As business sales to buy more inventory taxes takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. Business sales tax on inventory purchases is a complex topic with many nuances, but we’ll break it down in a way that’s easy to understand.

The content of the second paragraph that provides descriptive and clear information about the topic

Business Sales Tax on Inventory Purchases

Business sales tax is a tax imposed on the sale of goods and services. It is typically collected by the state or local government where the sale takes place. Businesses are required to collect sales tax from their customers and remit it to the appropriate tax authority.

Inventory purchases are subject to sales tax in most states. The tax rate varies depending on the state and the type of inventory being purchased. For example, some states have a lower sales tax rate for food and clothing than for other types of goods.

Calculating Sales Tax on Inventory Purchases

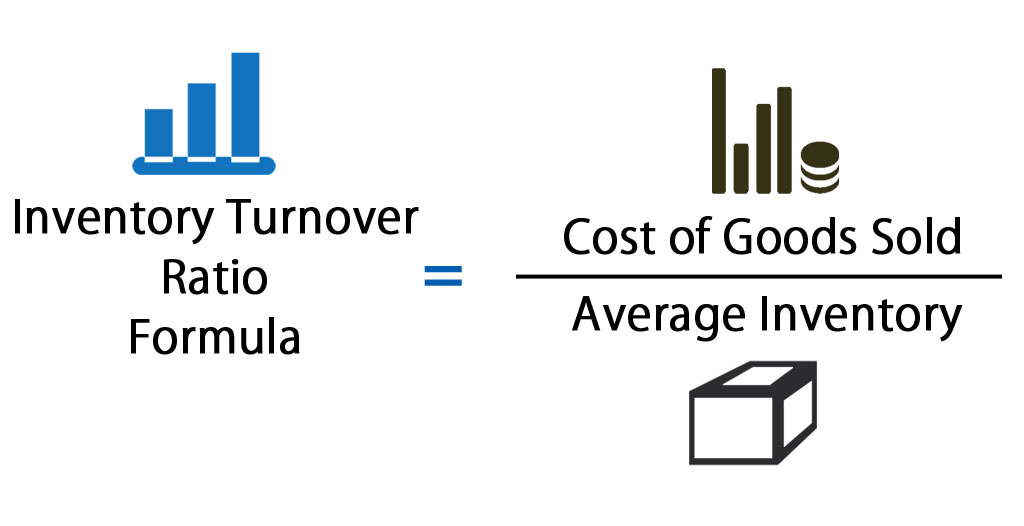

To calculate the sales tax on inventory purchases, businesses must first determine the taxable amount. The taxable amount is the total cost of the inventory, including shipping and handling costs. Once the taxable amount has been determined, the business must multiply the taxable amount by the applicable sales tax rate to calculate the sales tax due.

For example, if a business purchases $1,000 worth of inventory and the applicable sales tax rate is 6%, the sales tax due would be $60.

Impact of Business Sales Tax on Inventory Management

Business sales tax has a significant impact on inventory management decisions. Businesses need to be aware of the sales tax implications of their inventory levels to minimize their tax liability.One way businesses can optimize inventory levels is to keep safety stock to a minimum.

Safety stock is inventory that is held in reserve to meet unexpected demand. However, holding too much safety stock can increase the business’s sales tax liability.Another way businesses can optimize inventory levels is to use a just-in-time (JIT) inventory system.

A JIT system is an inventory management system that minimizes the amount of inventory on hand. This can reduce the business’s sales tax liability because the business is only paying sales tax on the inventory that it has sold.Businesses with multiple locations in different sales tax jurisdictions need to be aware of the sales tax rates in each jurisdiction.

This is because the business is required to collect and remit sales tax on the inventory that it sells in each jurisdiction.

Tax Exemptions for Business Sales on Inventory: Business Sales To Buy More Inventory Taxes

Businesses may qualify for tax exemptions on their inventory purchases, reducing their overall tax burden. These exemptions vary depending on the jurisdiction and type of business, but common categories include:

Sales for Resale

- Purchases of inventory intended for resale in the same form or as a component of a new product are generally exempt from sales tax.

- Businesses must provide proof of resale, such as a resale certificate or exemption certificate, to claim this exemption.

- Examples include retailers, wholesalers, and manufacturers who purchase raw materials or finished goods for resale.

Non-Profit Organizations

- Non-profit organizations are typically exempt from sales tax on inventory purchases used for their charitable or educational purposes.

- They must have a valid tax-exempt status and provide proof of their non-profit status to claim this exemption.

- Examples include schools, hospitals, and religious organizations.

Agricultural Products

- Purchases of agricultural products, such as livestock, seeds, and fertilizers, may be exempt from sales tax in certain jurisdictions.

- Farmers and agricultural businesses must meet specific criteria, such as being engaged in agricultural production, to qualify for this exemption.

- Examples include farmers, ranchers, and nurseries.

Reporting and Compliance for Business Sales Tax on Inventory

Businesses are obligated to adhere to specific reporting and compliance requirements when it comes to sales tax on inventory purchases. Understanding these requirements is crucial to avoid penalties and ensure proper tax management.

Reporting Requirements

Businesses are required to file periodic sales tax returns, typically on a monthly or quarterly basis, depending on the jurisdiction. These returns detail the amount of sales tax collected on inventory purchases during the reporting period.

Penalties for Non-Compliance, Business sales to buy more inventory taxes

Failure to comply with sales tax regulations can result in severe penalties, including fines, interest charges, and even criminal prosecution in certain cases. It is essential to stay up-to-date with the applicable tax laws and regulations to avoid these consequences.

Best Practices

To maintain accurate sales tax records and ensure timely filing of returns, businesses should implement the following best practices:

- Keep detailed records of all inventory purchases, including the date, vendor, invoice number, and amount of sales tax paid.

- Establish a system for tracking sales tax liability on inventory purchases and file returns promptly.

- Consider using accounting software or consulting with a tax professional to assist with sales tax compliance.

By adhering to these reporting and compliance requirements, businesses can avoid potential penalties and ensure the accuracy of their sales tax records.

Tax Planning for Business Sales on Inventory

Businesses can engage in tax planning strategies to minimize their sales tax liability on inventory purchases. These strategies can involve utilizing tax-advantaged structures, such as limited liability companies (LLCs) and S corporations.

Tax-Advantaged Structures

LLCs and S corporations offer pass-through taxation, meaning the business’s income and losses are passed through to the owners and reported on their personal tax returns. This structure can be advantageous for businesses that make large inventory purchases because it allows them to avoid paying corporate income tax on the profits from those purchases.

Example

For example, a business that purchases $100,000 of inventory and sells it for $150,000 would typically owe $15,000 in corporate income tax on the $50,000 profit. However, if the business were structured as an LLC or S corporation, the profit would be passed through to the owners and taxed at their individual income tax rates, which could result in significant tax savings.

Epilogue

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Resource

What is business sales tax?

Business sales tax is a tax levied on the sale of goods or services. It is typically collected by the seller and remitted to the government.

How does business sales tax apply to inventory purchases?

When a business purchases inventory, it is generally subject to sales tax. The amount of sales tax due will vary depending on the jurisdiction in which the purchase is made.

Are there any exemptions to business sales tax on inventory purchases?

Yes, there are a number of exemptions to business sales tax on inventory purchases. These exemptions vary from jurisdiction to jurisdiction.

What are the penalties for non-compliance with sales tax regulations?

The penalties for non-compliance with sales tax regulations vary from jurisdiction to jurisdiction. However, they can be significant.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY