Business inventory taxes on property taxes louisiana 2017 – Navigating the intricacies of business inventory taxes on property taxes in Louisiana for 2017 can be a complex endeavor. This comprehensive guide will delve into the nuances of the tax system, providing clarity and insights to empower businesses in their tax planning and compliance efforts.

Louisiana’s business inventory tax framework and its implications for property taxes will be thoroughly examined, along with an analysis of the impact on business operations and profitability. Furthermore, recent changes and upcoming modifications to the tax landscape will be explored, ensuring readers stay abreast of the evolving regulatory environment.

Business Inventory Taxes in Louisiana 2017

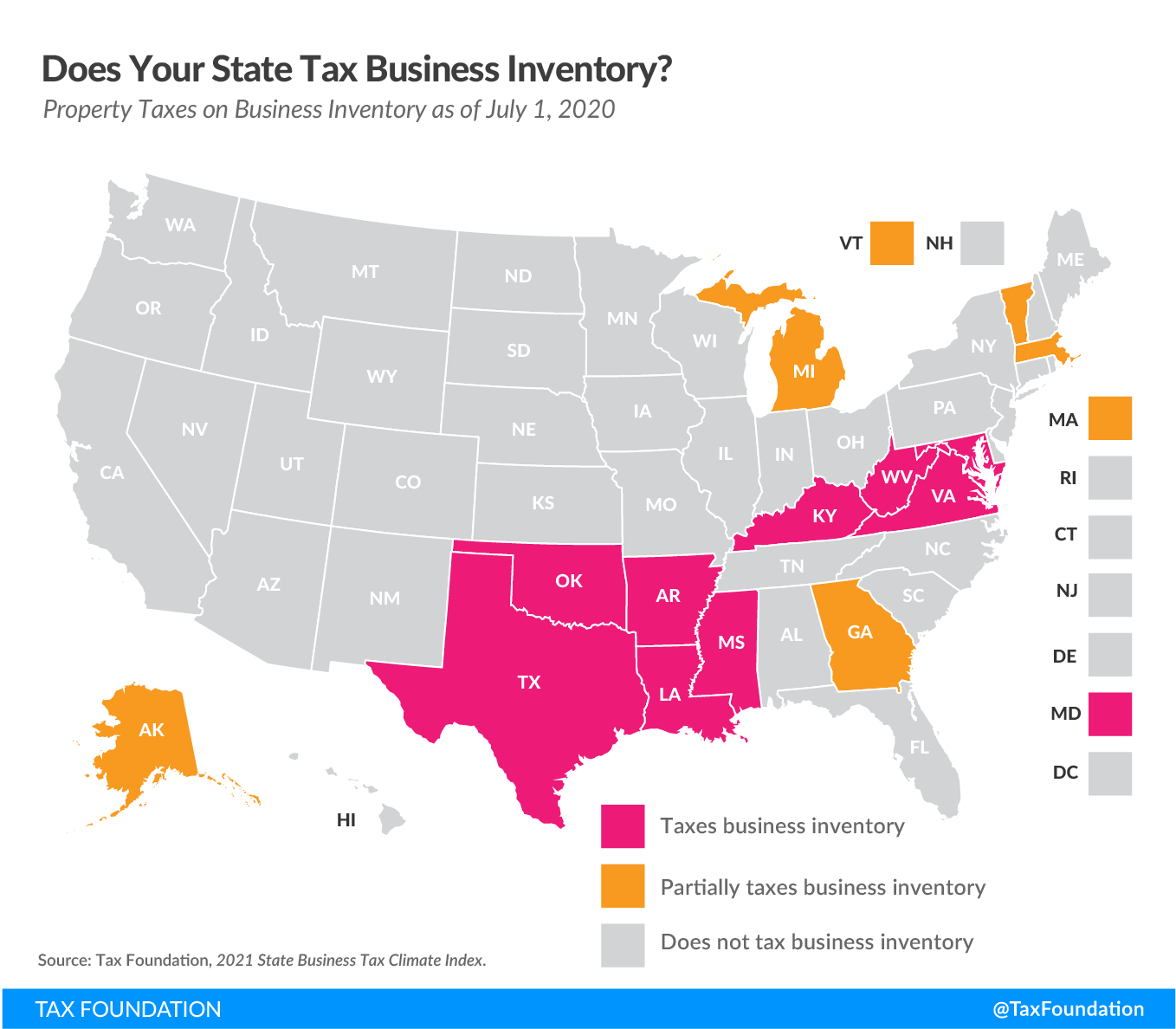

Louisiana imposes a business inventory tax on the average value of a business’s inventory held during the tax year. The tax rate is 0.45% of the average value of the inventory. The average value of the inventory is calculated by adding the beginning and ending inventory values and dividing the sum by two.There are a number of exemptions and deductions available for business inventory taxes in Louisiana.

These include:

- Inventory held for sale in the ordinary course of business

- Inventory held for lease or rental

- Inventory held for manufacturing or processing

- Inventory held in a public warehouse

- Inventory held by a non-profit organization

- Inventory held by a farmer or rancher

Impact of Business Inventory Taxes on Louisiana Businesses: Business Inventory Taxes On Property Taxes Louisiana 2017

In 2017, Louisiana businesses were subject to business inventory taxes on their stored goods. These taxes had a significant impact on business operations and profitability, creating challenges and opportunities for businesses in the state.

One of the main challenges presented by business inventory taxes is the increased cost of holding inventory. Businesses must factor in the cost of the tax when determining how much inventory to keep on hand. This can lead to businesses reducing their inventory levels, which can result in stockouts and lost sales.

Another challenge is the complexity of the business inventory tax system. Businesses must understand the different rules and regulations that apply to their specific type of inventory. This can be a time-consuming and costly process, especially for businesses that operate in multiple jurisdictions.

Despite these challenges, business inventory taxes can also provide opportunities for businesses in Louisiana. Businesses that are able to effectively manage their inventory can reduce their tax liability and improve their profitability. Additionally, businesses that are able to take advantage of tax breaks and incentives can further reduce their tax burden.

Opportunities for Louisiana Businesses

- Businesses can reduce their tax liability by taking advantage of tax breaks and incentives offered by the state of Louisiana.

- Businesses can also reduce their tax liability by implementing inventory management practices that reduce the amount of inventory they hold on hand.

Challenges for Louisiana Businesses, Business inventory taxes on property taxes louisiana 2017

- The cost of holding inventory can increase due to business inventory taxes, leading to reduced inventory levels and potential stockouts.

- The complexity of the business inventory tax system can be a challenge for businesses, especially those operating in multiple jurisdictions.

Recent Changes to Business Inventory Taxes in Louisiana

Louisiana has implemented several changes to its business inventory tax laws since 2017. These changes aim to simplify the tax code, reduce the tax burden on businesses, and promote economic growth in the state.One significant change is the elimination of the business inventory tax exemption for manufacturers.

Previously, manufacturers were exempt from paying taxes on their raw materials and finished goods. However, this exemption was repealed in 2018, resulting in increased tax liability for manufacturers.Another change is the reduction of the business inventory tax rate from 0.5% to 0.45% in 2019.

This reduction provides some relief to businesses that hold large amounts of inventory.

Upcoming Changes

There are no upcoming changes to business inventory taxes in Louisiana that are currently scheduled to take effect. However, the state legislature is constantly reviewing the tax code and may make changes in the future. Businesses should stay informed about any proposed changes to the business inventory tax laws.

Epilogue

In conclusion, understanding the intricacies of business inventory taxes on property taxes in Louisiana for 2017 is paramount for businesses seeking to optimize their tax strategies and ensure compliance. By leveraging the insights provided in this guide, businesses can navigate the tax landscape with confidence, mitigate potential liabilities, and maximize their financial performance.

FAQ Overview

What is the business inventory tax rate in Louisiana for 2017?

The business inventory tax rate in Louisiana for 2017 was 0.45% of the average monthly inventory value.

Are there any exemptions or deductions available for business inventory taxes in Louisiana?

Yes, certain exemptions and deductions may apply, such as inventory held for resale, inventory in transit, and inventory damaged or destroyed by casualty.

How are business inventory property taxes calculated in Louisiana?

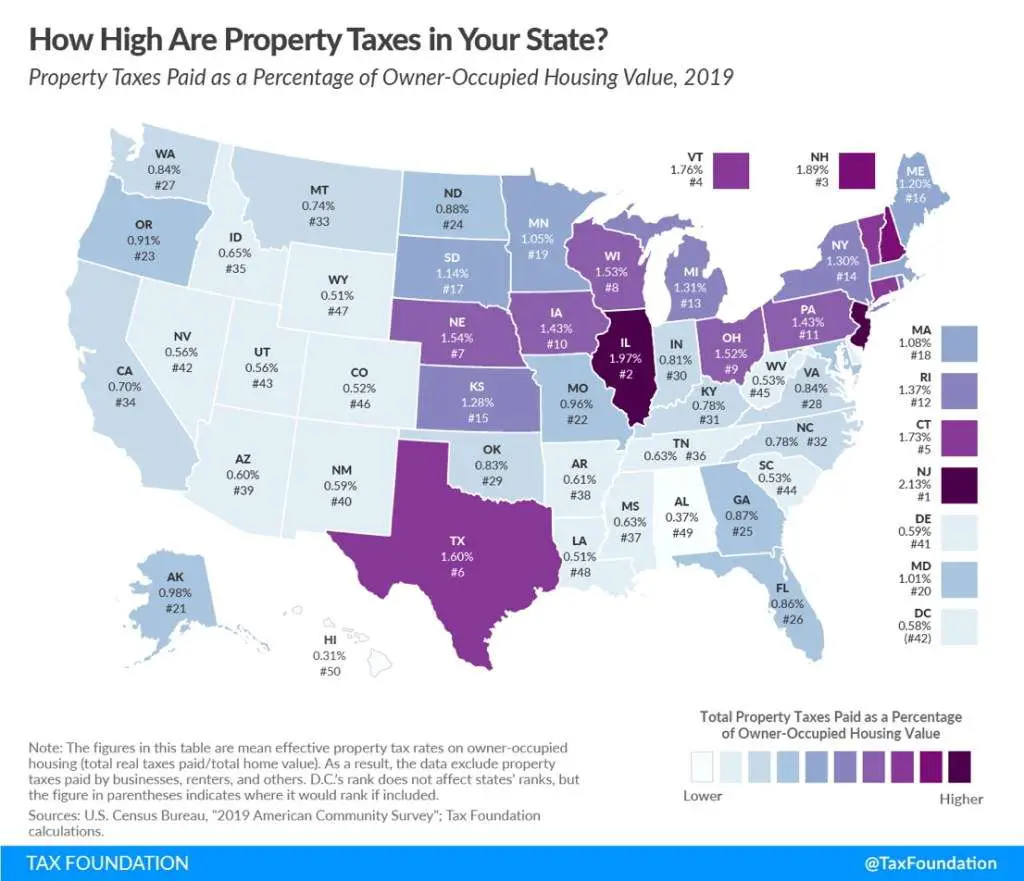

Business inventory property taxes are calculated by multiplying the assessed value of the inventory by the local property tax rate.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY