Business inventory tax wv – Delve into the intricacies of business inventory tax in West Virginia, a subject meticulously crafted to provide clarity and understanding. This comprehensive guide unravels the purpose, tax rates, exemptions, filing procedures, and consequences associated with this tax, empowering businesses to navigate this fiscal landscape with confidence.

As we embark on this journey, let’s explore the types of businesses subject to the tax, the inventory taxable, applicable tax rates, and exemptions that may apply. We will delve into the process of filing business inventory tax returns, including due dates and payment methods, ensuring compliance and avoiding penalties.

Business Inventory Tax in West Virginia

The business inventory tax in West Virginia is a tax levied on the average value of inventory held by businesses during the taxable year. The purpose of the tax is to generate revenue for the state and to ensure that businesses are contributing their fair share to the tax burden.

The tax is imposed on all businesses that have a physical presence in West Virginia and that maintain inventory for sale or use in the ordinary course of business. The tax is not imposed on businesses that only sell services or that have inventory that is not held in West Virginia.

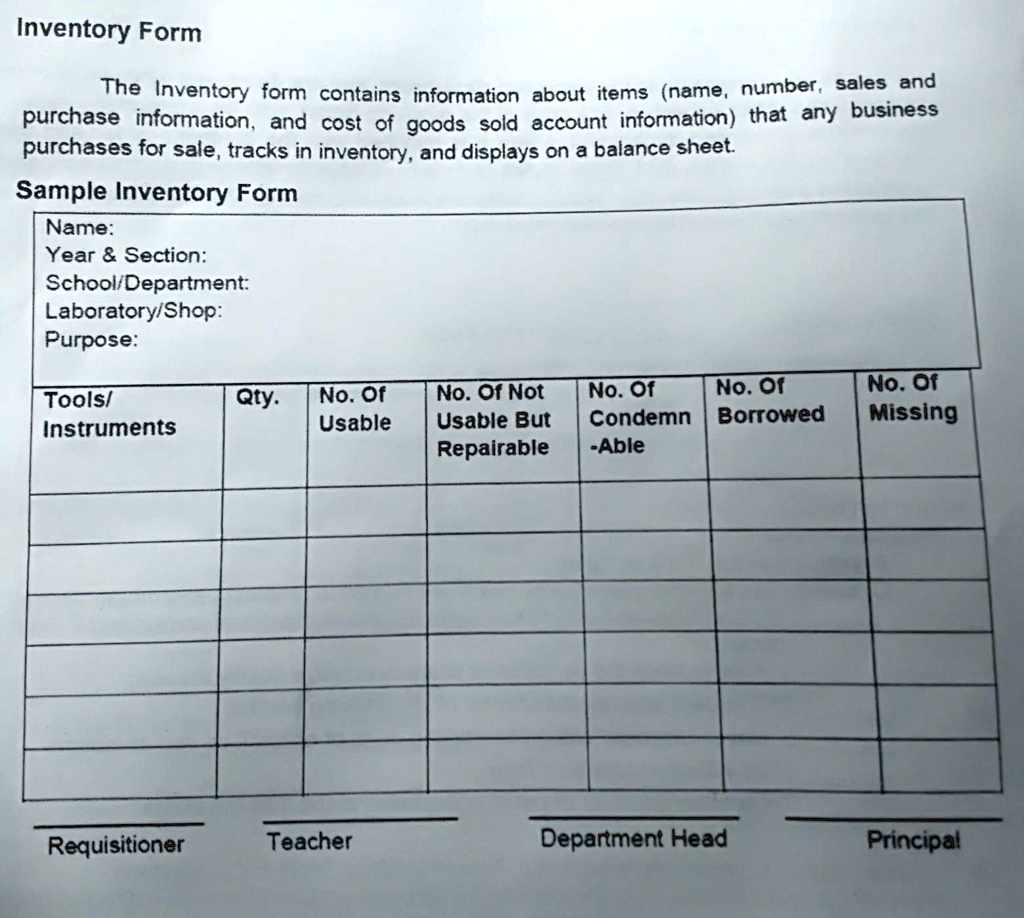

Taxable Inventory

The following types of inventory are taxable:

- Raw materials

- Work in progress

- Finished goods

- Supplies

The tax is not imposed on inventory that is held for personal use or that is held for sale outside of West Virginia.

Tax Rates and Exemptions: Business Inventory Tax Wv

The business inventory tax in West Virginia is levied at a rate of 0.6% on the average value of taxable inventory held during the taxable year.

Certain businesses and types of inventory may be exempt from the tax. These exemptions include:

Exemptions

- Inventory held by manufacturers for use in manufacturing

- Inventory held by wholesalers for resale

- Inventory held by retailers for resale

- Inventory held by public utilities

- Inventory held by non-profit organizations

- Inventory held by farmers

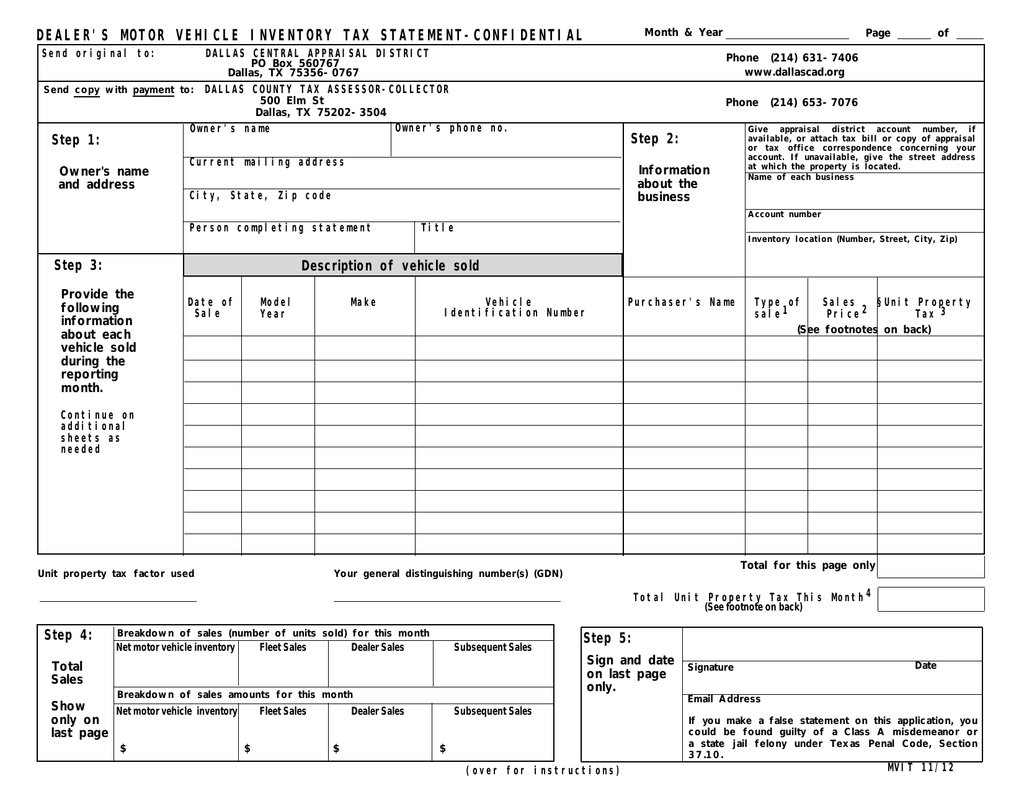

Filing and Payment Procedures

Businesses in West Virginia must adhere to specific procedures when filing their business inventory tax returns. This section Artikels the process, including due dates and acceptable payment methods.

Returns must be filed annually by April 15th. However, if the business’s fiscal year ends on a different date, the return is due within 90 days of the fiscal year-end.

Payment Methods, Business inventory tax wv

- Electronic funds transfer (EFT)

- Credit card

- Check or money order

Payments should be made payable to the West Virginia State Tax Commissioner.

Penalties and Interest

Failing to file or pay business inventory taxes on time in West Virginia can result in severe consequences. These include penalties and interest charges, which can significantly increase the amount you owe.

The West Virginia Tax Code imposes a penalty of 10% of the unpaid tax for each month or fraction of a month that the tax remains unpaid, up to a maximum of 50%. Additionally, interest accrues on the unpaid tax at the rate of 1% per month, compounded monthly.

Late Filing Penalty

A late filing penalty is imposed if you fail to file your business inventory tax return by the due date. The penalty is 5% of the unpaid tax for each month or fraction of a month that the return is late, up to a maximum of 25%.

Late Payment Penalty

A late payment penalty is imposed if you fail to pay your business inventory tax by the due date. The penalty is 10% of the unpaid tax for each month or fraction of a month that the tax remains unpaid, up to a maximum of 50%.

Interest Charges

Interest accrues on the unpaid tax at the rate of 1% per month, compounded monthly. This means that the amount of interest you owe will increase over time if you do not pay your taxes on time.

Resources and Support

The West Virginia State Tax Department provides various resources and support to businesses regarding the business inventory tax. These include:

- Website:The department’s website provides comprehensive information on the business inventory tax, including forms, instructions, and frequently asked questions.

- Contact Information:Businesses can contact the department’s customer service center by phone, email, or mail for assistance with the business inventory tax.

Support Programs

The West Virginia State Tax Department offers several support programs and initiatives for businesses regarding the business inventory tax. These include:

- Taxpayer Education:The department provides educational materials and workshops to help businesses understand the business inventory tax and their filing obligations.

- Compliance Assistance:The department offers compliance assistance to businesses, including personalized guidance and support with tax audits.

Conclusion

In conclusion, understanding business inventory tax in West Virginia is paramount for businesses operating within the state. This guide has provided a comprehensive overview of the tax, empowering businesses to make informed decisions, comply with regulations, and optimize their tax strategies.

By leveraging the resources and support available, businesses can navigate the complexities of this tax with confidence, ensuring financial stability and growth.

User Queries

What types of businesses are subject to business inventory tax in West Virginia?

Businesses engaged in manufacturing, wholesaling, retailing, or any other business that maintains an inventory of goods for sale are subject to the tax.

Are there any exemptions to the business inventory tax?

Yes, certain types of inventory are exempt from the tax, such as inventory held for resale by a retailer, inventory in transit, and inventory used in manufacturing.

What are the penalties for failing to file or pay business inventory taxes on time?

Penalties may include late filing fees, interest charges, and potential legal action.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY