Business no beginning or end inventory use process costing – In the realm of cost accounting, business process costing emerges as a distinctive method, particularly when applied in scenarios with no beginning or end inventory. This technique offers unique insights and poses intriguing challenges, which we will explore in this comprehensive guide.

Process costing, in its essence, entails accumulating costs and assigning them to units produced during a specific period, providing invaluable information for decision-making and performance evaluation.

When employing process costing without beginning or ending inventory, we delve into a specialized domain where assumptions and conditions shape the applicability of this approach. Assumptions such as continuous production and uniform unit costs within a process play a pivotal role in ensuring accurate cost calculations.

Understanding these nuances is crucial for effective implementation of this costing method.

Business Process Costing Overview: Business No Beginning Or End Inventory Use Process Costing

Business process costing is a costing method used to determine the cost of products or services produced through a continuous or repetitive process. It is commonly employed in industries with mass production, such as manufacturing, chemical processing, and food and beverage production.

The purpose of process costing is to allocate the total manufacturing costs incurred during a period to the units produced. This allows businesses to determine the cost of each unit and track the costs associated with different stages of the production process.

Applications of Process Costing

Process costing is particularly useful in situations where:

- Production is continuous or repetitive.

- Products or services are standardized and produced in large quantities.

- The costs of production are incurred gradually throughout the production process.

No Beginning or Ending Inventory in Process Costing

In process costing, the absence of beginning or ending inventory implies that all units introduced into the production process during a period are fully completed and transferred out. This method is applicable when production is continuous, and the units are identical and indistinguishable throughout the process.

Assumptions and Conditions

- Continuous production: The production process runs uninterrupted, with no significant breaks or stoppages.

- Identical units: All units produced during the period are identical in terms of their physical characteristics, materials used, and processing steps.

- No spoilage or rework: All units introduced into production are successfully completed without any significant spoilage or rework.

- Consistent production rate: The production rate remains relatively constant throughout the period, ensuring a steady flow of units.

Process Costing Calculations

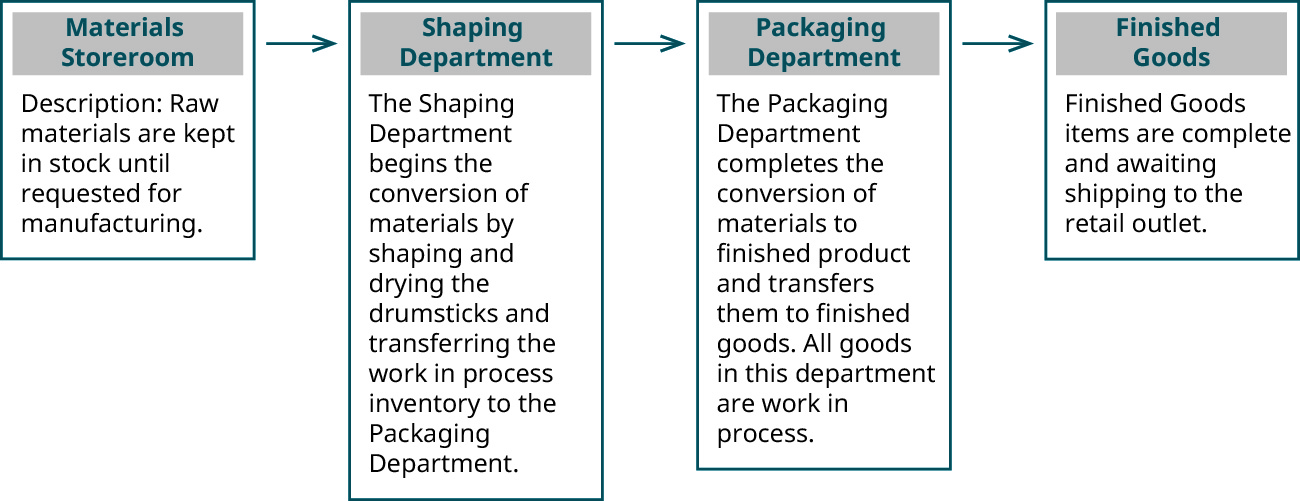

Process costing is a costing method used in industries where products are produced in a continuous or mass production process. In process costing, costs are accumulated for each process or department through which the units pass. The unit cost is then calculated by dividing the total costs incurred in a process by the number of units produced in that process.

The following steps are involved in calculating unit costs using process costing:

- Identify the processes involved in the production process.

- Accumulate the costs incurred in each process.These costs include direct materials, direct labor, and manufacturing overhead.

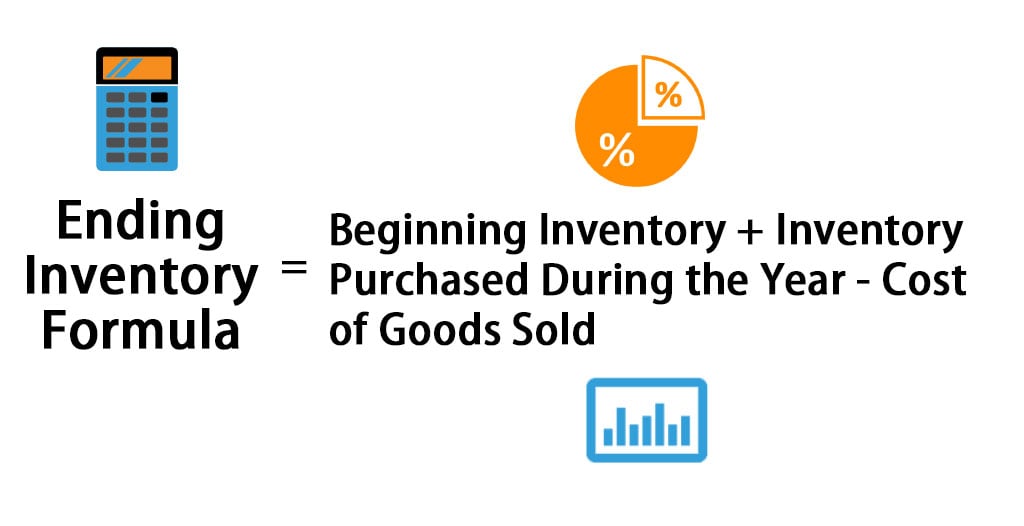

- Calculate the equivalent units of production.Equivalent units of production are the number of units that would have been produced if all units had been started and completed during the period.

- Calculate the unit cost.The unit cost is calculated by dividing the total costs incurred in a process by the equivalent units of production.

The following formulas are used to calculate unit costs using process costing:

- Equivalent units of production = Units started + (Units in ending work in process- % complete)

- Unit cost = Total costs incurred / Equivalent units of production

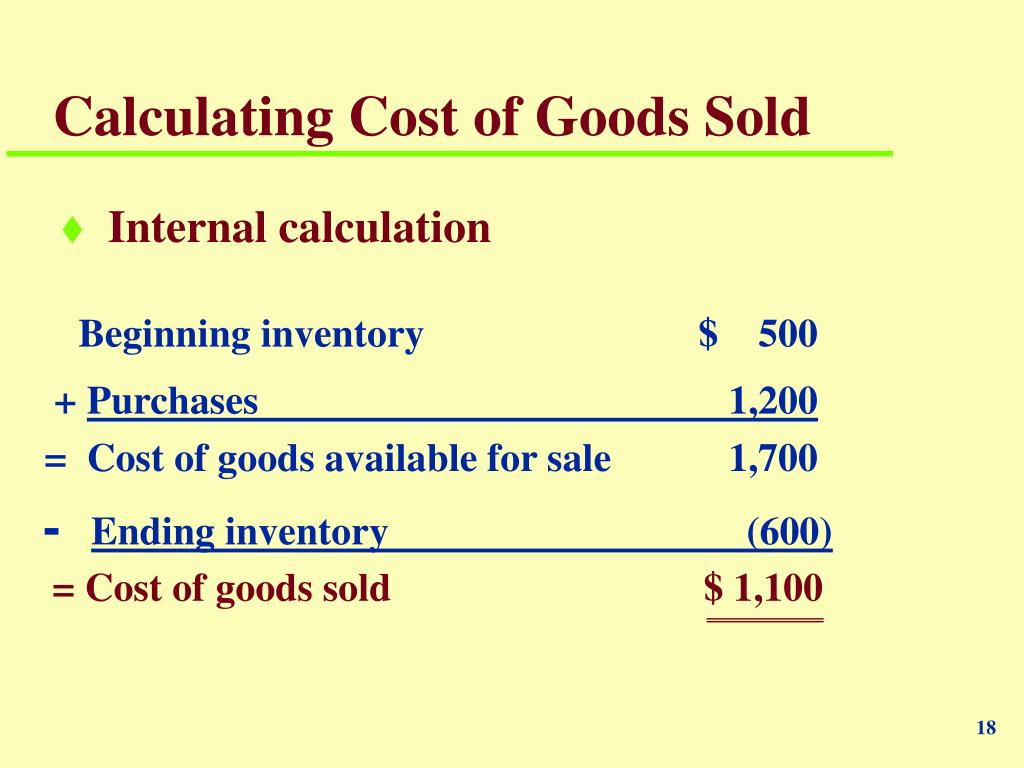

The following example illustrates the calculation of unit costs using process costing:

A company produces 10,000 units of product in a month. The total costs incurred in the production process are $100, 000. The equivalent units of production are 11,000 units. The unit cost is calculated as follows:

Equivalent units of production = 10,000 units + (1,000 units – 50%) = 11,000 units

Unit cost = $100,000 / 11,000 units = $9.09

The treatment of costs incurred during the period depends on whether the costs are direct or indirect.

- Direct costsare costs that can be directly traced to the production of a product. Direct costs include direct materials, direct labor, and variable manufacturing overhead.

- Indirect costsare costs that cannot be directly traced to the production of a product. Indirect costs include fixed manufacturing overhead and administrative expenses.

Direct costs are assigned to units of production as they are incurred. Indirect costs are allocated to units of production based on a predetermined allocation rate.

Advantages and Disadvantages of Process Costing

Process costing offers several advantages for businesses:

Simplicity

It is a relatively straightforward method that is easy to understand and implement.

Accuracy

Process costing provides accurate cost information by allocating costs to units of production based on their actual usage.

Timeliness

It generates cost data on a regular basis, allowing businesses to make informed decisions quickly.

Control

Process costing helps businesses identify and control costs by providing detailed information about the costs incurred at each stage of production.However, process costing also has some limitations:

Not suitable for all industries

It is most suitable for industries with continuous production processes and a high volume of homogeneous products.

Complexity

Process costing can become complex when there are multiple production processes or when products are produced in batches.

Assumptions

Process costing relies on certain assumptions, such as the accuracy of the cost allocation method and the stability of production processes.Compared to other costing methods, process costing is generally considered to be more accurate and timely. However, it may be less suitable for businesses with complex production processes or a low volume of products.

Applications of Process Costing

Process costing is commonly used in industries where production involves a continuous or repetitive process, resulting in a large volume of identical or similar units. It is particularly suitable for situations where:

Process costing is most suitable for production processes that are continuous or repetitive, with a high volume of output. These processes often involve the transformation of raw materials into finished goods through a series of sequential steps.

Industries Using Process Costing, Business no beginning or end inventory use process costing

Industries and businesses that commonly use process costing include:

- Oil refining

- Chemical processing

- Pharmaceutical manufacturing

- Food and beverage production

- Paper and pulp production

- Textile manufacturing

- Cement and concrete production

- Steel production

- Electronics manufacturing

- Automobile manufacturing

End of Discussion

In conclusion, business process costing, particularly in the absence of beginning or ending inventory, presents a valuable tool for organizations seeking to optimize production processes and enhance decision-making. By embracing its advantages and mitigating its limitations, businesses can harness the power of process costing to gain a competitive edge in their respective industries.

FAQ Insights

What are the key assumptions underlying process costing with no beginning or ending inventory?

Continuous production and uniform unit costs within a process are fundamental assumptions.

How does process costing differ from other costing methods?

Process costing focuses on accumulating costs for a specific period, while other methods allocate costs to individual units.

What are the advantages of using process costing with no beginning or ending inventory?

Simplicity, reduced data requirements, and cost savings are notable advantages.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY