Delving into the intricacies of business inventory taxes, this comprehensive guide unravels the complexities of this often-overlooked aspect of business finance. Whether you’re a seasoned entrepreneur or just starting out, understanding the nuances of inventory taxation is crucial for optimizing your tax strategy and maximizing profitability.

As we delve deeper, we’ll explore the various types of inventory taxes, unravel the impact of different inventory valuation methods, and uncover the exemptions and deductions that can significantly reduce your tax burden. Additionally, we’ll provide practical inventory management strategies and case studies to help you navigate the ever-changing landscape of business inventory taxation.

Business Inventory Taxes

Business inventory taxes are levied on the value of goods held by businesses for sale or use in production. These taxes are imposed by various jurisdictions and can vary significantly in their rates and regulations.

The purpose of business inventory taxes is to generate revenue for local governments and to encourage businesses to maintain optimal inventory levels. By taxing inventory, jurisdictions can ensure that businesses contribute to the local economy and that they do not accumulate excessive amounts of unsold goods.

Types of Business Inventory Taxes

There are several different types of business inventory taxes, including:

- Ad valorem taxes: These taxes are based on the value of the inventory as determined by an assessor.

- Specific taxes: These taxes are based on the quantity or weight of the inventory.

- Use taxes: These taxes are imposed on businesses that use inventory in their operations, even if the inventory was purchased outside the jurisdiction.

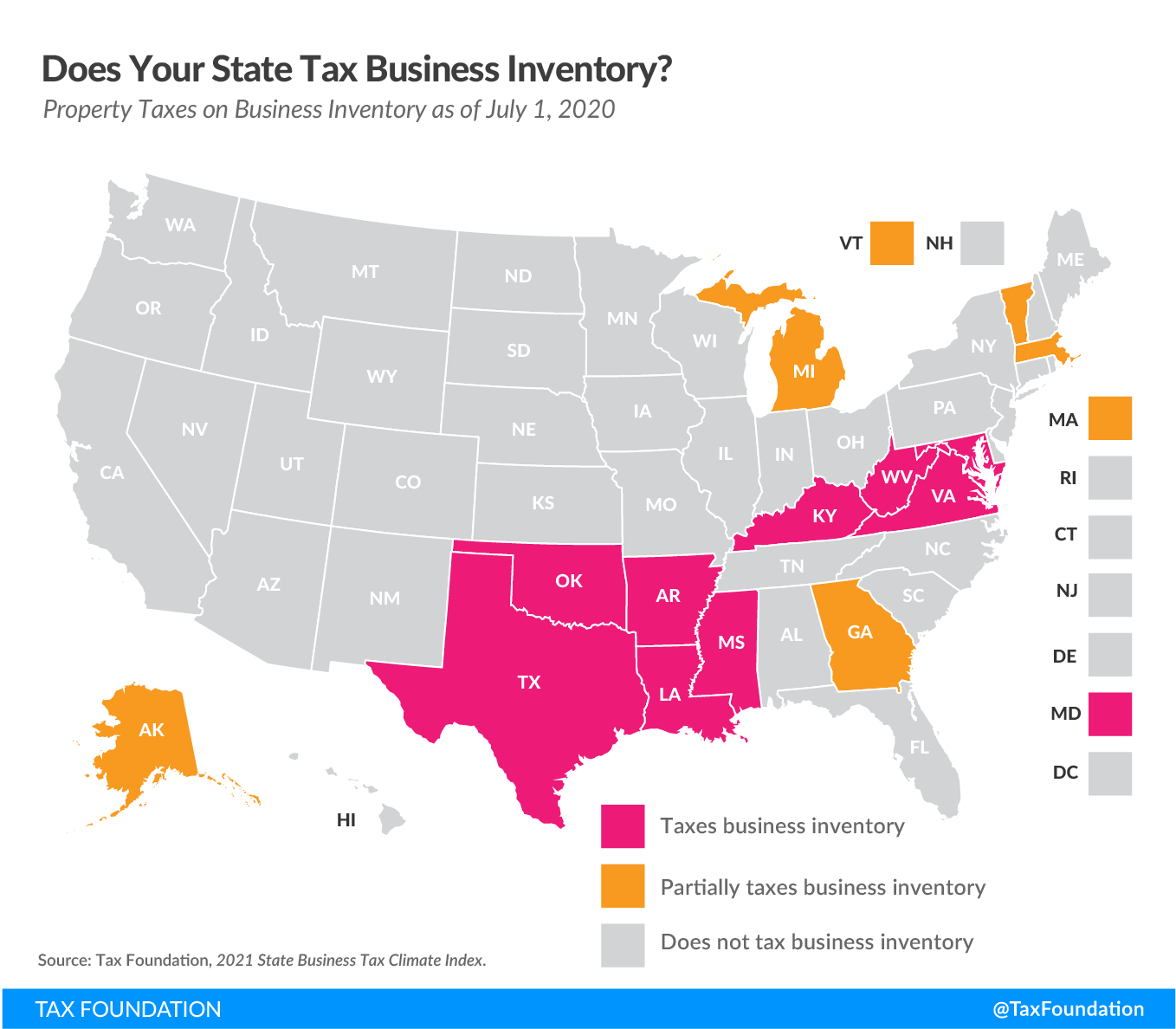

Jurisdictions with Inventory Tax Laws

Many jurisdictions around the world have inventory tax laws. Some examples include:

- United States: Most states in the US impose some form of inventory tax.

- Canada: All provinces in Canada impose inventory taxes.

- United Kingdom: The UK has a value-added tax (VAT) that applies to inventory.

- Australia: Australia has a goods and services tax (GST) that applies to inventory.

Inventory Valuation Methods

Inventory valuation methods are crucial for determining the value of inventory for tax purposes. Different methods result in varying inventory values, which can impact tax liability. Understanding these methods is essential for businesses to make informed decisions and optimize their tax strategy.

The three primary inventory valuation methods are:

First-In, First-Out (FIFO)

Under FIFO, the cost of goods sold is assumed to be the cost of the oldest inventory purchased. This method assumes that the first items purchased are the first to be sold. As a result, the ending inventory value is based on the cost of the most recently purchased items.

Impact on Inventory Tax Liability:FIFO typically results in a higher cost of goods sold and lower ending inventory value in periods of rising prices. This can lead to lower taxable income and reduced tax liability.

Last-In, First-Out (LIFO)

LIFO assumes that the cost of goods sold is the cost of the most recently purchased inventory. This method assumes that the last items purchased are the first to be sold. As a result, the ending inventory value is based on the cost of the oldest purchased items.

Impact on Inventory Tax Liability:LIFO typically results in a lower cost of goods sold and higher ending inventory value in periods of rising prices. This can lead to higher taxable income and increased tax liability.

Weighted Average

Weighted average assigns an average cost to all units of inventory. This method calculates the average cost per unit based on the cost and quantity of all inventory items on hand. The average cost is then used to value both cost of goods sold and ending inventory.

Impact on Inventory Tax Liability:Weighted average results in a cost of goods sold and ending inventory value that falls between FIFO and LIFO. It provides a more stable tax liability compared to the other methods.

Exemptions and Deductions

Business inventory is subject to various exemptions and deductions that can reduce the amount of taxes owed. These exemptions and deductions vary depending on the jurisdiction and the type of inventory.

Exemptions

- Work in Progress:Inventory that is still in the process of being manufactured or assembled is often exempt from taxes.

- Raw Materials:Raw materials used in the production of goods are also typically exempt from taxes.

- Finished Goods:Finished goods that are ready for sale are not always exempt from taxes, but there may be deductions available for these items.

Deductions

- Cost of Goods Sold (COGS):The cost of goods sold is a deduction that reduces the taxable income of a business. COGS includes the cost of the inventory that was sold during the year.

- Inventory Shrinkage:Inventory shrinkage is a deduction that allows businesses to reduce their taxable income by the amount of inventory that was lost or stolen during the year.

- Bad Debts:Bad debts are a deduction that allows businesses to reduce their taxable income by the amount of accounts receivable that are deemed uncollectible.

Tax Compliance and Reporting: Business Inventory Taxes

Businesses with inventory must adhere to specific tax compliance requirements. These requirements ensure accurate reporting of inventory values and proper payment of taxes.

Inventory taxes are reported on tax returns, typically using the following steps:

Inventory Valuation Method

Businesses must choose an inventory valuation method, such as FIFO (first-in, first-out), LIFO (last-in, first-out), or weighted average. The chosen method must be consistently applied and disclosed on tax returns.

Inventory Records

Detailed inventory records must be maintained, including the quantity, cost, and description of each item. These records serve as the basis for inventory valuation and tax reporting.

Cost of Goods Sold

The cost of goods sold (COGS) is calculated based on the inventory valuation method used. COGS represents the cost of inventory sold during the tax year and is a key factor in determining taxable income.

Tax Return Reporting

Inventory information, including the chosen valuation method, COGS, and any applicable deductions or exemptions, is reported on the appropriate tax return forms. The specific forms and reporting requirements vary depending on the business’s tax filing status.

Inventory Management Strategies

Businesses can adopt various inventory management strategies to minimize tax liability. Implementing best practices for inventory tracking and control helps businesses optimize inventory levels, reduce waste, and improve overall efficiency.

Inventory Valuation Methods

- First-in, first-out (FIFO): Assumes the oldest inventory is sold first, reducing taxable income in periods of rising prices.

- Last-in, first-out (LIFO): Assumes the most recent inventory is sold first, reducing taxable income in periods of falling prices.

- Weighted average cost: Calculates an average cost per unit based on all purchases, regardless of the order in which they were made.

Inventory Control Techniques

Businesses can implement inventory control techniques such as:

- Inventory tracking software: Automates inventory tracking, reduces errors, and provides real-time visibility.

- Cycle counting: Periodically counting inventory to verify accuracy and identify discrepancies.

- Just-in-time inventory: Minimizing inventory levels by receiving goods only when needed, reducing storage costs and spoilage.

Other Strategies, Business inventory taxes

- Bulk purchasing: Buying inventory in bulk when prices are low to reduce the average cost per unit.

- Consignment inventory: Holding inventory without taking ownership, eliminating tax liability until the goods are sold.

- Inventory reserves: Setting aside a portion of inventory to cover potential fluctuations in demand or prices, reducing the risk of overstocking or understocking.

Case Studies and Examples

Businesses across various industries have successfully implemented strategies to optimize inventory taxes. These strategies involve understanding tax laws, utilizing inventory valuation methods, and implementing effective inventory management practices.

One notable example is a manufacturing company that implemented a perpetual inventory system to track inventory levels in real-time. This allowed them to accurately determine the cost of goods sold and minimize tax liability by avoiding overstocking and obsolete inventory.

Successful Inventory Tax Management

- Understanding tax laws and regulations

- Implementing an effective inventory valuation method

- Maintaining accurate inventory records

- Optimizing inventory levels to minimize tax liability

- Utilizing tax deductions and exemptions

Future Trends and Considerations

The landscape of business inventory taxes is constantly evolving, driven by technological advancements, changing business practices, and evolving tax regulations. Understanding these trends and their potential impact is crucial for businesses to stay compliant and optimize their tax strategies.

One significant trend is the increasing adoption of cloud-based inventory management systems. These systems offer real-time visibility into inventory levels, automated inventory tracking, and improved data accuracy. This enhanced data availability can facilitate more accurate tax reporting and reduce the risk of errors.

Tax Policy Changes

Tax policies are subject to change over time, and businesses need to stay informed about these changes to ensure compliance. Recent trends include the adoption of new tax laws, modifications to existing tax rates, and the introduction of tax incentives or exemptions.

Businesses should monitor these changes closely and adjust their tax strategies accordingly.

Emerging Technologies

The rise of emerging technologies, such as artificial intelligence (AI) and blockchain, is expected to transform inventory management practices. AI-powered inventory optimization can improve forecasting accuracy, reduce waste, and optimize inventory levels. Blockchain technology can enhance inventory traceability, ensuring transparency and reducing the risk of fraud.

Sustainability Considerations

Businesses are increasingly focusing on sustainability, and inventory management is no exception. Sustainable inventory practices aim to minimize environmental impact and promote resource conservation. This may involve adopting eco-friendly packaging materials, implementing waste reduction programs, and optimizing inventory levels to reduce excess waste.

Conclusion

In the dynamic world of business, staying abreast of inventory tax regulations is paramount. By understanding the intricacies Artikeld in this guide, you’ll be well-equipped to navigate the complexities of inventory taxation, minimize your tax liability, and position your business for long-term success.

Remember, knowledge is power, and when it comes to business inventory taxes, knowledge is profit.

Helpful Answers

What are the most common types of business inventory taxes?

Sales tax, use tax, and property tax are the most prevalent types of inventory taxes businesses encounter.

How can I determine the value of my inventory for tax purposes?

FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted average are common inventory valuation methods used for tax reporting.

Are there any exemptions or deductions available for business inventory?

Yes, certain types of inventory, such as work in progress or inventory held for resale, may qualify for exemptions or deductions.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY