Business inventory tax rate hall county ga – Unveiling the business inventory tax rate in Hall County, Georgia, is a matter of paramount importance for business owners and tax professionals alike. This comprehensive guide delves into the intricacies of the tax rate, exemptions, deductions, assessment, payment, reporting requirements, audits, penalties, and provides valuable resources for further assistance.

With a focus on clarity and accessibility, this guide unravels the complexities of business inventory taxation in Hall County, Georgia, empowering businesses to navigate the tax landscape with confidence.

Business Inventory Tax Rate Hall County GA

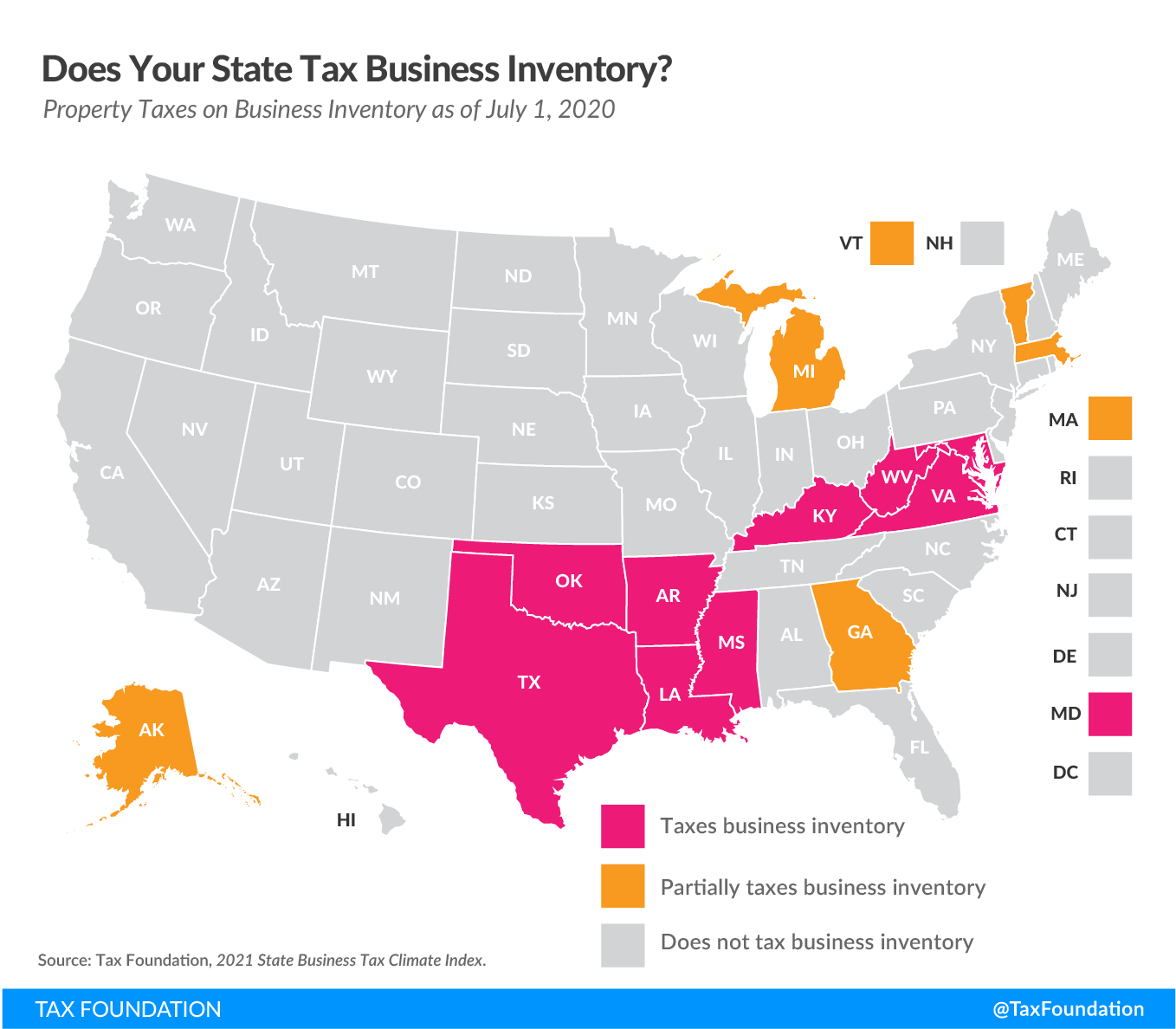

In Hall County, Georgia, the business inventory tax rate is currently set at 0.4%. This tax is levied on the average value of a business’s inventory held within the county during the taxable year. The tax applies to all businesses that maintain inventory in Hall County, regardless of their size or industry.

Examples of Application

Here are a few examples of how the business inventory tax rate is applied to different types of businesses:

- A retail store that sells clothing and accessories would be subject to the business inventory tax on the average value of its unsold merchandise.

- A manufacturing company that produces furniture would be subject to the business inventory tax on the average value of its raw materials, work-in-progress, and finished goods.

- A wholesale distributor that sells food and beverages would be subject to the business inventory tax on the average value of its unsold inventory.

Exemptions and Deductions

Hall County, Georgia, offers several exemptions and deductions that may reduce the amount of business inventory tax owed. These exemptions and deductions are designed to provide relief to businesses and encourage economic growth in the county.

Inventory Held for Resale

One of the most common exemptions is for inventory held for resale. This exemption applies to businesses that purchase inventory with the intention of reselling it to customers. To qualify for this exemption, businesses must maintain detailed records of their inventory purchases and sales.

Inventory Used in Manufacturing

Another exemption is available for inventory used in manufacturing. This exemption applies to businesses that use inventory to produce finished goods. To qualify for this exemption, businesses must demonstrate that the inventory is used directly in the manufacturing process.

Inventory Damaged or Destroyed

Businesses may also be eligible for a deduction for inventory that is damaged or destroyed. This deduction is available for inventory that is damaged or destroyed due to events such as fire, theft, or natural disasters. To qualify for this deduction, businesses must provide documentation of the damage or destruction.

Application Process

To apply for any of these exemptions or deductions, businesses must file an application with the Hall County Tax Assessor’s Office. The application must include documentation to support the exemption or deduction being claimed. The Tax Assessor’s Office will review the application and make a determination on whether to grant the exemption or deduction.

Assessment and Payment

Assessing and paying business inventory taxes in Hall County, Georgia, involves a specific process with established deadlines and payment methods. Understanding these requirements ensures timely compliance and avoids potential penalties.

The Hall County Tax Assessor’s Office is responsible for assessing the value of business inventories subject to taxation. Based on this assessment, the county determines the amount of tax owed by each business.

Payment Deadlines

Business inventory taxes in Hall County are due and payable on or before April 1st of each year. Payments received after this date may be subject to late payment penalties.

Payment Methods

Payments can be made online through the Hall County Tax Assessor’s Office website, by mail, or in person at the tax assessor’s office. Online payments are processed through a secure portal and require a valid credit card or electronic check.

Mail-in payments should be made payable to the Hall County Tax Assessor and mailed to the address provided on the tax bill. In-person payments can be made at the tax assessor’s office during regular business hours.

Late Payment Penalties

Late payments are subject to a penalty of 10% of the unpaid tax amount, plus interest at the rate of 1% per month on the unpaid balance. To avoid these penalties, it is crucial to make payments on or before the established deadline.

Reporting Requirements: Business Inventory Tax Rate Hall County Ga

Businesses in Hall County, Georgia, are required to report their business inventory annually to the Hall County Tax Assessor’s Office.

The reporting period is from January 1 to December 31 of each year, and the return is due on April 15 of the following year.

Format and Supporting Documentation, Business inventory tax rate hall county ga

The return must be filed on the prescribed form provided by the Hall County Tax Assessor’s Office and must include the following information:

- The name and address of the business

- The taxpayer identification number (TIN) of the business

- A description of the inventory

- The cost or market value of the inventory

- The location of the inventory

The return must also be accompanied by the following supporting documentation:

- A copy of the business’s financial statements

- A list of all inventory items

- A description of the method used to value the inventory

Audits and Penalties

The Hall County Tax Commissioner’s Office may conduct audits to verify the accuracy of business inventory tax returns. During an audit, the taxpayer will be required to provide documentation supporting the information reported on their return.

Failure to comply with the business inventory tax laws can result in penalties, including fines and interest charges. The amount of the penalty will depend on the severity of the violation.

Penalties

- Failure to file a return:10% of the tax due, plus interest.

- Filing a late return:5% of the tax due, plus interest.

- Underpayment of tax:10% of the tax due, plus interest.

- Fraudulent return:50% of the tax due, plus interest.

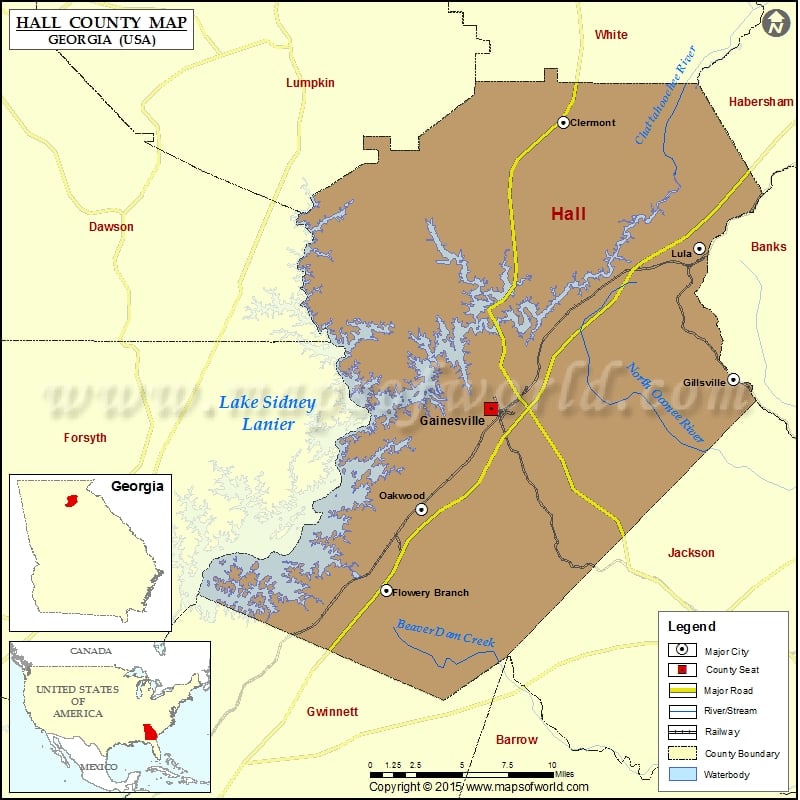

Resources and Contact Information

Taxpayers with questions or needing assistance with business inventory taxes in Hall County, Georgia, can access various resources and contact information.

The following resources are available:

Hall County Tax Commissioner’s Office

- Website: https://www.hallcounty.org/302/Tax-Commissioner

- Phone: (770) 531-6810

- Email: [email protected]

- Address: 2875 Browns Bridge Road, Suite 200, Gainesville, GA 30504

Georgia Department of Revenue

- Website: https://dor.georgia.gov/

- Phone: (404) 656-4090

- Email: [email protected]

Final Review

In conclusion, understanding the business inventory tax rate in Hall County, Georgia, is crucial for businesses to ensure compliance and optimize tax strategies. By leveraging the information provided in this guide, businesses can make informed decisions, minimize tax liabilities, and maintain a competitive edge in the marketplace.

Popular Questions

What is the current business inventory tax rate in Hall County, Georgia?

The current business inventory tax rate in Hall County, Georgia, is 0.4%.

Are there any exemptions or deductions for business inventory in Hall County, Georgia?

Yes, certain exemptions and deductions may apply, such as the exemption for manufacturers and the deduction for inventory held for resale.

When are business inventory taxes due in Hall County, Georgia?

Business inventory taxes are due on April 15th of each year.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY