Business inventory tax wv – Welcome to our in-depth exploration of business inventory tax in West Virginia. This guide will delve into the intricacies of this tax, providing a clear understanding of its implications for businesses operating within the state.

As we navigate through this topic, we’ll cover essential aspects such as the definition of business inventory tax, its applicability to various business types, and the exemptions that may apply.

Business Inventory Tax Overview

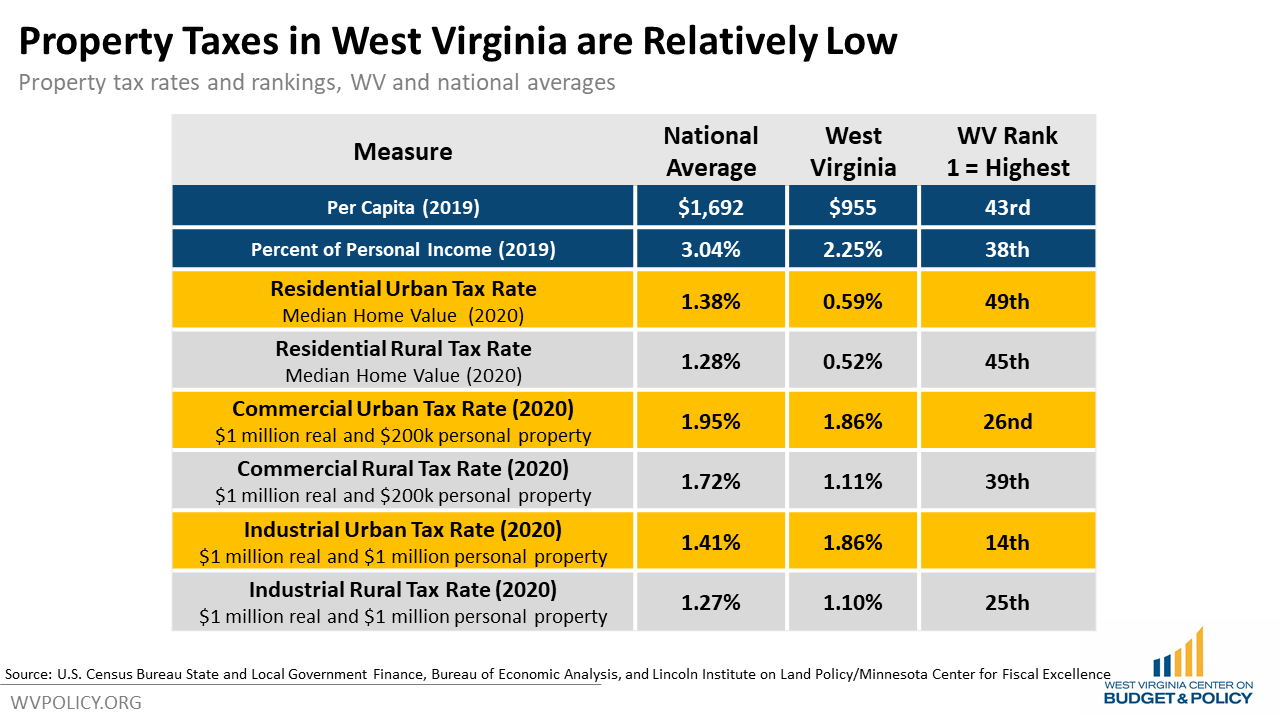

Business inventory tax is a tax levied on the average value of a business’s inventory during the taxable year. In West Virginia, businesses with an average inventory value exceeding $50,000 are subject to this tax. The tax rate is 0.6% of the average inventory value.

Applicability to Businesses in West Virginia, Business inventory tax wv

The business inventory tax applies to all businesses operating in West Virginia, including corporations, partnerships, and sole proprietorships. Businesses that are exempt from the tax include:

- Public utilities

- Financial institutions

- Insurance companies

- Nonprofit organizations

Tax Rates and Exemptions

In West Virginia, the business inventory tax is levied on the average value of a business’s inventory during the tax year. The tax rate is 0.35%.

There are a number of exemptions to the business inventory tax, including:

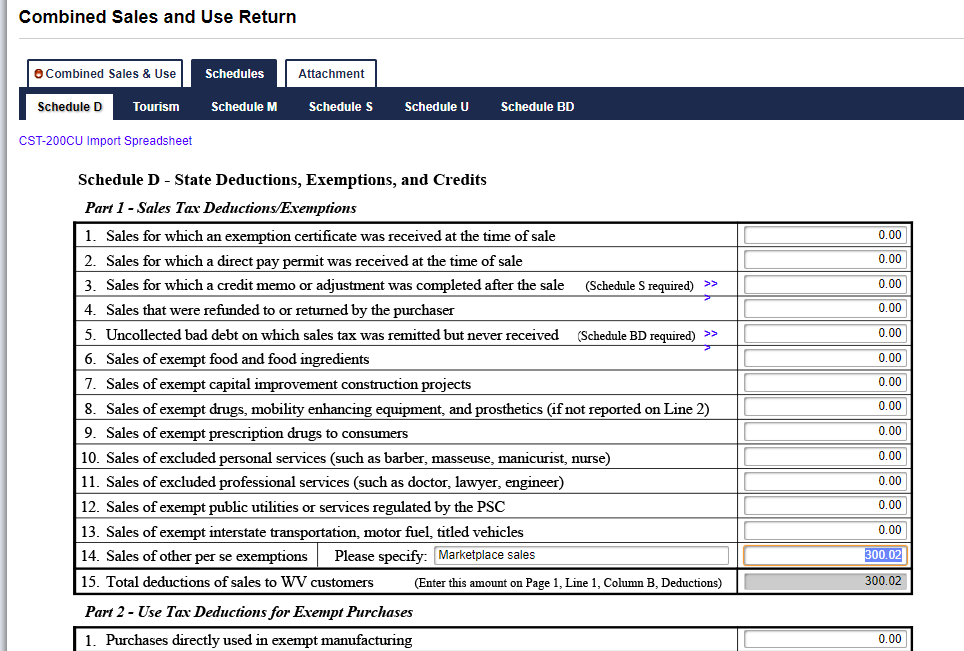

- Inventory held by a manufacturer for use in manufacturing

- Inventory held by a retailer for sale

- Inventory held by a wholesaler for sale

- Inventory held by a public utility

- Inventory held by a nonprofit organization

To determine if a business qualifies for an exemption, the business must file an application with the West Virginia Tax Department. The application must include information about the business’s inventory, its use, and its ownership.

Filing and Payment Requirements

Understanding the filing and payment requirements for the business inventory tax in West Virginia is crucial for business owners. This section will guide you through the process of filing, calculating the tax due, and exploring the available payment options.

Filing Requirements

- Businesses with a total inventory value exceeding $5,000 as of January 1st are required to file a business inventory tax return.

- The return must be filed by April 15th of each year, unless an extension is granted.

- The return should be filed with the West Virginia State Tax Department.

Calculating the Tax Due

The business inventory tax is calculated based on the average value of the inventory held during the preceding year.

Tax Due = Average Inventory Value x Tax Rate

- The average inventory value is calculated by adding the beginning and ending inventory values and dividing by 2.

- The tax rate is 0.05%.

Payment Options

The business inventory tax can be paid online, by mail, or in person at the West Virginia State Tax Department.

- Online:Payments can be made through the West Virginia State Tax Department’s website using a credit card or electronic check.

- Mail:Payments can be mailed to the West Virginia State Tax Department at the address provided on the tax return.

- In Person:Payments can be made in person at the West Virginia State Tax Department’s office in Charleston.

It is important to note that late payments may be subject to penalties and interest.

Penalties and Interest

Penalties and interest charges are imposed on taxpayers who fail to meet their business inventory tax obligations. These charges are intended to encourage timely filing and payment of taxes.

Penalties

Late filing of the business inventory tax return can result in a penalty of 5% of the tax due, with an additional 5% penalty for each month the return is late, up to a maximum of 25%. Late payment of the tax can also result in a penalty of 5% of the tax due, plus interest charges.

Interest

Interest on unpaid taxes is calculated at the rate of 1% per month, or 12% per year. Interest charges begin to accrue from the due date of the tax.

Penalty and Interest Abatement

In certain circumstances, taxpayers may be eligible for penalty and interest abatement. Abatement is the process of forgiving or reducing penalties and interest charges. To be eligible for abatement, taxpayers must demonstrate that their failure to file or pay on time was due to reasonable cause and not willful neglect.

Audits and Appeals

The West Virginia Tax Department may audit businesses to verify the accuracy of their business inventory tax returns. During an audit, the auditor will examine the taxpayer’s records to ensure that all taxable inventory has been reported and that the correct amount of tax has been paid.If the auditor finds any discrepancies, they will issue a notice of proposed assessment (NPA).

The taxpayer has the right to appeal the NPA within 60 days of its issuance. The appeal process involves submitting a written protest to the Tax Department and providing evidence to support the taxpayer’s position.If the Tax Department denies the taxpayer’s appeal, the taxpayer may file a petition for review with the West Virginia Office of Tax Appeals.

The Office of Tax Appeals is an independent body that reviews tax disputes between taxpayers and the Tax Department.

Options for Resolving Disputes

If a taxpayer disagrees with the Tax Department’s audit findings, they have several options for resolving the dispute:

- Informal Resolution:The taxpayer can meet with the auditor to discuss the findings and try to resolve the dispute informally.

- Formal Protest:The taxpayer can file a formal protest with the Tax Department, outlining their objections to the audit findings and providing supporting documentation.

- Appeal to the Office of Tax Appeals:If the Tax Department denies the taxpayer’s protest, the taxpayer can appeal to the Office of Tax Appeals for an independent review of the dispute.

- Litigation:As a last resort, the taxpayer can file a lawsuit in the West Virginia courts to challenge the Tax Department’s audit findings.

It is important to note that the taxpayer has the burden of proof in any dispute with the Tax Department. This means that the taxpayer must provide evidence to support their claims.

Closing Summary: Business Inventory Tax Wv

In conclusion, business inventory tax in West Virginia is a crucial consideration for businesses operating within the state. By understanding the tax rates, exemptions, filing requirements, and potential penalties, businesses can ensure compliance and minimize their tax liability.

Remember, staying informed about tax regulations is vital for businesses to operate efficiently and avoid any unnecessary financial burdens.

FAQ Resource

What is the definition of business inventory tax in West Virginia?

Business inventory tax is a tax levied on the average value of a business’s inventory over the course of a taxable year.

How does the business inventory tax apply to businesses in West Virginia?

The tax applies to all businesses that maintain inventory in West Virginia, regardless of their location or the type of inventory they hold.

What types of businesses are subject to the business inventory tax?

All businesses that maintain inventory in West Virginia are subject to the tax, including manufacturers, wholesalers, retailers, and service businesses that hold inventory for resale.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY