Business property insurance for inventory plays a crucial role in safeguarding the financial stability and reputation of businesses. It provides coverage for the loss or damage of inventory due to various perils, ensuring that businesses can recover from unforeseen events and continue their operations smoothly.

Different types of business property insurance policies are available, each with its unique coverage options and limits. Businesses should carefully assess the value of their inventory and determine the appropriate level of coverage to protect their assets adequately.

Introduction

Business property insurance for inventory protects businesses from financial losses due to damage, destruction, or theft of their inventory. It is a crucial coverage for businesses that store or handle physical goods, as inventory represents a significant investment and is essential for day-to-day operations.

This type of insurance provides coverage for various types of inventory, including raw materials, finished goods, and work-in-progress. It can protect against losses caused by events such as fire, theft, natural disasters, and accidents. By having business property insurance for inventory, businesses can safeguard their financial stability and minimize the impact of unexpected events.

Businesses that need this type of insurance

Businesses that store or handle physical inventory, regardless of their size or industry, can benefit from business property insurance for inventory. Some examples include:

- Retail stores

- Warehouses

- Manufacturing companies

- Distribution centers

- Online retailers

By obtaining this coverage, these businesses can protect their inventory investments and ensure the continuity of their operations.

Types of Business Property Insurance for Inventory

Business property insurance for inventory provides coverage for businesses’ inventory in the event of loss or damage due to various perils. There are different types of business property insurance available, each with its own coverage options and limits.

Types of Business Property Insurance for Inventory

The following are the main types of business property insurance for inventory:

- Replacement Cost Insurance:This type of insurance provides coverage for the cost of replacing the inventory with new items of similar quality and value. It covers the cost of materials, labor, and other expenses associated with replacing the inventory.

- Actual Cash Value Insurance:This type of insurance provides coverage for the actual cash value of the inventory at the time of the loss. It takes into account depreciation and wear and tear, so the payout will be less than the replacement cost.

- Agreed Value Insurance:This type of insurance provides coverage for a predetermined value of the inventory. The value is agreed upon between the business and the insurance company before the policy is issued. It provides certainty in the event of a loss, as the payout will be the agreed-upon value.

Each type of insurance has its own advantages and disadvantages. Businesses should carefully consider their needs and the value of their inventory when choosing a type of insurance.

Factors to Consider When Choosing Business Property Insurance for Inventory

Choosing the right business property insurance for inventory is crucial to protect your assets and minimize financial losses in case of unforeseen events. Several factors should be carefully considered when making this decision:

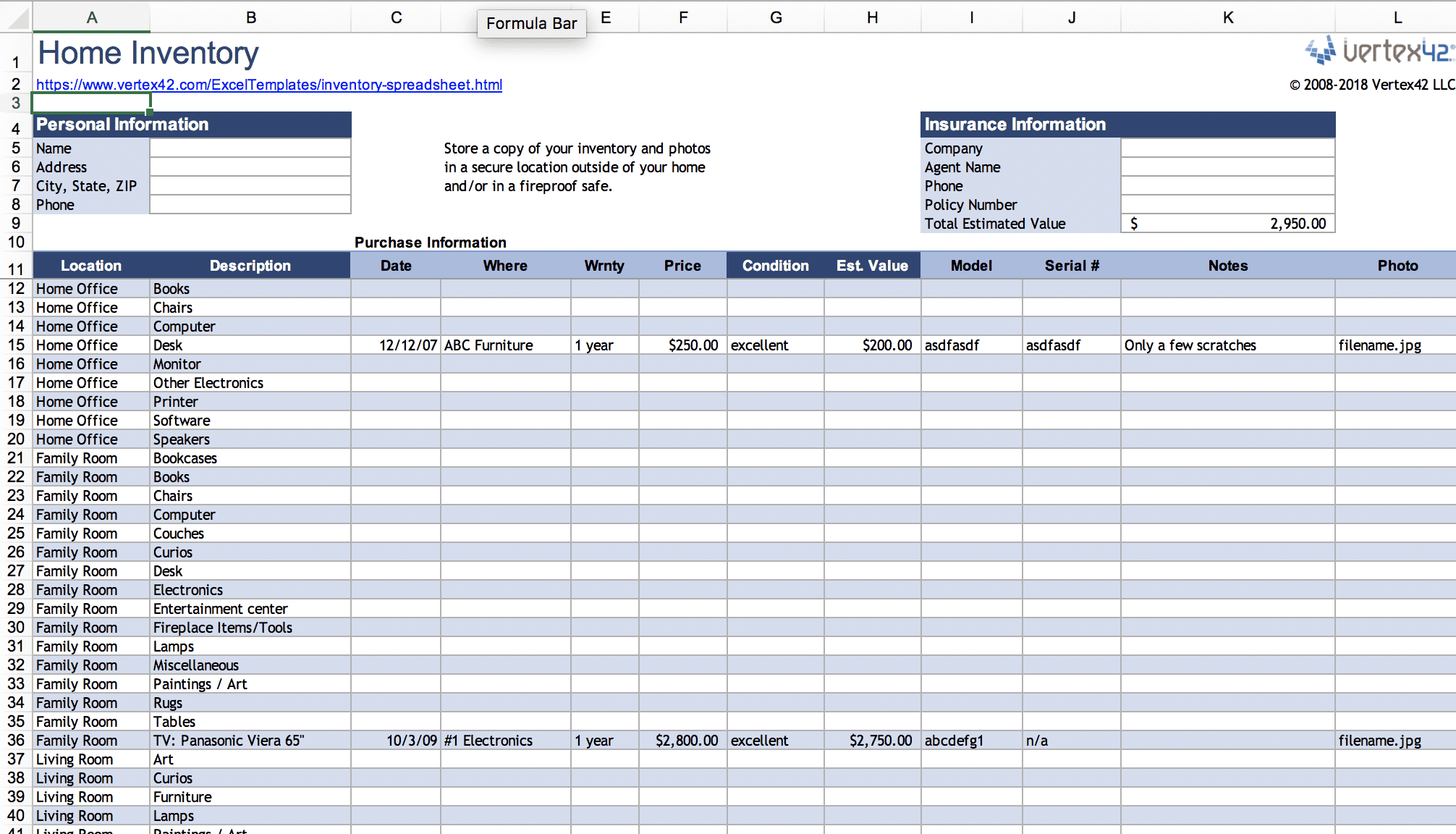

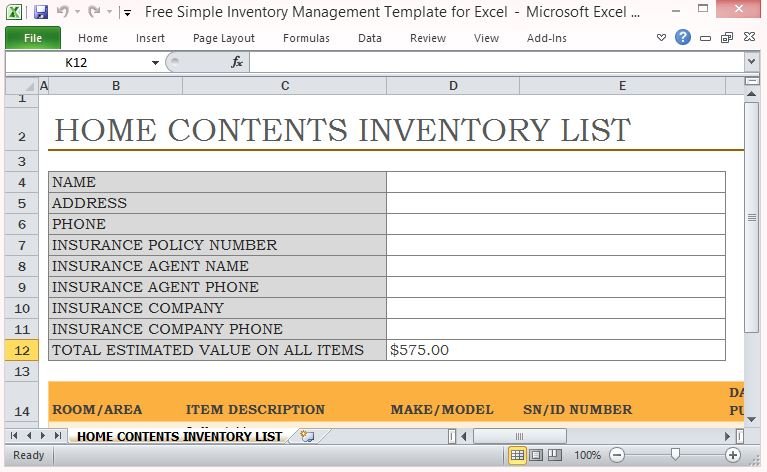

Assessing the Value of Inventory, Business property insurance for inventory

Determining the value of your inventory is essential to ensure adequate coverage. Consider the following methods:

- Physical Inventory Count:Conduct regular inventory counts to determine the quantity and value of items on hand.

- Cost of Goods Sold (COGS) Method:Calculate the value of inventory based on the cost of goods purchased minus the cost of goods sold.

- Gross Profit Method:Estimate the value of inventory based on the gross profit margin and sales revenue.

Determining the Appropriate Level of Coverage

Once the value of your inventory is established, you need to determine the appropriate level of coverage. Consider the following factors:

- Deductible:The amount you pay out of pocket before the insurance coverage kicks in. A higher deductible typically results in lower premiums.

- Coverage Limits:The maximum amount the insurance company will pay for covered losses.

- Replacement Cost Value (RCV):Coverage that pays to replace or repair damaged or lost inventory at current market prices.

Choosing the Right Insurance Company and Policy

Selecting a reputable insurance company with a proven track record of claims handling is crucial. Consider the following tips:

- Check Financial Stability:Review the insurance company’s financial ratings to ensure they have the ability to pay claims.

- Read Policy Details:Carefully examine the policy terms and conditions to understand the coverage, exclusions, and limitations.

- Compare Quotes:Obtain quotes from multiple insurance companies to compare coverage and premiums.

Benefits of Business Property Insurance for Inventory

Business property insurance for inventory provides a safety net for businesses, safeguarding their financial stability and reputation in the event of unexpected events. It offers several key benefits that can make a significant difference in the face of adversity.

One of the primary benefits of business property insurance for inventory is financial protection. In the event of a covered loss, such as fire, theft, or natural disaster, the insurance policy will reimburse the business for the value of the lost or damaged inventory.

This can prevent significant financial losses that could otherwise threaten the business’s survival.

Another benefit of business property insurance for inventory is the protection of the business’s reputation. A damaged or lost inventory can lead to disruptions in operations, delayed deliveries, and dissatisfied customers. By having insurance in place, businesses can minimize the impact of these events on their reputation and maintain customer confidence.

Real-Life Examples

Numerous businesses have experienced firsthand the benefits of having business property insurance for inventory. For instance, a clothing store suffered a fire that destroyed its entire inventory. Thanks to its insurance policy, the store was able to replace the lost inventory quickly and resume operations within a matter of weeks, minimizing the impact on its customers and reputation.

In another case, a manufacturing company had its warehouse damaged by a tornado. The business property insurance policy covered the cost of replacing the damaged equipment and inventory, allowing the company to continue production and meet its customer commitments.

Conclusion

To summarize, business property insurance for inventory plays a crucial role in safeguarding your assets against unforeseen events. It provides financial protection against losses or damage to your inventory, ensuring business continuity and minimizing the impact of disasters.

Businesses of all sizes should strongly consider obtaining this type of insurance to protect their valuable inventory. By investing in business property insurance, you can safeguard your financial stability and give your business the peace of mind to operate with confidence.

Summary

In conclusion, business property insurance for inventory is an essential investment for businesses of all sizes. It provides peace of mind and financial protection, allowing businesses to focus on their operations and growth without the fear of significant losses due to inventory-related incidents.

Commonly Asked Questions: Business Property Insurance For Inventory

What types of perils are typically covered by business property insurance for inventory?

Common perils covered include fire, theft, vandalism, natural disasters, and water damage.

How do I determine the appropriate level of coverage for my inventory?

Businesses should conduct a thorough inventory assessment to determine the value of their inventory and consult with an insurance professional to determine the optimal coverage amount.

What are the benefits of having business property insurance for inventory?

It provides financial protection against losses, ensures business continuity, and enhances the company’s reputation by demonstrating its commitment to risk management.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY