Business line of credit for inventory is a versatile financing tool that can provide businesses with the flexibility and liquidity they need to manage their inventory effectively. In this comprehensive guide, we’ll delve into the concept of an LOC for inventory, explore its benefits, and provide practical advice on how to qualify for and utilize this valuable financial instrument.

Whether you’re a small business owner looking to optimize your inventory levels or a seasoned entrepreneur seeking to expand your operations, this guide will equip you with the knowledge and insights you need to make informed decisions about using a business line of credit for inventory.

Business Line of Credit for Inventory

A business line of credit (LOC) specifically for inventory financing is a flexible and cost-effective way for businesses to manage their inventory levels. It provides access to funds that can be used to purchase inventory as needed, without having to take out a traditional loan.

Benefits of Using an LOC for Inventory Management, Business line of credit for inventory

There are several benefits to using an LOC for inventory management, including:

- Increased flexibility:An LOC provides businesses with the flexibility to purchase inventory as needed, without having to worry about obtaining financing each time. This can be especially beneficial for businesses that experience seasonal fluctuations in demand or that need to respond quickly to changes in market conditions.

- Reduced risk:An LOC can help businesses reduce their risk by allowing them to maintain a lower level of inventory on hand. This can help to reduce the risk of obsolescence and spoilage, and can also free up cash flow for other purposes.

How to Qualify for a Business LOC for Inventory

Obtaining a business line of credit (LOC) for inventory requires meeting specific eligibility criteria set by lenders. These requirements aim to assess the business’s financial stability, creditworthiness, and ability to manage inventory effectively.

Business Plan and Financial History

A well-structured business plan is essential for demonstrating the viability of your business and its ability to repay the LOC. It should Artikel your business goals, market analysis, financial projections, and inventory management strategy.

Additionally, lenders will review your business’s financial history, including financial statements, tax returns, and cash flow statements. A strong financial track record, with consistent revenue growth and profitability, indicates a lower risk to lenders.

Comparing Different Business LOC for Inventory Options: Business Line Of Credit For Inventory

Choosing the right business line of credit for inventory financing is crucial for businesses looking to optimize their inventory management and cash flow. There are various LOC providers offering different interest rates, fees, and repayment terms, making it essential to compare these options carefully.

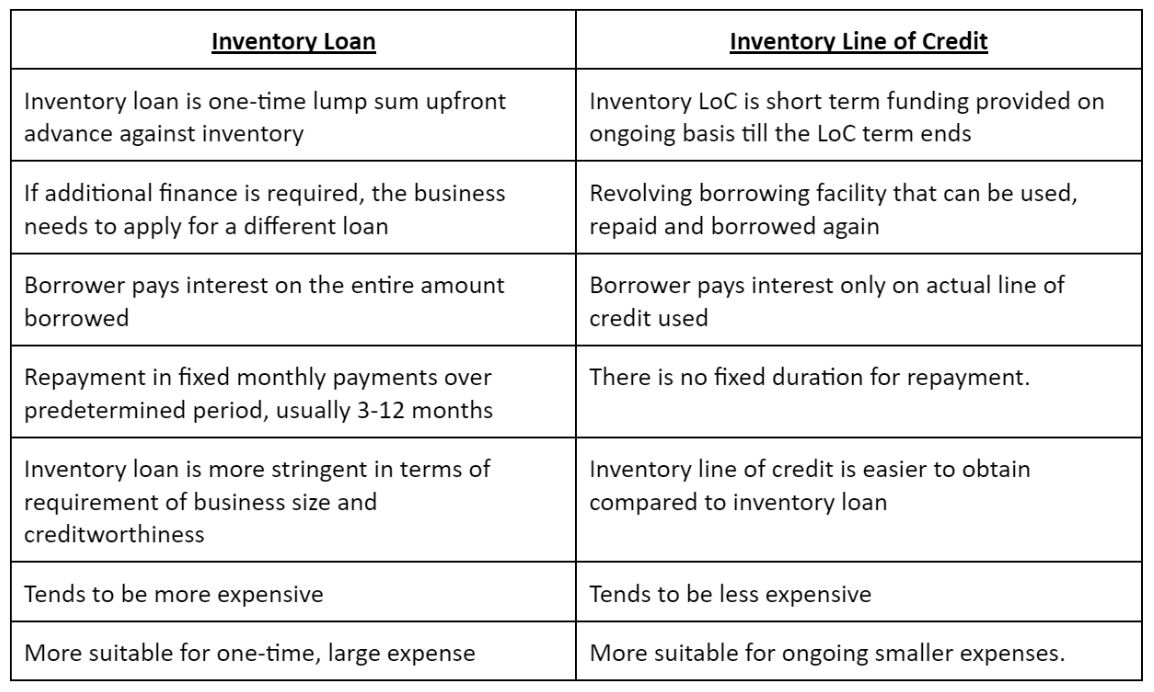

Another important consideration is the structure of the LOC. Secured LOCs require collateral, such as inventory or equipment, while unsecured LOCs do not. Revolving LOCs allow businesses to borrow and repay funds multiple times, while non-revolving LOCs are one-time loans.

Interest Rates and Fees

Interest rates on business LOCs for inventory typically range from 5% to 12%. Fees may include origination fees, annual fees, and late payment fees. It’s important to compare these costs to find the most competitive option.

| Provider | Interest Rate | Origination Fee | Annual Fee | Late Payment Fee |

|---|---|---|---|---|

| Provider A | 5%

|

1% | $100 | $25 |

| Provider B | 6%

|

2% | $50 | $30 |

| Provider C | 7%

|

0.5% | $75 | $20 |

Advantages and Disadvantages of Different LOC Structures

Secured vs. Unsecured LOCs

- Secured LOCsoffer lower interest rates but require collateral, which could be risky if the business is unable to repay the loan.

- Unsecured LOCshave higher interest rates but do not require collateral, making them a more flexible option for businesses with limited assets.

Revolving vs. Non-Revolving LOCs

- Revolving LOCsprovide ongoing access to funds, allowing businesses to borrow and repay as needed.

- Non-revolving LOCsare one-time loans that must be repaid in full by a specific date.

Using a Business LOC for Inventory Management

An effectively utilized business line of credit (LOC) can optimize inventory levels and cash flow for businesses. It provides access to funds specifically for inventory financing, allowing businesses to maintain optimal stock levels without straining their cash reserves.

Examples of Successful LOC Utilization for Inventory Financing

Retail

A clothing store used an LOC to finance seasonal inventory purchases, ensuring they had ample stock during peak shopping periods.

Manufacturing

A manufacturing company used an LOC to cover the costs of raw materials and components, allowing them to fulfill orders promptly.

Distribution

A distribution company used an LOC to maintain a diverse inventory, enabling them to meet the varying demands of their customers.By utilizing an LOC for inventory management, businesses can:

Maintain Optimal Inventory Levels

LOCs provide flexible funding that can be adjusted as inventory needs fluctuate, ensuring businesses always have the right amount of stock on hand.

Improve Cash Flow

By financing inventory purchases with an LOC, businesses can preserve their cash reserves for other operational expenses, such as payroll or marketing.

Increase Sales

Having adequate inventory levels allows businesses to meet customer demand and increase sales opportunities.

Reduce Storage Costs

By optimizing inventory levels, businesses can minimize storage costs associated with excess inventory.

Enhance Customer Satisfaction

Maintaining optimal inventory levels ensures that customers can find the products they need, leading to increased customer satisfaction and loyalty.

Alternatives to a Business LOC for Inventory

Besides business lines of credit, there are alternative financing options available for businesses seeking to finance their inventory. These alternatives offer unique advantages and considerations that may align with specific business needs and circumstances.

Inventory Financing Companies

Inventory financing companies provide specialized financing solutions tailored to businesses with inventory-intensive operations. These companies offer secured loans using inventory as collateral. Advantages:* Higher loan-to-value ratios, allowing businesses to borrow a greater percentage of their inventory’s value

- Flexible repayment terms, providing customized options to match cash flow cycles

- Potential for lower interest rates compared to traditional loans

Disadvantages:* Requires pledging inventory as collateral, which may limit access to capital if inventory levels fluctuate

- May have strict eligibility criteria, including minimum inventory value and business performance requirements

- Can be more expensive than other financing options, especially for smaller businesses

Factoring

Factoring involves selling accounts receivable to a third-party factoring company. This provides immediate cash flow to the business, reducing the need for inventory financing. Advantages:* Immediate access to cash, even before customers pay their invoices

- Can improve cash flow predictability and stability

- May reduce administrative costs associated with managing accounts receivable

Disadvantages:* Can be expensive, with factoring fees typically ranging from 1-5% of the invoice value

- May damage customer relationships if customers are notified of the factoring arrangement

- Can limit the business’s ability to offer extended credit terms to customers

Final Review

In conclusion, a business line of credit for inventory can be a powerful tool for businesses of all sizes. By carefully considering the factors discussed in this guide, you can determine if an LOC is the right financing option for your business and leverage it effectively to achieve your inventory management goals.

Questions and Answers

What are the eligibility requirements for a business LOC for inventory?

Typical eligibility requirements include a strong business plan, good credit history, and sufficient cash flow to cover repayments.

What are the advantages of using an LOC for inventory management?

LOCs offer flexibility, reduced risk, and the ability to optimize inventory levels and cash flow.

What are the alternatives to a business LOC for inventory?

Alternative financing options include inventory financing companies and factoring.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY