Business inventory tax texas – The business inventory tax in Texas is a complex and ever-changing topic. This guide will provide you with a comprehensive overview of the tax, including its purpose, history, current rates, and filing requirements. We will also discuss special considerations for certain types of businesses and inventory, as well as how to handle the sale or disposal of inventory.

This guide is designed to help you understand the business inventory tax in Texas and comply with all applicable laws. By following the guidance provided in this guide, you can avoid penalties and interest charges, and ensure that you are paying the correct amount of tax.

Business Inventory Tax in Texas

The business inventory tax in Texas is a local tax imposed on businesses that maintain inventory within the state. The tax is used to fund local government services, such as schools, roads, and libraries.

The business inventory tax was first enacted in 1931. The tax rate has changed several times over the years, and the current rate is 0.5%.

Exemptions

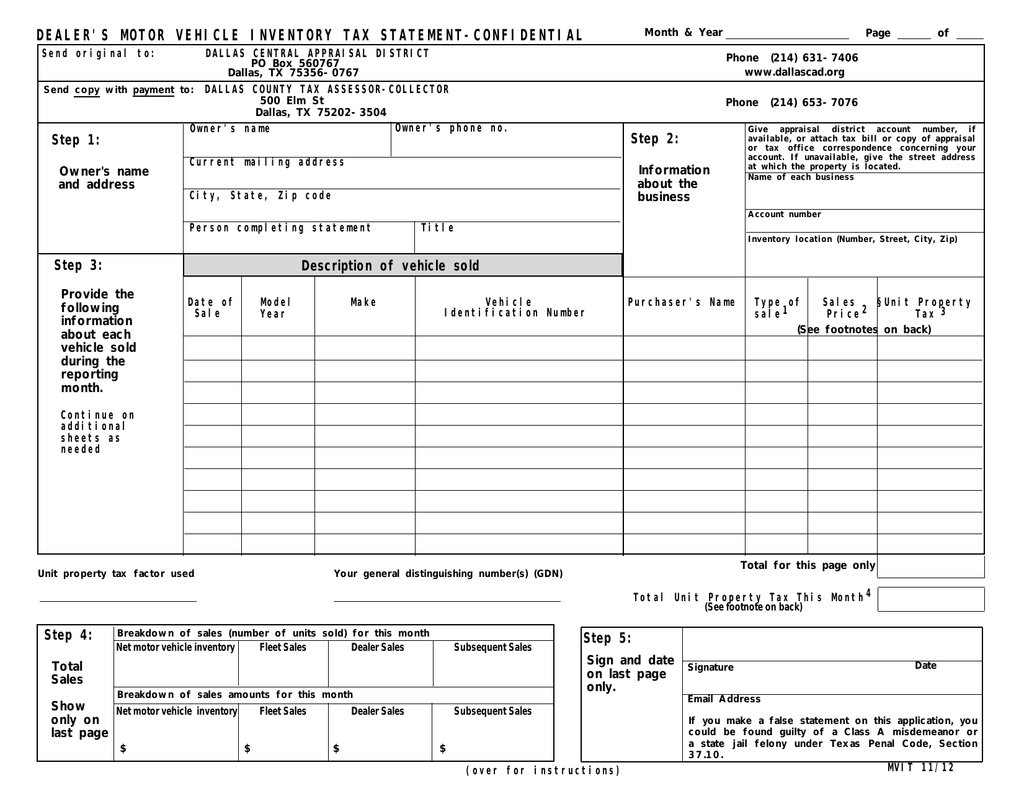

The following types of businesses are exempt from the business inventory tax:

- Businesses with less than $100,000 in inventory

- Businesses that are engaged in manufacturing

- Businesses that are engaged in farming

- Businesses that are engaged in the sale of motor vehicles

- Businesses that are engaged in the sale of food and beverages

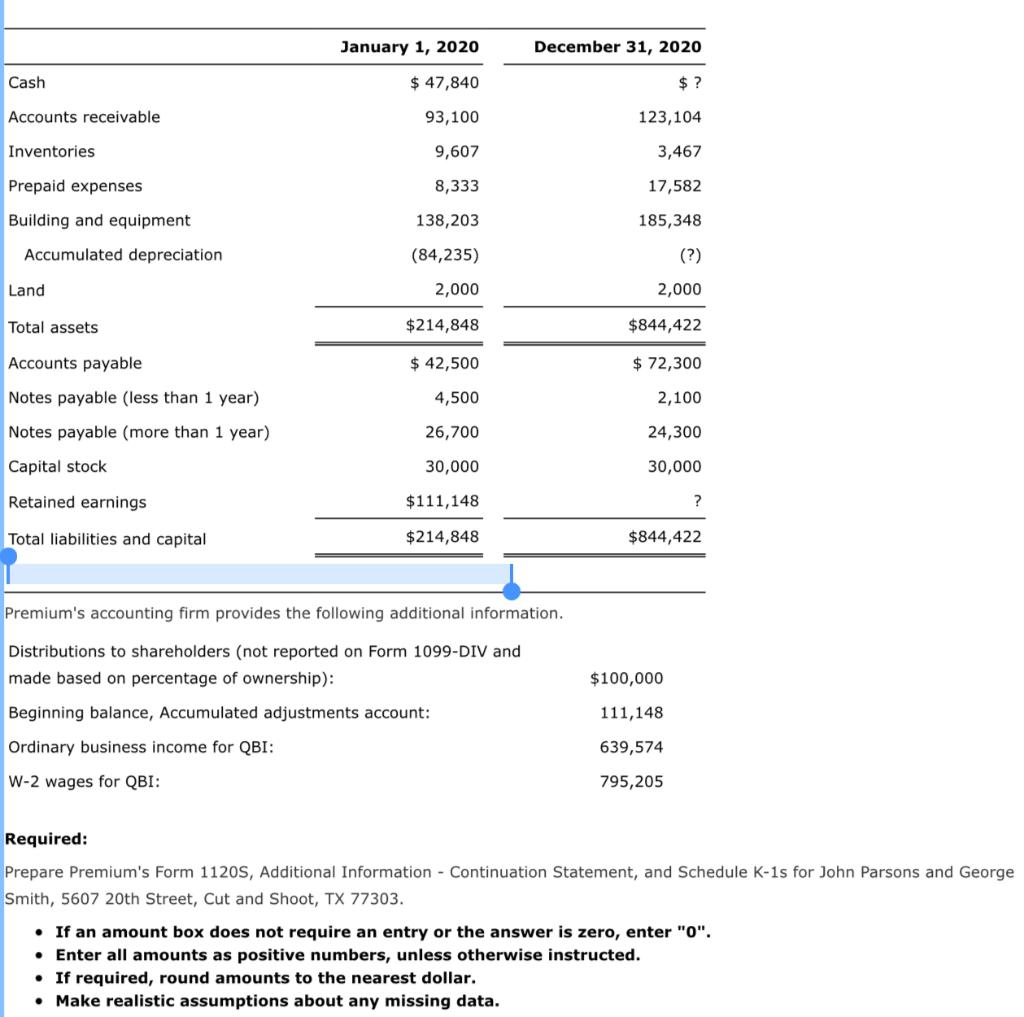

Filing and Payment

Filing and paying the business inventory tax in Texas are essential responsibilities for businesses with eligible inventory. Understanding the deadlines, methods, and potential consequences is crucial to ensure compliance.

Filing Deadlines

The business inventory tax return is due on or before May 15th each year. If May 15th falls on a weekend or holiday, the deadline is extended to the next business day.

Filing Methods, Business inventory tax texas

Businesses can file their inventory tax return electronically through the Texas Comptroller’s website or by mail using Form 102.

Payment Methods

Payments can be made online through the Comptroller’s website, by mail, or in person at a local tax office. Businesses can pay by check, money order, or credit/debit card.

Penalties and Interest

Late filing or payment of the business inventory tax may result in penalties and interest charges. The penalty for late filing is 5% of the tax due, plus 1% per month until the return is filed. The interest rate for late payment is 1% per month.

Inventory Valuation: Business Inventory Tax Texas

Inventory valuation is the process of determining the value of a business’s inventory for tax purposes. There are three methods allowed for valuing inventory for tax purposes: cost, lower of cost or market, and retail. The method used by a business will depend on the nature of its inventory and the business’s accounting practices.

The cost method is the most straightforward method of inventory valuation. Under this method, the value of inventory is simply the cost of the inventory to the business. This cost includes the purchase price of the inventory, as well as any other costs incurred in getting the inventory ready for sale, such as shipping and handling costs.

Lower of Cost or Market

The lower of cost or market method is a more conservative method of inventory valuation. Under this method, the value of inventory is the lower of the cost of the inventory or its market value. The market value of inventory is the price at which the inventory could be sold to a willing buyer in the ordinary course of business.

Retail

The retail method is a more complex method of inventory valuation. Under this method, the value of inventory is the retail price of the inventory multiplied by a predetermined percentage. The percentage used is based on the business’s historical experience with markups and markdowns.

The impact of inventory valuation on the amount of tax owed can be significant. This is because the value of inventory is used to calculate the cost of goods sold, which is a major factor in determining a business’s taxable income.

Concluding Remarks

We hope this guide has been helpful. If you have any further questions, please consult with a tax professional.

Popular Questions

What is the purpose of the business inventory tax in Texas?

The business inventory tax is a tax on the average value of inventory held by businesses in Texas. The revenue from this tax is used to fund public education and other essential government services.

What is the current tax rate?

The current tax rate is 0.5%.

When are the deadlines for filing and paying the business inventory tax?

The deadline for filing and paying the business inventory tax is May 15th.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY