In the realm of business operations, maintaining an accurate and comprehensive inventory list is paramount for effective asset management and safeguarding your valuable possessions. Enter the business personal property inventory list, an indispensable tool that empowers businesses to track, organize, and protect their tangible assets.

This comprehensive guide delves into the intricacies of business personal property inventory lists, exploring their purpose, types, methods of creation, essential elements, organization and maintenance, and diverse uses. By understanding the significance of these lists, businesses can ensure the accuracy and completeness of their inventory, enabling them to make informed decisions, mitigate risks, and maximize the value of their assets.

Purpose of a Business Personal Property Inventory List

A business personal property inventory list serves as a comprehensive record of all physical assets owned by a business. Creating and maintaining an accurate inventory is crucial for several reasons:

Accurate Insurance Coverage

- Provides a detailed record of all business assets, ensuring accurate insurance coverage in the event of theft, damage, or loss.

- Helps businesses avoid underinsurance or overinsurance, ensuring adequate protection against financial losses.

Efficient Asset Management

- Tracks and manages all business assets, including their location, condition, and maintenance history.

- Enables businesses to optimize asset utilization, identify underutilized assets, and make informed decisions about asset disposal.

Tax Compliance, Business personal property inventory list

- Provides documentation for tax purposes, such as depreciation calculations and property tax assessments.

- Helps businesses comply with tax regulations and avoid potential penalties.

Enhanced Security

- Serves as a deterrent against theft by providing a detailed record of all assets, making it easier to identify and track stolen items.

- Helps businesses recover stolen assets more quickly and efficiently.

Smooth Business Transitions

- Facilitates the transfer of ownership or assets during mergers, acquisitions, or liquidations.

- Provides a clear and accurate record of all business assets, ensuring a smooth and transparent transition.

Types of Business Personal Property

Business personal property refers to movable assets used in business operations. These assets are distinct from real property, such as land and buildings. An inventory list categorizes these assets for various purposes, including insurance, accounting, and taxation.

Categories of Business Personal Property

- Office Equipment:Items used in daily office operations, such as computers, printers, copiers, desks, and chairs.

- Furniture:Non-fixed items used for comfort and functionality, such as couches, tables, shelves, and filing cabinets.

- Machinery:Equipment used in production or manufacturing processes, such as assembly lines, CNC machines, and forklifts.

- Inventory:Raw materials, work-in-progress, and finished goods held for sale or use in business operations.

- Vehicles:Cars, trucks, and other motorized equipment used for transportation or business purposes.

- Tools:Hand-held or power tools used in various tasks, such as hammers, wrenches, and drills.

- Electronic Equipment:Devices used for communication, entertainment, or security, such as phones, televisions, and surveillance cameras.

Methods for Creating a Business Personal Property Inventory List

Creating a business personal property inventory list is essential for tracking and managing your company’s assets. There are several methods you can use to create an inventory list, each with its advantages and disadvantages.

Manual Entry

- Advantages:Low cost, easy to implement, provides a physical record.

- Disadvantages:Time-consuming, prone to errors, difficult to update.

Inventory Management Software

- Advantages:Automated, accurate, easy to update, provides real-time data.

- Disadvantages:Can be expensive, requires technical expertise, may not be suitable for small businesses.

Hiring a Professional

- Advantages:Ensures accuracy, provides professional documentation, saves time.

- Disadvantages:Can be costly, may not be necessary for small inventories.

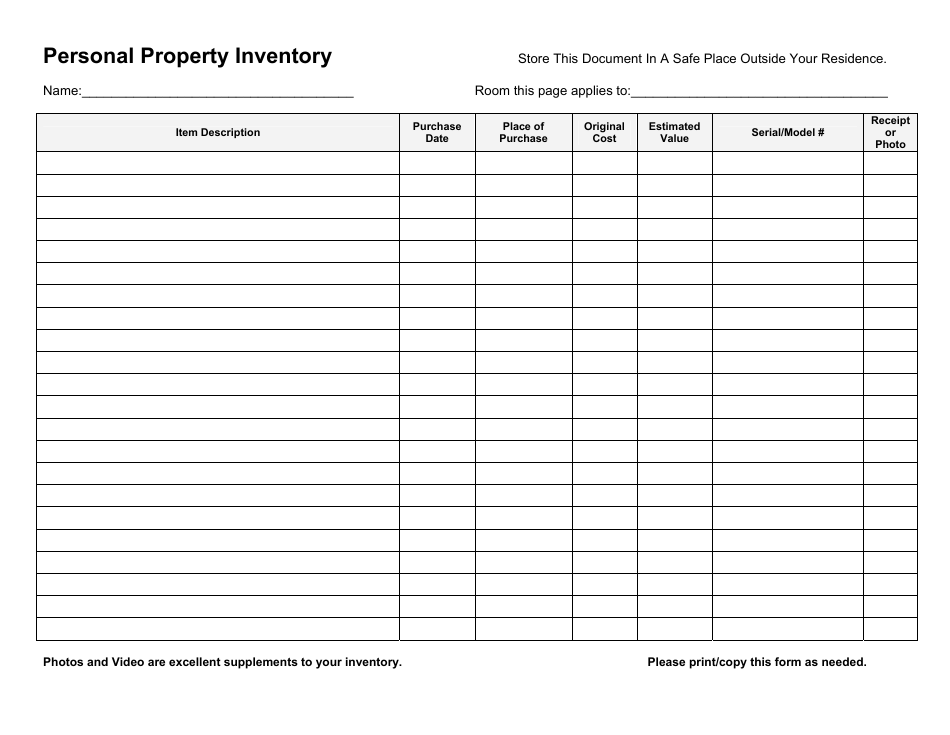

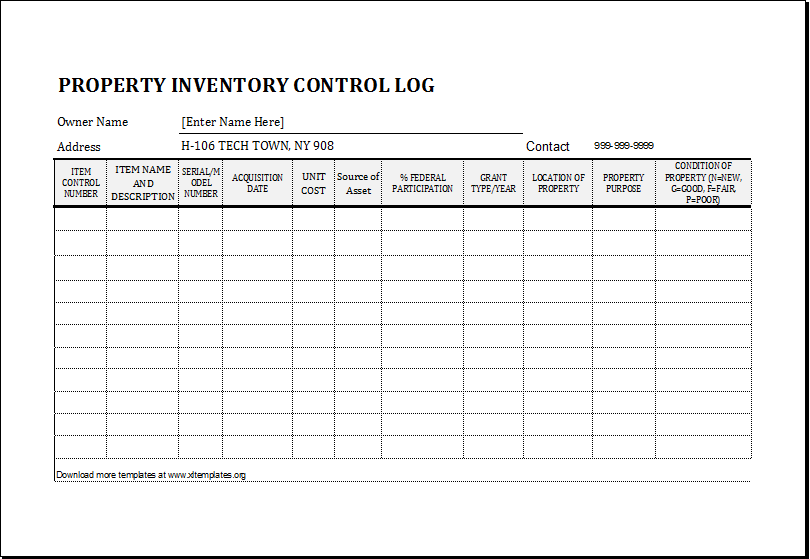

Elements of a Comprehensive Business Personal Property Inventory List

A comprehensive business personal property inventory list is essential for businesses to track and manage their assets. It provides a detailed record of all the business’s personal property, including its description, value, and location. This information can be used for a variety of purposes, such as insurance claims, tax reporting, and asset management.To create a comprehensive business personal property inventory list, you should include the following elements:

- Item Description:A detailed description of the item, including its make, model, serial number, and any other identifying information.

- Serial Number:The serial number is a unique identifier for the item. It is important to include the serial number on your inventory list so that you can track the item if it is lost or stolen.

- Purchase Date:The date the item was purchased. This information can be helpful for insurance claims and tax reporting.

- Current Value:The current value of the item. This information can be used for insurance claims and asset management.

- Location:The location of the item. This information can be helpful for tracking the item if it is lost or stolen.

By including these elements in your business personal property inventory list, you will have a valuable tool that can help you manage your assets and protect your business.

Organizing and Maintaining an Inventory List

Maintaining an organized and up-to-date business personal property inventory list is crucial for effective asset management. By implementing best practices, businesses can ensure the accuracy and accessibility of their inventory data.

Regular updates are essential to reflect changes in the inventory, such as additions, removals, or depreciation. Periodic reviews allow businesses to identify any discrepancies or inaccuracies and make necessary corrections.

Tips for Keeping the Inventory List Accurate and Accessible

- Establish a clear and consistent naming convention for all assets.

- Use a centralized database or software to store and manage the inventory list.

- Assign responsibility for inventory updates and reviews to specific individuals or teams.

- Conduct regular physical inventory counts to verify the accuracy of the list.

- Provide easy access to the inventory list for authorized personnel.

Uses of a Business Personal Property Inventory List

A business personal property inventory list serves as a comprehensive record of all movable assets owned by a business. It provides a clear overview of the assets, their condition, and their value, making it a valuable tool for various business operations.

One of the primary uses of an inventory list is to facilitate insurance claims. In the event of a loss due to theft, damage, or natural disaster, the inventory list provides detailed documentation of the affected assets. This enables businesses to quickly and accurately report their losses to insurance companies, ensuring timely and appropriate compensation.

Tax Reporting

The inventory list also plays a crucial role in tax reporting. It provides a record of all depreciable assets, which can be used to calculate depreciation expenses. Accurate depreciation tracking is essential for minimizing tax liability and ensuring compliance with tax regulations.

Asset Management

Furthermore, the inventory list is a valuable asset management tool. It helps businesses track the location, condition, and usage of their assets, enabling them to make informed decisions regarding maintenance, repairs, and replacements. Regular inventory updates ensure that the list remains accurate and up-to-date, providing a reliable source of information for asset management purposes.

Tracking Depreciation

The inventory list is essential for tracking depreciation, which is the gradual decrease in the value of an asset over time. By recording the cost and acquisition date of each asset, businesses can accurately calculate depreciation expenses. This information is crucial for financial reporting and tax purposes, ensuring compliance and minimizing tax liability.

Identifying Potential Theft

Regular inventory checks can help identify potential theft or unauthorized asset removal. By comparing the physical inventory with the recorded list, businesses can quickly detect any discrepancies and investigate potential security breaches or internal theft. This proactive approach helps mitigate losses and protect valuable assets.

Additional Considerations: Business Personal Property Inventory List

Additional considerations related to business personal property inventory lists include:

Factors affecting accuracy and completeness:

- Time constraints:Rushed or incomplete inventories can lead to omissions or inaccuracies.

- Lack of knowledge:Employees may not be familiar with all items or their values.

- Physical limitations:Access to certain areas or items may be restricted.

Recommendations for meeting specific business needs:

- Tailor the inventory to specific requirements:Consider the purpose of the inventory and the specific assets that need to be tracked.

- Establish clear guidelines:Define the scope of the inventory, the level of detail required, and the frequency of updates.

- Utilize technology:Leverage software or mobile apps to streamline the inventory process and enhance accuracy.

End of Discussion

In conclusion, a business personal property inventory list serves as a cornerstone of asset management, providing businesses with a clear understanding of their tangible possessions and their value. By adhering to best practices for creating, organizing, and maintaining these lists, businesses can reap the benefits of improved insurance coverage, accurate tax reporting, efficient asset management, and enhanced protection against theft and loss.

Embracing the power of business personal property inventory lists empowers businesses to optimize their operations, safeguard their assets, and achieve long-term success.

FAQ Insights

What is the primary purpose of a business personal property inventory list?

A business personal property inventory list serves as a comprehensive record of all tangible assets owned by a business, providing a clear overview of their quantity, value, and location.

What are the key elements that should be included in a business personal property inventory list?

Essential elements include item description, serial number, purchase date, current value, location, and condition.

How can businesses ensure the accuracy and completeness of their business personal property inventory lists?

Regular updates, periodic reviews, and thorough documentation are crucial for maintaining accurate and complete inventory lists.

What are the potential uses of a business personal property inventory list?

These lists are invaluable for insurance claims, tax reporting, asset management, tracking depreciation, and identifying potential theft.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY