Business inventory removed for personal use irs form – When business owners divert inventory for personal use, the tax implications can be complex. Understanding IRS Form 4797 is crucial to ensure proper reporting and avoid potential penalties. This guide delves into the tax consequences, recordkeeping requirements, and strategies for minimizing tax liability when removing business inventory for personal use.

Failure to properly account for such transactions can result in costly mistakes. By staying informed and adhering to IRS regulations, business owners can protect their financial interests and maintain compliance.

Tax Implications of Removing Business Inventory for Personal Use

Removing business inventory for personal use has tax consequences that business owners should be aware of. Understanding these implications can help ensure compliance with tax regulations and avoid potential penalties.

When business inventory is removed for personal use, it is considered a taxable event. The value of the inventory removed is included in the business’s gross income, increasing its taxable income. This can result in higher business income taxes.

Taxable Situations

Removing business inventory for personal use is generally taxable, regardless of the reason for the removal. Some common taxable situations include:

- Using inventory for personal projects or hobbies

- Taking inventory home for personal use

- Giving inventory away as gifts

- Selling inventory below cost for personal gain

Non-Taxable Situations, Business inventory removed for personal use irs form

There are a few exceptions where removing business inventory for personal use is not taxable. These include:

- Inventory that is damaged or obsolete and has no value to the business

- Inventory that is used for employee compensation (e.g., bonuses)

- Inventory that is used for charitable donations

It is important to note that the tax treatment of removing business inventory for personal use can vary depending on specific circumstances and tax laws. Business owners should consult with a tax professional for guidance on their specific situation.

IRS Form 4797

IRS Form 4797, Sales of Business Property, is used to report the sale or exchange of certain business assets, including inventory, when they are no longer used in the business.

When removing business inventory for personal use, it is considered a sale or exchange, and you must report the transaction on Form 4797. The form helps the IRS determine the gain or loss on the sale and calculate any applicable taxes.

How to Complete Form 4797

To complete Form 4797, you will need to provide information about the inventory, including its cost or other basis, the date of sale, and the amount of gain or loss. You will also need to provide information about the buyer, such as their name, address, and taxpayer identification number.

The form is relatively straightforward to complete, but it is important to be accurate in your reporting. If you are not sure how to complete the form, you can consult with a tax professional for assistance.

Penalties for Incorrect Reporting

There are penalties for incorrectly reporting the sale of business inventory on Form 4797. These penalties can include fines and interest charges. It is therefore important to ensure that you report the transaction accurately and on time.

Recordkeeping and Documentation: Business Inventory Removed For Personal Use Irs Form

Maintaining proper records and documentation is crucial when removing business inventory for personal use. Accurate records provide a clear audit trail and support the taxpayer’s position in case of an IRS audit.

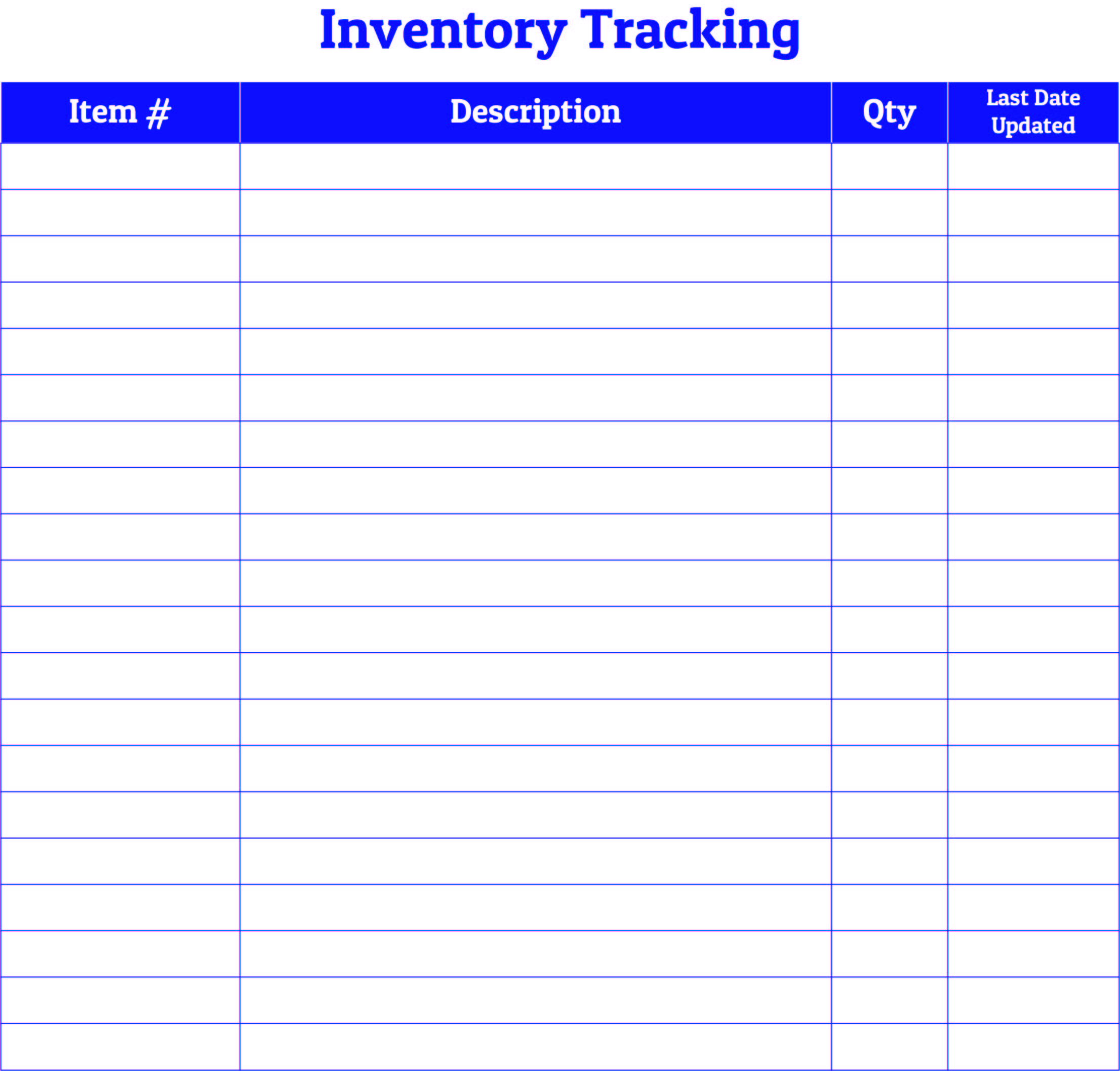

The taxpayer should keep the following records for a minimum of three years:

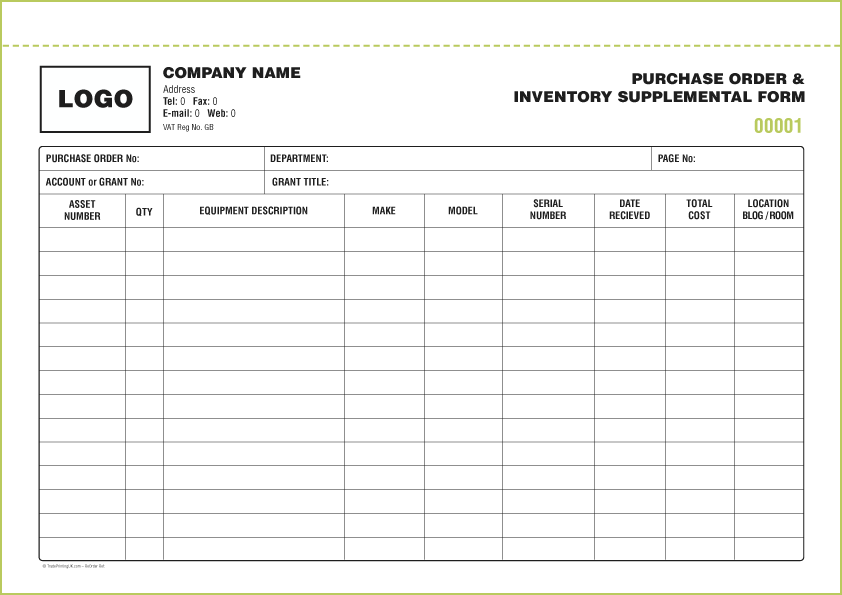

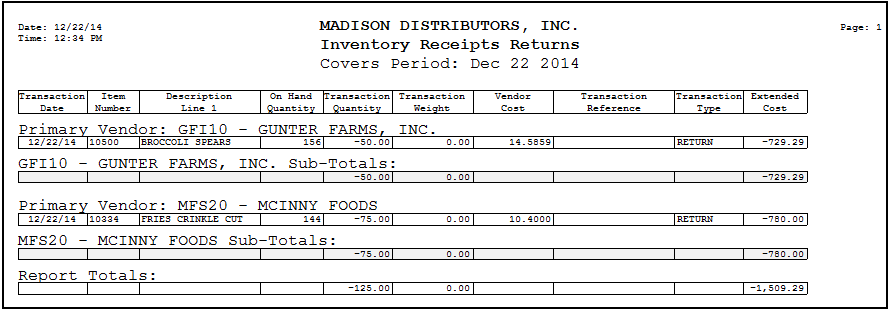

- A detailed inventory list of the items removed, including descriptions, quantities, and original acquisition costs.

- Documentation of the removal date and the intended personal use of the items.

- Receipts or other proof of purchase for any items purchased specifically for personal use.

Failure to maintain adequate records can result in the IRS disallowing the deduction for personal use of business inventory. Additionally, the taxpayer may be subject to penalties for failing to properly report the transaction.

Tax Planning Strategies

When removing business inventory for personal use, implementing effective tax planning strategies is crucial to minimize tax liability. These strategies involve utilizing cost segregation studies and employing various methods to optimize tax benefits.

Cost Segregation Studies

Cost segregation studies allow businesses to reclassify certain assets, such as building components, from real property to personal property. This reclassification accelerates depreciation deductions, resulting in significant tax savings. For example, a building’s HVAC system, which is typically depreciated over 39 years, can be reclassified as personal property, enabling depreciation over a shorter period of 5 or 7 years.

Other Methods

- Inventory Valuation Methods:Choosing an appropriate inventory valuation method, such as FIFO (first-in, first-out) or LIFO (last-in, first-out), can impact the cost of goods sold and taxable income.

- Donation of Excess Inventory:Donating excess inventory to qualified charities can generate tax deductions while reducing the taxable gain on the sale of inventory.

- Section 1031 Exchange:Utilizing a Section 1031 exchange allows businesses to defer capital gains tax when exchanging business property for like-kind property.

Successful Tax Planning Strategies

Successful tax planning strategies often involve a combination of the aforementioned methods. For instance, a business may conduct a cost segregation study to accelerate depreciation deductions, donate excess inventory to reduce taxable income, and utilize a Section 1031 exchange to defer capital gains tax on the sale of business property.

Last Recap

Navigating the complexities of removing business inventory for personal use requires a comprehensive understanding of the tax implications and proper documentation. IRS Form 4797 plays a vital role in ensuring accurate reporting and minimizing tax liability. By following the guidelines Artikeld in this guide, business owners can confidently manage these transactions and maintain compliance with tax regulations.

FAQ Overview

What are the tax consequences of removing business inventory for personal use?

The removal of business inventory for personal use is generally considered a taxable transaction. The business owner must report the fair market value of the inventory as income and pay applicable taxes.

How do I complete IRS Form 4797 when removing business inventory for personal use?

IRS Form 4797 requires information such as the date of the transaction, description of the inventory, fair market value, and cost or other basis of the inventory. Detailed instructions are provided on the form itself.

What records should I keep to support the removal of business inventory for personal use?

It is essential to maintain proper records, such as invoices, receipts, and documentation of the fair market value of the inventory. These records should be kept for at least three years from the date of the transaction.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY