently, the net income and profitability of the business.There are several commonly used inventory valuation methods, each with its advantages and disadvantages.

The most common methods include:

First-In, First-Out (FIFO)

- Assumes that the oldest inventory items are sold first.

- Inventory costs are matched to the revenue generated from the sale of those items.

- During periods of rising prices, FIFO results in higher COGS and lower net income.

- During periods of falling prices, FIFO results in lower COGS and higher net income.

Last-In, First-Out (LIFO)

- Assumes that the most recently acquired inventory items are sold first.

- Inventory costs are matched to the revenue generated from the sale of those items.

- During periods of rising prices, LIFO results in lower COGS and higher net income.

- During periods of falling prices, LIFO results in higher COGS and lower net income.

Weighted Average Cost (WAC), Business spending on inventories

- Calculates the average cost of inventory items based on their acquisition costs.

- This average cost is then used to value all inventory items.

- WAC results in a more stable COGS and net income compared to FIFO and LIFO.

Specific Identification

- Assigns a unique cost to each individual inventory item.

- This method is typically used for high-value or unique inventory items.

- Specific identification provides the most accurate valuation of inventory, but it can be time-consuming and complex to implement.

Lower of Cost or Market (LCM)

- Values inventory at the lower of its cost or its current market value.

- This method is used to ensure that inventory is not overstated on the balance sheet.

- LCM can result in inventory write-downs, which can impact net income and cash flow.

The choice of inventory valuation method depends on several factors, including the nature of the business, the type of inventory, and the financial reporting objectives. Businesses should carefully consider the advantages and disadvantages of each method before making a decision.

| Inventory Valuation Method | Advantages | Disadvantages |

|---|---|---|

| FIFO | – Matches inventory costs to revenue more accurately during periods of rising prices.

|

– May result in lower net income during periods of rising prices.

|

| LIFO | – Matches inventory costs to revenue more accurately during periods of falling prices.

|

– May result in lower net income during periods of falling prices.

|

| WAC | – Provides a more stable COGS and net income.

|

– May not accurately reflect the actual cost of inventory items.

|

| Specific Identification | – Provides the most accurate valuation of inventory.

|

– Time-consuming and complex to implement.

|

| LCM | – Ensures that inventory is not overstated on the balance sheet.

|

– May result in inventory undervaluation.

|

Inventory Costing Techniques

Inventory costing techniques are accounting methods used to assign a cost to inventory items. These techniques play a crucial role in determining the value of inventory on a company’s balance sheet and can significantly impact business spending.There are several inventory costing techniques available, each with its advantages and disadvantages.

The choice of technique depends on various factors, including the nature of the business, the industry, and the company’s accounting policies.

Factors to Consider When Choosing an Inventory Costing Technique

* Nature of the Business:The type of business and its operations can influence the choice of inventory costing technique. For example, a manufacturing company may use a different technique than a retail store.

Industry Standards

Certain industries may have established norms or preferred inventory costing techniques. Adhering to industry standards ensures consistency and comparability with competitors.

Accounting Policies

A company’s accounting policies dictate the specific inventory costing techniques that can be used. These policies are typically established to ensure consistency and accuracy in financial reporting.

Inventory Optimization Strategies

Inventory optimization is a critical aspect of business operations, enabling businesses to streamline their inventory management practices and minimize costs. By implementing effective inventory optimization strategies, businesses can reduce their inventory holding costs, improve cash flow, and enhance customer satisfaction.

Inventory optimization involves a comprehensive approach that encompasses various techniques and strategies, each tailored to the specific needs and characteristics of a business. Let’s explore some key inventory optimization strategies:

Just-in-Time (JIT) Inventory

- JIT is a lean manufacturing technique that aims to minimize inventory levels by producing products only when there is a customer order. This approach reduces storage costs, minimizes waste, and improves production efficiency.

Vendor Managed Inventory (VMI)

- VMI is a collaborative inventory management strategy where the supplier assumes responsibility for managing the inventory levels at the customer’s location. This approach improves inventory visibility, reduces stockouts, and optimizes supply chain efficiency.

Safety Stock Optimization

- Safety stock is the extra inventory held to buffer against unexpected demand fluctuations or supply chain disruptions. Inventory optimization involves determining the optimal safety stock levels to minimize the risk of stockouts while avoiding excessive inventory carrying costs.

Demand Forecasting and Planning

- Accurate demand forecasting is crucial for effective inventory management. Businesses can leverage historical data, market trends, and predictive analytics to forecast future demand and plan their inventory levels accordingly.

Inventory Replenishment Strategies

- Businesses can choose from various inventory replenishment strategies, such as fixed-order quantity, fixed-order interval, or periodic review. The optimal strategy depends on factors like demand patterns, lead times, and inventory carrying costs.

Effective Inventory Optimization can lead to significant cost reductions for businesses:

- Reduced inventory carrying costs

- Improved cash flow

- Minimized waste and obsolescence

- Enhanced customer satisfaction

Case Study: Amazon’s Inventory Optimization Success

- Amazon has implemented a highly sophisticated inventory optimization system that leverages machine learning and predictive analytics. This system enables Amazon to optimize its inventory levels across its vast distribution network, reducing carrying costs and improving customer service.

Inventory Forecasting Techniques

Inventory forecasting techniques are essential for businesses to plan for future spending. They help businesses predict the demand for their products and services, which in turn helps them determine how much inventory to keep on hand. There are a variety of inventory forecasting techniques available, each with its own advantages and disadvantages.

Accuracy and Complexity of Forecasting Methods

The accuracy of an inventory forecasting technique is determined by a number of factors, including the availability of historical data, the volatility of demand, and the length of the forecast horizon. The complexity of a forecasting technique refers to the amount of data and computational resources required to implement it.The following table compares the accuracy and complexity of different forecasting methods:| Forecasting Method | Accuracy | Complexity ||—|—|—|| Moving Average | Low | Low || Exponential Smoothing | Medium | Medium || Linear Regression | High | High || Machine Learning | High | High |

End of Discussion

In conclusion, business spending on inventories is a complex but essential aspect of business operations. By implementing effective inventory management strategies, businesses can optimize their inventory levels, reduce costs, improve customer service, and gain a competitive advantage in today’s dynamic market.

FAQ Resource: Business Spending On Inventories

What are the benefits of effective inventory management?

Effective inventory management can lead to reduced costs, improved customer satisfaction, increased sales, and enhanced overall business efficiency.

How can businesses optimize their inventory levels?

Businesses can optimize their inventory levels by implementing inventory optimization strategies such as ABC analysis, just-in-time inventory, and safety stock management.

What are the different inventory valuation methods?

Common inventory valuation methods include FIFO (first-in, first-out), LIFO (last-in, first-out), and weighted average cost.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY