The business screening inventory, a cornerstone of risk management, empowers organizations to proactively identify and mitigate potential threats. As a crucial tool for due diligence and compliance, it provides a systematic approach to evaluating the integrity and reliability of business partners, customers, and vendors.

Delving into the intricacies of business screening inventories, this comprehensive guide unravels their types, methodologies, components, applications, and future trends. By exploring the challenges and limitations associated with these inventories, we aim to equip readers with the knowledge and strategies necessary to harness their full potential.

Introduction

A business screening inventory is a comprehensive assessment of a company’s financial health, operations, and management practices.

Its purpose is to identify potential risks and opportunities, and to help businesses make informed decisions about their future.

Purpose of Business Screening Inventory

- Identify potential risks and opportunities

- Help businesses make informed decisions about their future

- Provide a baseline for future performance comparisons

- Identify areas for improvement

Importance of Business Screening Inventory

- Can help businesses avoid costly mistakes

- Can help businesses identify new opportunities

- Can help businesses improve their performance

- Can help businesses attract investors

Types of Business Screening Inventories

Business screening inventories categorize and assess various aspects of a business to evaluate its financial health, operational efficiency, and overall performance. They help identify potential risks and opportunities, enabling decision-makers to make informed choices.

Financial Screening Inventories

- Balance Sheet Analysis:Examines a company’s financial position by analyzing its assets, liabilities, and equity.

- Income Statement Analysis:Evaluates a company’s revenue, expenses, and profits over a specific period.

- Cash Flow Statement Analysis:Assesses a company’s cash inflows and outflows to determine its liquidity and financial stability.

Operational Screening Inventories

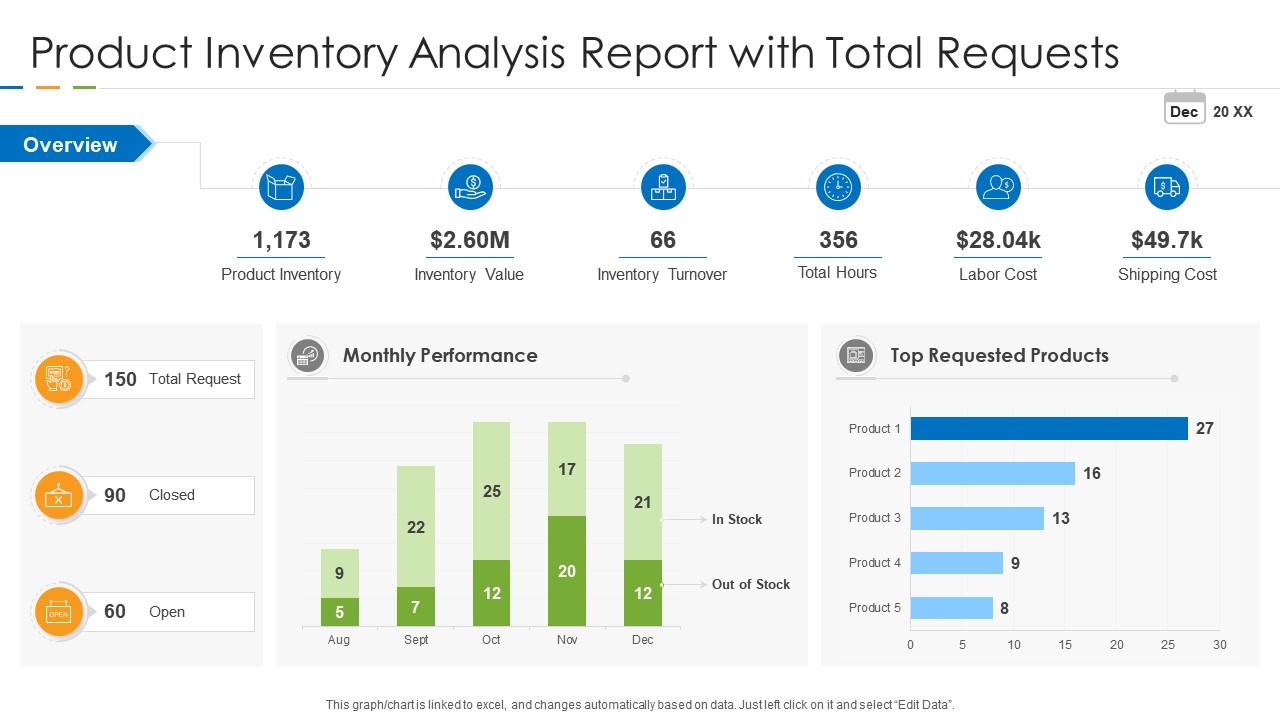

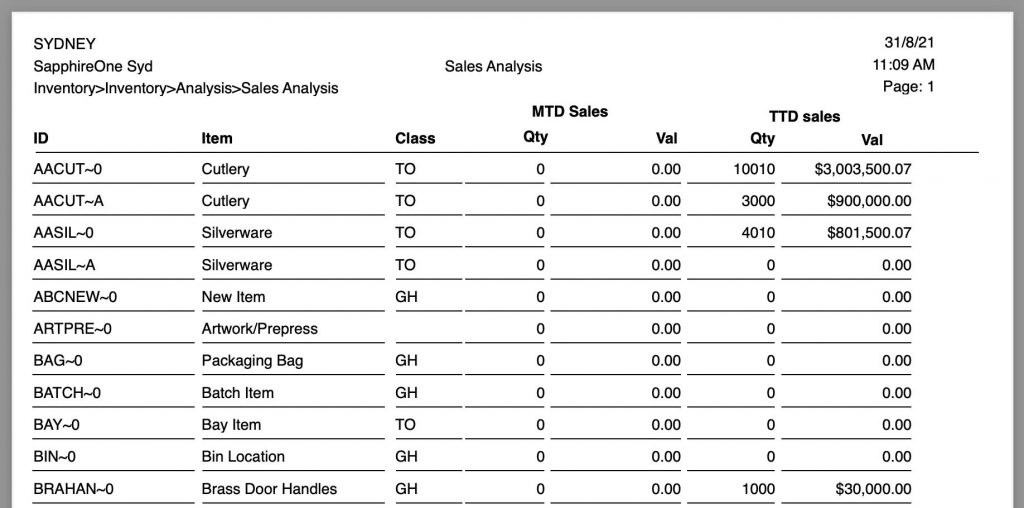

- Inventory Management Analysis:Reviews a company’s inventory levels, turnover rates, and carrying costs to assess efficiency and identify areas for improvement.

- Production Process Analysis:Examines a company’s production processes to identify bottlenecks, inefficiencies, and potential areas for optimization.

- Human Resource Management Analysis:Assesses a company’s workforce, talent management practices, and employee engagement levels.

Risk Screening Inventories

- Credit Risk Analysis:Evaluates a company’s ability to repay its debts and meet its financial obligations.

- Operational Risk Analysis:Identifies and assesses potential risks that could disrupt a company’s operations, such as natural disasters, supply chain disruptions, or cyberattacks.

- Compliance Risk Analysis:Examines a company’s adherence to regulatory requirements and industry standards.

Methods for Conducting Business Screening Inventories

Conducting business screening inventories is crucial for assessing potential risks and identifying opportunities. There are various methods available, each with its own advantages and disadvantages.

Interviews

Interviews involve direct conversations with key stakeholders, such as employees, managers, and customers. They allow for in-depth exploration of perspectives and insights, enabling a comprehensive understanding of the business.

- Pros:In-depth insights, personal connection.

- Cons:Time-consuming, potential for bias.

Questionnaires

Questionnaires are written or electronic surveys that gather data from a wider audience. They are efficient and cost-effective, providing quantifiable results.

- Pros:Efficient, quantifiable results.

- Cons:Limited depth, response rate issues.

Document Reviews

Document reviews involve examining existing business documents, such as financial statements, contracts, and employee records. They provide objective data and historical context.

- Pros:Objective data, historical context.

- Cons:Limited insights, potential for outdated information.

Observation

Observation involves observing the business in action, either directly or through video recordings. It provides real-time insights into operations and behaviors.

- Pros:Real-time insights, unbiased data.

- Cons:Can be intrusive, limited scope.

Data Analysis

Data analysis involves extracting insights from business data, such as sales records, customer feedback, and financial performance. It provides quantitative evidence and trends.

- Pros:Quantitative evidence, trends.

- Cons:Limited qualitative insights, data quality issues.

Components of Business Screening Inventories

Business screening inventories are comprehensive tools used to evaluate and assess businesses for various purposes. They consist of several key components, each playing a crucial role in providing a thorough understanding of the business’s financial health, operational efficiency, and overall risk profile.

The following are the key components of business screening inventories:

Financial Information

- Balance Sheet:Provides a snapshot of the business’s financial position at a specific point in time, showing its assets, liabilities, and equity.

- Income Statement:Summarizes the business’s revenue, expenses, and profits over a period of time, providing insights into its profitability and operational performance.

- Cash Flow Statement:Tracks the movement of cash within the business, indicating its ability to generate and manage cash flow.

Operational Information

- Management Team:Assesses the experience, qualifications, and track record of the business’s management team, which is crucial for evaluating their ability to lead the business effectively.

- Operations:Examines the business’s operations, including its production processes, supply chain management, and customer service capabilities, to assess its efficiency and effectiveness.

- Industry Analysis:Evaluates the industry in which the business operates, including its competitive landscape, market trends, and regulatory environment, to assess the business’s competitive position and potential risks.

Risk Assessment

- Credit Risk:Assesses the business’s ability to meet its financial obligations, considering factors such as its debt-to-equity ratio, cash flow, and payment history.

- Operational Risk:Identifies and evaluates potential operational risks that could disrupt the business’s operations, such as supply chain disruptions, technology failures, or natural disasters.

- Compliance Risk:Assesses the business’s compliance with applicable laws and regulations, including environmental, labor, and tax laws, to identify potential legal liabilities and reputational risks.

Applications of Business Screening Inventories: Business Screening Inventory

Business screening inventories serve as valuable tools for various purposes within organizations, including:

Pre-Acquisition Screening

When considering acquisitions, companies use business screening inventories to assess the target company’s financial health, operational efficiency, and overall business risk.

Due Diligence

During the due diligence process, business screening inventories provide insights into the target company’s assets, liabilities, and other relevant information to facilitate informed decision-making.

Performance Management

Organizations use business screening inventories to evaluate the performance of existing business units or divisions, identify areas for improvement, and make data-driven decisions.

Risk Management

Business screening inventories assist in identifying potential risks within an organization, allowing management to develop appropriate mitigation strategies.

Benefits and Limitations, Business screening inventory

Business screening inventories offer several benefits, including:

- Objective and standardized evaluation process

- Identification of potential risks and opportunities

- Facilitation of informed decision-making

However, it’s important to consider the limitations as well:

- May not capture all relevant factors

- Can be time-consuming and resource-intensive

- Relies on the accuracy of the data provided

Challenges and Limitations of Business Screening Inventories

Business screening inventories, while valuable tools, are not without their challenges and limitations. Recognizing these limitations is crucial for effective utilization and accurate interpretation of the results.

One common challenge is the potential for bias or subjectivity in the screening process. Raters’ personal experiences, beliefs, and biases can influence their evaluations, leading to inconsistent or inaccurate assessments. To mitigate this, it’s essential to use standardized screening tools and ensure raters are trained and calibrated to minimize subjectivity.

Data Accuracy and Reliability

The accuracy and reliability of business screening inventories can also be affected by the quality of the data collected. Inaccurate or incomplete information can compromise the validity of the results. To ensure data accuracy, it’s important to use reliable data sources and employ rigorous data collection methods.

Time and Resource Constraints

Conducting business screening inventories can be time-consuming and resource-intensive, especially for large organizations. The time and effort required for data collection, analysis, and interpretation can be a challenge. To address this, organizations should carefully consider the scope and objectives of the screening process and allocate appropriate resources.

Resistance from Employees

Employees may resist or be apprehensive about participating in business screening inventories, perceiving them as intrusive or judgmental. This resistance can affect the accuracy and completeness of the data collected. To overcome this, it’s important to communicate the purpose and benefits of the screening process to employees, ensuring they understand its value and confidentiality.

Future Trends in Business Screening Inventories

The future of business screening inventories is expected to be driven by technological advancements, globalization, and changing business practices. As organizations seek to enhance their efficiency, accuracy, and compliance, the demand for innovative and comprehensive screening solutions is anticipated to grow.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing various industries, including business screening. AI-powered screening tools can automate time-consuming tasks, improve data analysis, and identify potential risks with greater accuracy and efficiency. ML algorithms can learn from historical data and adapt to changing risk patterns, enabling organizations to make more informed decisions.

Cloud-Based Solutions

Cloud-based business screening inventories offer numerous benefits, such as scalability, accessibility, and cost-effectiveness. Organizations can access screening services from anywhere with an internet connection, eliminating the need for on-premise infrastructure. Cloud-based solutions also facilitate collaboration and data sharing among multiple stakeholders.

Integration with Other Systems

Business screening inventories are becoming increasingly integrated with other enterprise systems, such as customer relationship management (CRM) and enterprise resource planning (ERP) systems. This integration allows for seamless data transfer and automated screening processes, reducing manual effort and improving overall efficiency.

Globalization and Compliance

Globalization has led to increased cross-border transactions and complex regulatory landscapes. Business screening inventories must adapt to meet the compliance requirements of different jurisdictions and ensure that organizations can conduct business globally with confidence.

Predictive Analytics

Predictive analytics is becoming an integral part of business screening inventories. By leveraging historical data and advanced algorithms, organizations can identify potential risks and vulnerabilities before they materialize. This proactive approach enables organizations to take preemptive measures and mitigate risks effectively.

Conclusion

In the ever-evolving landscape of risk management, business screening inventories continue to play a pivotal role. As organizations navigate an increasingly complex global marketplace, the need for robust and effective screening processes becomes paramount. By embracing innovative technologies and staying abreast of emerging trends, businesses can leverage the power of business screening inventories to safeguard their reputation, protect their assets, and foster sustainable growth.

Question & Answer Hub

What is the purpose of a business screening inventory?

A business screening inventory is a comprehensive tool used to evaluate the integrity and reliability of potential business partners, customers, and vendors. It helps organizations identify and mitigate risks associated with these relationships, ensuring compliance with regulatory requirements and protecting their reputation.

What are the different types of business screening inventories?

There are various types of business screening inventories, including watchlist screening, sanctions screening, adverse media screening, and political exposure screening. Each type focuses on specific risk areas and utilizes different data sources to assess potential threats.

How are business screening inventories conducted?

Business screening inventories can be conducted manually or through automated systems. Manual screening involves reviewing data sources such as public records, news articles, and social media profiles. Automated systems leverage sophisticated algorithms and databases to expedite the screening process and enhance accuracy.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY