Business inventory fiscal year tax kentucky – Welcome to the comprehensive guide on business inventory fiscal year tax in Kentucky. This guide will provide you with all the essential information you need to understand and comply with the Kentucky business inventory tax. We will cover everything from the basics of the tax to reporting and payment requirements, as well as strategies for ensuring compliance.

Kentucky’s business inventory tax is a tax on the average value of a business’s inventory over the course of its fiscal year. The tax rate is 0.06%, and the tax is due on April 15th of each year. Businesses that are required to file a Kentucky corporate income tax return are also required to file a business inventory tax return.

Business Inventory Tax in Kentucky

In Kentucky, businesses are subject to an inventory tax on their stock of goods and materials on hand as of January 1st of each year. The tax is calculated as a percentage of the average value of the inventory held during the preceding calendar year.

The tax rate for the business inventory tax in Kentucky is 0.06%. This means that for every $100 of inventory value, a business will owe $0.06 in taxes.

Taxable Inventory

Taxable inventory includes all goods and materials held for sale in the ordinary course of business, including raw materials, work in progress, and finished goods.

- Raw materials are materials that have not yet been processed into finished goods.

- Work in progress is inventory that is in the process of being manufactured or assembled.

- Finished goods are inventory that is ready for sale to customers.

Non-Taxable Inventory

Non-taxable inventory includes certain items that are exempt from the business inventory tax, such as:

- Inventory held for resale by retailers

- Inventory held by manufacturers for use in manufacturing

- Inventory held by farmers for use in farming

- Inventory held by non-profit organizations

Fiscal Year Considerations: Business Inventory Fiscal Year Tax Kentucky

The fiscal year you choose for your business can impact your business inventory tax calculations. It’s important to understand the implications of your fiscal year choice and to make sure you’re using the correct fiscal year for your business.

The fiscal year is a 12-month period that businesses use for accounting and tax purposes. It doesn’t have to match the calendar year (January 1 to December 31). Businesses can choose any 12-month period as their fiscal year.

Determining the Correct Fiscal Year

There are a few factors to consider when choosing a fiscal year for your business:

- Your business’s activity.Some businesses have natural fiscal years that are based on their business cycle. For example, a retail business might choose a fiscal year that ends on January 31, which is the end of the holiday shopping season.

- Your tax filing requirements.If you’re required to file state income taxes, you’ll need to use the same fiscal year for both state and federal tax purposes.

- Your accounting software.Some accounting software programs are designed to work with specific fiscal years. Make sure your accounting software is compatible with the fiscal year you choose.

Adjusting Inventory Values for Different Fiscal Years

If you change your fiscal year, you’ll need to adjust your inventory values to reflect the new fiscal year. This is because the inventory value on your tax return must be based on the inventory you have on hand at the end of your fiscal year.

To adjust your inventory values, you’ll need to:

- Determine the inventory value at the end of your old fiscal year.This is the value of the inventory you had on hand on the last day of your old fiscal year.

- Determine the inventory value at the end of your new fiscal year.This is the value of the inventory you had on hand on the last day of your new fiscal year.

- Calculate the difference between the two inventory values.This is the amount of inventory you gained or lost during the fiscal year.

- Adjust your inventory value on your tax return.You’ll need to add the amount of inventory you gained during the fiscal year to your inventory value at the end of your old fiscal year. If you lost inventory during the fiscal year, you’ll need to subtract the amount of inventory you lost from your inventory value at the end of your old fiscal year.

Tax Exemptions and Deductions

Kentucky offers several tax exemptions and deductions to businesses that hold inventory. These incentives are designed to reduce the overall tax burden for businesses and encourage economic growth.

Eligibility Criteria, Business inventory fiscal year tax kentucky

The eligibility criteria for each exemption or deduction vary depending on the specific provision. Generally, businesses must meet certain requirements, such as:

- Operating in Kentucky

- Maintaining a physical presence in the state

- Holding inventory for sale or use in the ordinary course of business

Examples of Exemptions and Deductions

Some of the most common tax exemptions and deductions available for business inventory in Kentucky include:

Exemption for Raw Materials and Work-in-Process Inventory

Raw materials and work-in-process inventory are exempt from the state’s sales and use tax.

Deduction for Inventory Losses

Businesses can deduct losses incurred due to theft, damage, or obsolescence of inventory.

Deduction for Inventory Held for Resale

Businesses can deduct the cost of inventory held for resale from their gross income.

Additional Considerations

Businesses should carefully review the eligibility criteria and requirements for each exemption or deduction to ensure they qualify. It is also important to keep accurate records to support any claims for exemptions or deductions.

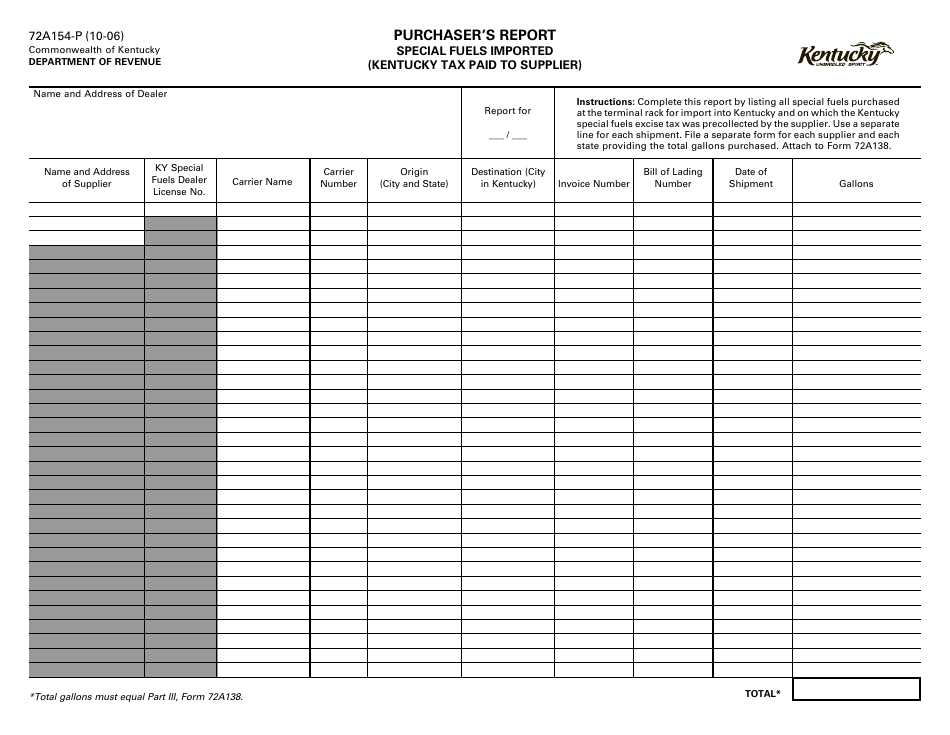

Reporting and Payment Requirements

The Kentucky business inventory tax requires businesses to file an annual return and make payments by specific deadlines. The return must be filed with the Kentucky Department of Revenue and must include the following information:

- The business’s name and address

- The business’s Kentucky business license number

- The total value of the business’s inventory as of the last day of the fiscal year

- The amount of tax due

The deadline for filing the business inventory tax return is May 15th. The tax is due when the return is filed. If the tax is not paid by the due date, the business will be subject to penalties and interest.

Penalties for Late Filing or Payment

The Kentucky Department of Revenue may impose penalties on businesses that file their business inventory tax returns late or fail to pay the tax by the due date. The penalties for late filing or payment are as follows:

- A 5% penalty for each month or fraction of a month that the return is late, up to a maximum of 25%

- A 10% penalty for failure to pay the tax by the due date

- Interest on the unpaid tax at the rate of 1% per month

Compliance Strategies

Ensuring compliance with the business inventory tax in Kentucky is crucial to avoid penalties and interest charges. Businesses can implement several strategies to ensure they meet their obligations.

Maintaining accurate and organized records is essential for compliance. Businesses should establish a system for tracking inventory levels, purchases, and sales. This system should include regular inventory counts and reconciliation with purchase and sales records.

Recordkeeping Best Practices

- Establish a clear and consistent inventory tracking system.

- Conduct regular physical inventory counts and reconcile them with inventory records.

- Maintain detailed purchase and sales records, including dates, quantities, and costs.

- Keep all records organized and easily accessible for review.

Staying informed about the latest tax laws and regulations is also important. Businesses should regularly review Kentucky’s tax website and consult with tax professionals to ensure they are aware of any changes that may impact their inventory tax liability.

Tips for Avoiding Common Errors

- Incorrectly valuing inventory: Businesses should use the correct valuation method as prescribed by Kentucky tax laws.

- Failing to include all taxable inventory: All inventory held for sale or lease should be included in the tax calculation.

- Incorrectly claiming exemptions: Businesses should carefully review the list of eligible exemptions and ensure they meet the specific criteria.

- Missing filing deadlines: Businesses should mark their calendars and file their inventory tax returns on time to avoid late filing penalties.

By following these compliance strategies, businesses can minimize the risk of errors and ensure they meet their business inventory tax obligations in Kentucky.

Ultimate Conclusion

By following the guidance in this guide, you can ensure that your business is in compliance with the Kentucky business inventory tax. If you have any questions, please contact the Kentucky Department of Revenue.

Essential Questionnaire

What is the business inventory tax rate in Kentucky?

The business inventory tax rate in Kentucky is 0.06%.

When is the business inventory tax due?

The business inventory tax is due on April 15th of each year.

What businesses are required to file a business inventory tax return?

Businesses that are required to file a Kentucky corporate income tax return are also required to file a business inventory tax return.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY