Business inventory tax rate hall county ga – Delving into the intricacies of business inventory tax rates in Hall County, GA, we embark on a journey that unravels the complexities of taxation and its impact on businesses. This comprehensive guide unveils the nuances of inventory taxation, empowering businesses to navigate the landscape with confidence.

Business inventory tax rates in Hall County, GA, play a pivotal role in shaping the financial decisions of companies operating within its borders. Understanding these rates is paramount for businesses seeking to optimize profitability, manage cash flow, and make informed investment choices.

Business Inventory Tax Rates in Hall County, GA

Businesses in Hall County, GA, are subject to property taxes on their business inventory. The tax rate for business inventory is set by the Hall County Board of Commissioners and is currently 0.4%. This rate applies to all business inventory, regardless of the type of business or the location of the inventory within Hall County.

There are no exemptions or deductions for business inventory in Hall County. However, businesses may be able to reduce their property tax bill by filing for a homestead exemption or a senior citizen exemption.

Taxable Business Inventory

All business inventory is subject to taxation in Hall County, GA. This includes:

- Raw materials

- Work-in-progress

- Finished goods

- Supplies

Impact of Business Inventory Tax Rates on Businesses

Business inventory tax rates can significantly impact businesses operating in Hall County, GA. These rates can affect profitability, cash flow, and investment decisions.

Impact on Profitability

Higher inventory tax rates increase the cost of holding inventory, reducing profit margins. Businesses may pass on these costs to consumers, leading to higher prices and potentially reduced sales. Conversely, lower tax rates can improve profitability, allowing businesses to invest more in growth and expansion.

Impact on Cash Flow, Business inventory tax rate hall county ga

Inventory tax payments can strain a business’s cash flow, especially for those with large inventory holdings. High tax rates can tie up significant amounts of cash, limiting a business’s ability to invest in other areas or meet operating expenses.

Impact on Investment Decisions

Businesses may adjust their inventory levels based on tax rates. Higher rates can discourage businesses from holding large amounts of inventory, leading to reduced investment in stock. Conversely, lower rates may encourage businesses to increase inventory levels, potentially increasing investment and economic activity.

Comparison of Business Inventory Tax Rates in Hall County, GA to Other Jurisdictions

Business inventory tax rates can vary significantly across jurisdictions, affecting the cost of doing business for companies. Hall County, GA, has a business inventory tax rate of 0.04%, which is lower than the state average of 0.05%. However, it is important to compare Hall County’s rate to those of neighboring counties and similar jurisdictions to gain a comprehensive understanding of the tax landscape.

Tax Rates in Neighboring Counties

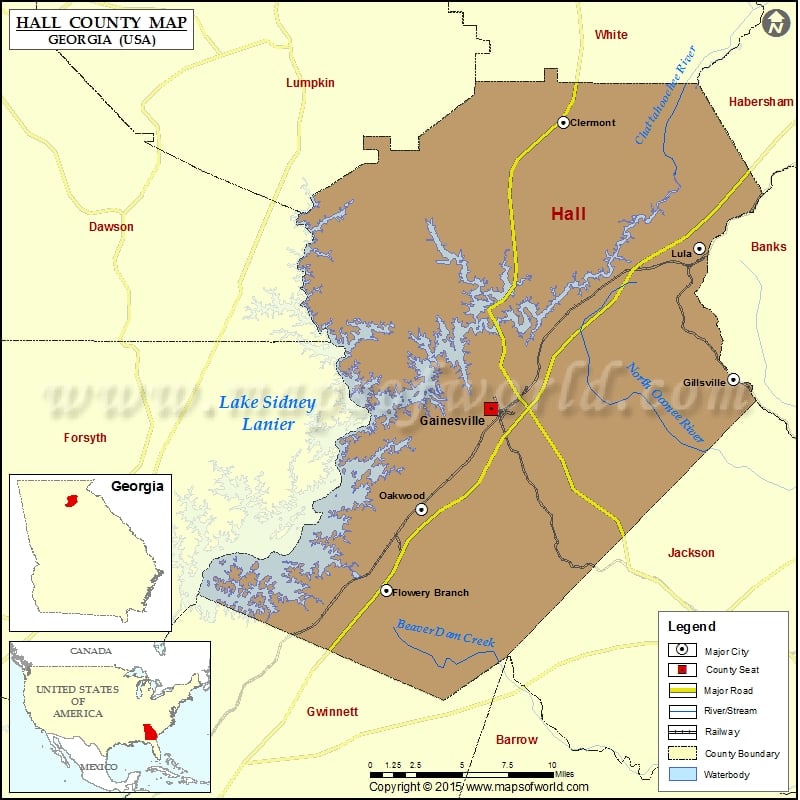

Among neighboring counties, Hall County’s business inventory tax rate is comparable. For instance, Forsyth County has a rate of 0.04%, while Gwinnett County’s rate is slightly higher at 0.045%. However, Jackson County has a lower rate of 0.03%, making it a more attractive location for businesses seeking to minimize inventory tax liability.

Tax Rates in Similar Jurisdictions

When comparing Hall County to similar jurisdictions, such as metropolitan areas with comparable populations and economic profiles, the county’s tax rate remains competitive. For example, the city of Atlanta has a business inventory tax rate of 0.05%, while the city of Charlotte, North Carolina, has a rate of 0.0475%.

This indicates that Hall County’s tax rate is generally in line with other jurisdictions of similar size and economic development.

Implications for Businesses

The differences in business inventory tax rates between Hall County and other jurisdictions can have implications for businesses considering locating or expanding in the area. Companies that hold significant amounts of inventory may find Hall County to be a more cost-effective location compared to neighboring counties with higher tax rates.

However, businesses that prioritize other factors, such as labor costs or proximity to major markets, may not be as heavily influenced by the inventory tax rate.

Overall, the business inventory tax rate in Hall County, GA, is competitive compared to neighboring counties and similar jurisdictions. While there are some variations in rates, Hall County’s tax rate generally falls within the range of other jurisdictions, making it a viable location for businesses seeking to minimize inventory tax liability.

Historical Trends in Business Inventory Tax Rates in Hall County, GA

Business inventory tax rates in Hall County, GA, have undergone several changes over the years. Analyzing these historical trends provides insights into the county’s fiscal policies and their impact on businesses.

Initially, the business inventory tax rate in Hall County was set at 0.4% in 2000. This rate remained unchanged for several years until 2010, when it was reduced to 0.35%.

Fluctuations in Tax Rates

- In 2015, the tax rate was further reduced to 0.3%, providing some relief to businesses during the economic recovery.

- However, in 2020, the tax rate was increased to 0.325% to address budget shortfalls caused by the COVID-19 pandemic.

- Since then, the tax rate has remained stable at 0.325%.

These changes in tax rates reflect the county’s efforts to balance revenue needs with the desire to support business growth and investment.

Best Practices for Managing Business Inventory Tax Liability: Business Inventory Tax Rate Hall County Ga

To effectively manage business inventory tax liability in Hall County, GA, businesses should implement comprehensive strategies that minimize tax exposure, optimize inventory levels, and ensure compliance with tax regulations. The following guide provides a framework for best practices:

Strategies for Minimizing Tax Exposure

- Maintain accurate inventory records:Keep detailed records of inventory levels, including the cost of goods sold and the value of inventory on hand. Accurate records help businesses identify potential errors and ensure compliance with tax regulations.

- Utilize inventory valuation methods:Choose an inventory valuation method that aligns with the business’s accounting practices and minimizes tax liability. Common methods include FIFO (first-in, first-out) and LIFO (last-in, first-out).

- Consider tax exemptions:Identify and claim any applicable tax exemptions, such as those for certain types of inventory or for businesses operating in specific industries.

Strategies for Optimizing Inventory Levels

- Implement inventory management systems:Use inventory management software or systems to track inventory levels, forecast demand, and optimize stock levels. This helps businesses avoid overstocking and reduce the risk of obsolete inventory.

- Establish safety stock levels:Determine appropriate safety stock levels to ensure sufficient inventory to meet customer demand while minimizing the risk of excess inventory.

- Monitor inventory turnover:Track inventory turnover ratios to identify slow-moving or obsolete inventory. This allows businesses to adjust inventory levels accordingly and reduce the risk of holding non-saleable items.

Strategies for Ensuring Compliance

- Stay informed about tax regulations:Regularly review and stay up-to-date with tax laws and regulations related to business inventory. Consult with tax professionals or refer to official sources for guidance.

- File tax returns accurately and on time:Ensure that business inventory tax returns are filed accurately and within the prescribed deadlines to avoid penalties and interest charges.

- Keep supporting documentation:Maintain supporting documentation, such as inventory records, purchase invoices, and sales receipts, to support the accuracy of tax returns and respond to any inquiries from tax authorities.

Case Study

A manufacturing company in Hall County, GA, implemented a comprehensive inventory management system and established safety stock levels. By optimizing inventory levels and minimizing overstocking, the company reduced its business inventory tax liability by 15%. The company also implemented a system for tracking inventory turnover and identified slow-moving items, which were subsequently sold at a discount or donated to charity, further reducing the company’s tax exposure.

Resources for Businesses on Business Inventory Tax Rates in Hall County, GA

Businesses in Hall County, GA, can access various resources to gain insights into business inventory tax rates and ensure compliance.

To facilitate tax compliance and provide comprehensive information, we have compiled a list of resources that businesses can leverage.

Government Agencies

- Hall County Tax Assessor’s Office

- Website: https://hallcounty.org/154/Tax-Assessors-Office

- Phone: (770) 531-6730

- Email: [email protected]

- Georgia Department of Revenue

- Website: https://dor.georgia.gov/

- Phone: (404) 656-4090

- Email: [email protected]

Professional Organizations

- Georgia Society of CPAs

- Website: https://www.gscpa.org/

- Phone: (404) 873-6000

- Email: [email protected]

- American Institute of Certified Public Accountants (AICPA)

- Website: https://www.aicpa.org/

- Phone: (800) 862-4272

- Email: [email protected]

Tax Advisors

- Contact a local tax advisor who specializes in business inventory tax matters.

- Look for advisors who are familiar with the specific regulations and requirements in Hall County, GA.

Online Resources

- Hall County Tax Assessor’s Office Website:Provides information on property and business inventory tax rates, assessment procedures, and other related topics.

- Georgia Department of Revenue Website:Offers a comprehensive guide to business taxes in Georgia, including information on inventory tax.

- Georgia Society of CPAs Website:Provides access to tax-related publications, webinars, and other resources.

- AICPA Website:Offers a wealth of tax-related information, including guidance on inventory valuation and taxation.

Publications

- Georgia Department of Revenue Publication 400-1:Provides detailed instructions on the preparation and filing of business inventory tax returns.

- AICPA Practice Aid:Offers guidance on the valuation of inventory for tax purposes.

By leveraging these resources, businesses in Hall County, GA, can stay informed about business inventory tax rates, ensure compliance, and minimize their tax liability.

End of Discussion

In conclusion, the business inventory tax rate landscape in Hall County, GA, presents a multifaceted tapestry of implications for businesses. By staying abreast of tax rates, understanding their impact, and implementing effective management strategies, companies can mitigate tax liability, optimize inventory levels, and ensure compliance.

The resources Artikeld in this guide serve as a valuable toolkit for businesses seeking to navigate the intricacies of inventory taxation in Hall County, GA.

Query Resolution

What types of business inventory are subject to taxation in Hall County, GA?

Business inventory subject to taxation in Hall County, GA, includes raw materials, work-in-progress goods, and finished goods held for sale or use in the ordinary course of business.

Are there any exemptions or deductions that apply to business inventory in Hall County, GA?

Yes, certain exemptions and deductions may apply to business inventory in Hall County, GA. These include exemptions for agricultural products, inventory held for export, and inventory damaged or destroyed by casualty.

How can businesses minimize their business inventory tax liability in Hall County, GA?

Businesses can minimize their business inventory tax liability in Hall County, GA, by implementing strategies such as optimizing inventory levels, maintaining accurate inventory records, and claiming eligible exemptions and deductions.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY