Business property taxable inventory rate oklahoma – In the realm of business property taxation, Oklahoma’s taxable inventory rate holds a pivotal position. This comprehensive analysis delves into the intricacies of this rate, examining its determination, application, and the impact it wields on businesses within the state. Through a blend of clarity and engaging prose, we unravel the complexities surrounding this crucial aspect of Oklahoma’s tax landscape.

Oklahoma’s business property taxable inventory rate plays a significant role in shaping the operational landscape for businesses. By understanding how this rate is calculated and applied, business owners can make informed decisions that optimize their tax liability and enhance their profitability.

Our exploration delves into the nuances of this rate, empowering businesses with the knowledge to navigate the complexities of Oklahoma’s tax system.

Business Property Taxable Inventory Rate in Oklahoma

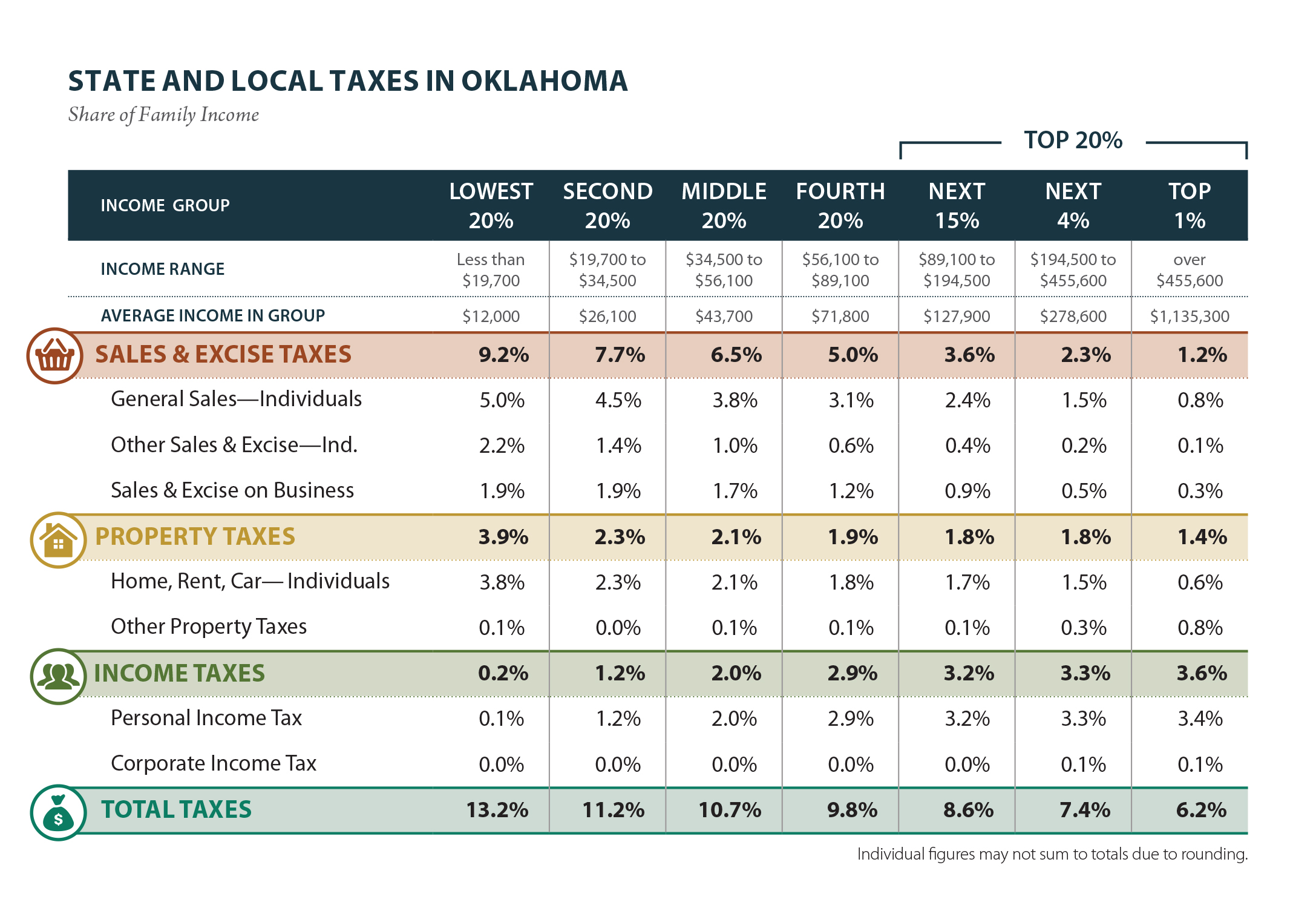

Oklahoma’s business property taxable inventory rate is set by the Oklahoma Tax Commission and is applied to the average value of a business’s inventory over the course of a year. The rate is used to calculate the amount of property tax that a business owes on its inventory.

The current rate is 1.0%, but it can vary from year to year.

The taxable inventory rate is determined by the Oklahoma Tax Commission based on a number of factors, including the average value of inventory held by businesses in the state, the cost of living, and the overall economic climate. The rate is designed to be fair and equitable to all businesses in the state, regardless of their size or industry.

Exemptions and Deductions, Business property taxable inventory rate oklahoma

There are a number of exemptions and deductions that may apply to the business property taxable inventory rate. These include:

- Inventory that is held for sale in the ordinary course of business

- Inventory that is used in the production of a product

- Inventory that is held for future use

Businesses that qualify for these exemptions or deductions should contact the Oklahoma Tax Commission to learn more about how to apply them.

Impact of the Business Property Taxable Inventory Rate on Businesses

The business property taxable inventory rate in Oklahoma significantly influences business operations and financial decisions. Higher rates can increase the cost of doing business, reducing profitability and discouraging investment.

Impact on Business Operations

Elevated inventory tax rates can strain cash flow and limit a business’s ability to purchase new inventory or expand operations. This can hinder growth and competitiveness, particularly for small businesses with limited capital.

Impact on Profitability

Increased inventory taxes directly reduce business profits. Companies may need to pass on these costs to customers through higher prices, potentially reducing demand and further impacting profitability.

Impact on Investment Decisions

High inventory tax rates can discourage businesses from investing in Oklahoma. Companies may choose to locate in states with lower rates or reduce their inventory levels in Oklahoma to minimize tax liability.

Examples of Impact

* A manufacturing company in Oklahoma City saw its inventory tax bill increase by 15% after the rate was raised. The company was forced to reduce its workforce and postpone expansion plans.

- A retail chain with multiple locations in Oklahoma reported a decline in sales after increasing prices to cover higher inventory taxes.

- A distribution center in Tulsa decided to move its operations out of state due to the high inventory tax rate in Oklahoma.

Comparison of Oklahoma’s Business Property Taxable Inventory Rate to Other States

Oklahoma’s business property taxable inventory rate stands out compared to other states. Understanding how Oklahoma’s rate compares to others provides valuable context for businesses and policymakers.

Oklahoma’s business property taxable inventory rate is 35%, significantly higher than the national average of 26.7%. This rate places Oklahoma among the states with the highest inventory tax rates in the country.

Neighboring States

Among neighboring states, Oklahoma’s rate is notably higher. Kansas has a rate of 26%, Texas has a rate of 25%, Arkansas has a rate of 23%, and Missouri has a rate of 22.9%. This difference in rates can impact businesses operating in multiple states, as they must navigate varying tax burdens.

Contributing Factors

Several factors contribute to the differences in business property taxable inventory rates across states. These include:

- State revenue needs: States with higher revenue needs may impose higher inventory taxes to generate additional revenue.

- Economic development incentives: Some states offer tax breaks or incentives to attract businesses, which can result in lower inventory tax rates.

- Political priorities: The political priorities of a state’s government can influence the level of taxation on businesses.

Historical Trends in Oklahoma’s Business Property Taxable Inventory Rate

The business property taxable inventory rate in Oklahoma has undergone several changes over the years, influenced by various factors. These changes have had a significant impact on businesses operating within the state.

One notable trend has been the gradual decrease in the rate. In the early 2000s, the rate stood at 15%. However, it was subsequently reduced to 12% in 2006 and further to 10% in 2016. This reduction has been driven by the desire to make Oklahoma more competitive for businesses and attract new investment.

Impact of Economic Conditions

The business property taxable inventory rate has also been affected by economic conditions. During periods of economic downturn, the state has often considered increasing the rate to generate additional revenue. However, during periods of economic growth, the rate has typically been reduced to provide relief to businesses.

Legislative Changes

Legislative changes have also played a role in shaping the historical trends of the business property taxable inventory rate. In 2015, the Oklahoma Legislature passed a law that allowed counties to set their own rates within a certain range. This has resulted in some counties having higher rates than others.

Future Outlook for Oklahoma’s Business Property Taxable Inventory Rate

The future outlook for Oklahoma’s business property taxable inventory rate is uncertain. Several factors may influence the rate, including economic conditions, legislative changes, and court decisions.

Economic Conditions

Economic conditions can significantly impact the business property taxable inventory rate. In periods of economic growth, businesses may hold more inventory, leading to a higher tax base and potentially a lower tax rate. Conversely, during economic downturns, businesses may reduce their inventory levels, resulting in a lower tax base and potentially a higher tax rate.

Legislative Changes

Legislative changes can also affect the business property taxable inventory rate. For example, the Oklahoma Legislature could pass a law that exempts certain types of inventory from taxation or that changes the method for valuing inventory. Such changes could significantly impact the rate.

Court Decisions

Court decisions can also impact the business property taxable inventory rate. For example, a court could rule that a particular method of valuing inventory is unconstitutional. Such a ruling could lead to a change in the rate.

Projections and Estimates

Given the uncertainty surrounding the factors that may influence the business property taxable inventory rate in Oklahoma, it is difficult to make specific projections or estimates of the rate’s future trajectory. However, it is reasonable to expect that the rate will continue to fluctuate in response to changes in economic conditions, legislative changes, and court decisions.

Conclusive Thoughts

In conclusion, Oklahoma’s business property taxable inventory rate stands as a multifaceted aspect of the state’s tax framework. Its impact on business operations, profitability, and investment decisions underscores the importance of understanding its intricacies. By staying abreast of the rate’s historical trends and potential future trajectory, businesses can proactively plan for tax implications and position themselves for success in Oklahoma’s dynamic business environment.

FAQ Resource: Business Property Taxable Inventory Rate Oklahoma

What factors determine Oklahoma’s business property taxable inventory rate?

The rate is set by the Oklahoma Tax Commission and is based on the average cost of goods sold by businesses in the state.

How is the business property taxable inventory rate applied to businesses?

Businesses are required to report their inventory value on their annual tax return. The taxable inventory rate is then applied to this value to calculate the amount of tax owed.

Are there any exemptions or deductions that apply to the business property taxable inventory rate?

Yes, there are a number of exemptions and deductions that may apply, such as the homestead exemption and the deduction for qualified research expenses.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY