Business loan using inventory as collateral – Unlocking the financial potential of your business inventory is now possible with business loans using inventory as collateral. This innovative financing solution offers a unique advantage for businesses seeking to expand, meet operational costs, or seize new opportunities.

Discover the ins and outs of leveraging your inventory as collateral, including eligibility criteria, loan application process, and strategies for managing inventory effectively. Whether you’re a seasoned entrepreneur or just starting out, this guide will empower you to make informed decisions and secure the funding you need.

Understanding Business Loans Using Inventory as Collateral

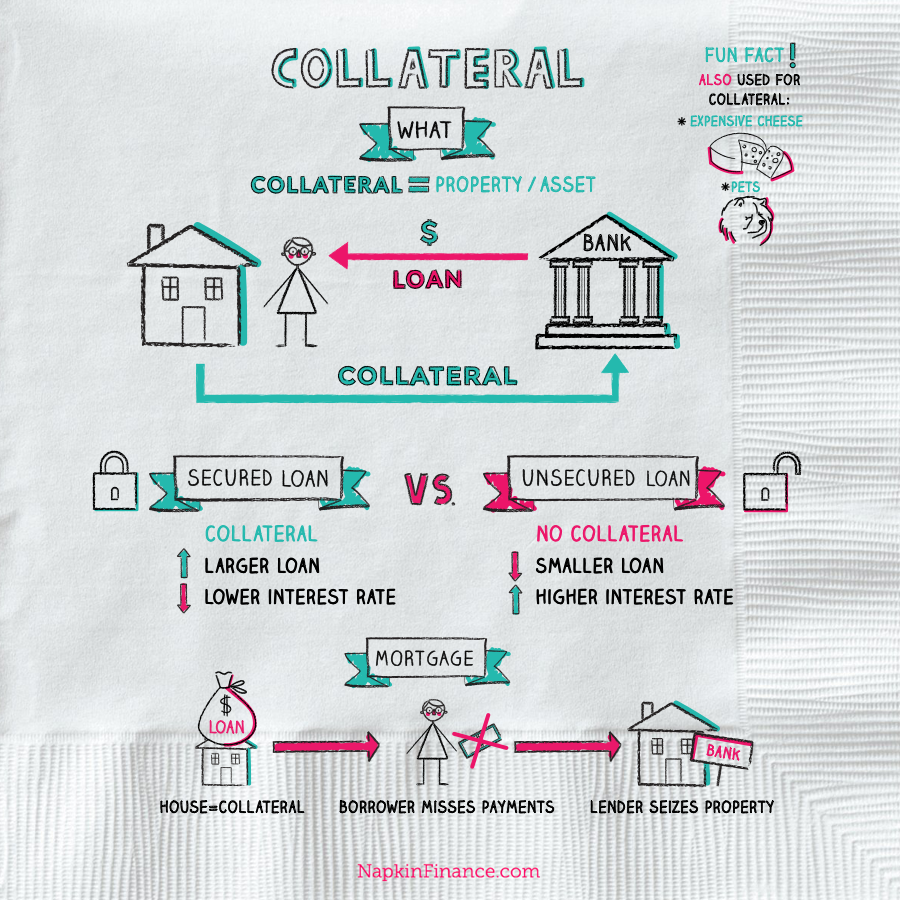

In the world of business, securing financing is often crucial for growth and success. One option that businesses may consider is a business loan using inventory as collateral. This type of loan allows businesses to leverage their inventory as security for the loan, providing lenders with a tangible asset in case of default.

Advantages of Using Inventory as Collateral

- Increased Borrowing Capacity:Using inventory as collateral can significantly increase a business’s borrowing capacity, as lenders are more likely to approve larger loans when they have a valuable asset to secure against.

- Lower Interest Rates:Due to the reduced risk for lenders, loans secured by inventory often come with lower interest rates compared to unsecured loans.

- Flexible Repayment Terms:Lenders may offer flexible repayment terms for inventory-backed loans, allowing businesses to tailor the loan to their specific cash flow needs.

Disadvantages of Using Inventory as Collateral

- Risk of Liquidation:If the business defaults on the loan, the lender may liquidate the inventory to recover the outstanding balance, potentially disrupting the business’s operations.

- Inventory Fluctuations:The value of inventory can fluctuate over time, which can affect the amount of collateral available to secure the loan.

- Additional Costs:Inventory-backed loans may come with additional costs, such as appraisal fees and storage costs.

Examples of Businesses That Use Inventory as Collateral

Businesses that typically use inventory as collateral include:

- Retail stores

- Wholesalers

- Manufacturers

- Importers and exporters

Evaluating Inventory for Loan Eligibility

Assessing the eligibility of inventory as collateral involves examining its characteristics and value. Lenders evaluate factors such as inventory turnover rate, age, condition, marketability, and susceptibility to obsolescence.

Inventory Valuation

Inventory valuation is crucial as it determines the amount of loan that can be secured. Common valuation methods include:

- Cost: Purchase price plus expenses incurred in bringing the inventory to its current location.

- Market value: Current selling price in the ordinary course of business.

- Net realizable value: Estimated selling price minus costs of completion and disposal.

The valuation method used will depend on the industry, type of inventory, and lender’s requirements.

Inventory Report

To support loan applications, a detailed inventory report is necessary. It should include:

- List of inventory items, including descriptions, quantities, and unit prices.

- Valuation method used and supporting documentation.

- Inventory turnover rate and average age.

- Condition of inventory and any potential risks to its value.

A well-prepared inventory report demonstrates the quality and value of the collateral, increasing the likelihood of loan approval and favorable terms.

Alternatives to Using Inventory as Collateral: Business Loan Using Inventory As Collateral

Inventory may not always be the most suitable collateral for a business loan. Exploring alternative forms of collateral can provide businesses with more options and flexibility when securing financing.

Real Estate

- Pros: Stable asset with potential for appreciation; provides high loan-to-value (LTV) ratios.

- Cons: May require significant equity or down payment; subject to market fluctuations.

Equipment and Machinery

- Pros: Specialized assets that can generate revenue; provides lower LTV ratios than real estate.

- Cons: May require appraisals or inspections; subject to depreciation.

Accounts Receivable, Business loan using inventory as collateral

- Pros: Represents future cash flow; provides lower LTV ratios than inventory.

- Cons: Can be difficult to value accurately; may require factoring or assignment.

Personal Guarantees

- Pros: Easy to obtain; no need for appraisals or inspections.

- Cons: Puts personal assets at risk; can damage creditworthiness if not honored.

Choosing the Most Suitable Collateral Option

The best collateral option depends on the individual business’s circumstances and needs. Factors to consider include:

- Value and liquidity of the collateral

- Loan amount and term

- Business’s financial strength and creditworthiness

By carefully evaluating alternative forms of collateral, businesses can secure financing without tying up valuable inventory.

Final Thoughts

In conclusion, business loans using inventory as collateral provide a valuable funding option for businesses seeking to unlock the value of their assets. By understanding the eligibility criteria, application process, and inventory management strategies, you can position your business for success and secure the financial support you need to thrive in today’s competitive market.

FAQ Overview

What are the advantages of using inventory as collateral for a business loan?

Using inventory as collateral offers several advantages, including access to larger loan amounts, lower interest rates, and flexible repayment terms.

How do I determine if my inventory is eligible for collateral?

Lenders typically assess the eligibility of inventory based on factors such as its value, liquidity, and marketability.

What steps are involved in obtaining a loan using inventory as collateral?

The process typically involves submitting a loan application, providing financial statements, and undergoing an inventory valuation.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY