Business inventory fiscal year tax kentucky – Understanding business inventory fiscal year tax in Kentucky is crucial for businesses operating within the state. This guide delves into the intricacies of inventory management, fiscal year considerations, tax implications, and best practices to ensure compliance and optimize operations.

Effective inventory management is essential for Kentucky businesses to maintain accurate records, minimize losses, and optimize cash flow. Determining the appropriate fiscal year for your business is also vital, as it impacts inventory valuation and tax obligations. Moreover, understanding the various taxes applicable to business inventory in Kentucky, such as sales and use tax, is essential for proper tax compliance.

Inventory Management in Kentucky Businesses

Inventory management is a crucial aspect of business operations in Kentucky, ensuring that businesses maintain optimal stock levels to meet customer demand while minimizing costs and maximizing efficiency. Effective inventory management practices are essential for Kentucky businesses to remain competitive and successful.

Importance of Inventory Management for Kentucky Businesses

Proper inventory management provides numerous benefits for Kentucky businesses, including:

- Improved Customer Service:Adequate inventory levels ensure that customers can easily find and purchase the products they need, leading to increased customer satisfaction and loyalty.

- Reduced Costs:Efficient inventory management minimizes storage costs, waste, and the risk of obsolete inventory, resulting in significant cost savings.

- Enhanced Efficiency:Well-managed inventory enables businesses to streamline operations, reduce lead times, and improve overall productivity.

- Increased Sales:Optimal inventory levels prevent stockouts, ensuring that businesses can meet customer demand and maximize sales opportunities.

- Improved Decision-Making:Accurate inventory data provides valuable insights for making informed decisions about production, purchasing, and marketing strategies.

Effective Inventory Management Strategies Used by Kentucky Businesses

Kentucky businesses employ various effective inventory management strategies to optimize their operations:

- Just-in-Time (JIT) Inventory:JIT involves holding minimal inventory and replenishing stock as needed, reducing storage costs and minimizing waste.

- ABC Analysis:This method categorizes inventory items based on their value and usage, allowing businesses to prioritize inventory management efforts and focus on high-value items.

- Cycle Counting:Regular physical inventory counts help businesses identify discrepancies and ensure inventory accuracy.

- Inventory Management Software:Advanced software solutions automate inventory tracking, forecasting, and reporting, improving efficiency and accuracy.

- Vendor Managed Inventory (VMI):VMI involves outsourcing inventory management to suppliers, who monitor stock levels and replenish inventory as needed, reducing inventory costs and improving supply chain efficiency.

Fiscal Year Considerations for Business Inventory

A fiscal year is a 12-month accounting period that a business uses to track its financial performance. It is important for businesses to select an appropriate fiscal year that aligns with their business cycle and tax reporting requirements.

Kentucky businesses have the flexibility to choose their fiscal year. However, there are certain factors to consider when making this decision, such as:

Determining the Appropriate Fiscal Year

- Business cycle:The fiscal year should align with the business’s natural business cycle. For example, a business that experiences seasonal fluctuations in sales may want to choose a fiscal year that begins at the start of its busy season.

- Tax reporting:The fiscal year should also align with the business’s tax reporting requirements. Kentucky businesses are required to file their state income tax returns on a calendar year basis. However, businesses may elect to file their federal income tax returns on a fiscal year basis.

Impact of Fiscal Year Selection

The selection of a fiscal year can have a significant impact on inventory valuation and tax implications. For example, a business that chooses a fiscal year that ends on December 31 will have to take inventory on that date. This could result in a higher inventory valuation if the business has a large amount of inventory on hand at the end of the year.

Additionally, the selection of a fiscal year can affect the timing of tax payments. Businesses that file their federal income tax returns on a fiscal year basis may have to make estimated tax payments during the year. These payments are based on the business’s estimated tax liability for the year.

If the business’s actual tax liability is different from its estimated tax liability, it may have to pay additional taxes or receive a refund when it files its tax return.

Tax Implications of Business Inventory in Kentucky

Businesses in Kentucky must be aware of the various tax implications associated with their business inventory. This includes understanding the sales and use tax laws, as well as any available tax deductions and credits.

Kentucky Sales and Use Tax Laws Related to Inventory

Kentucky imposes a 6% sales tax on the sale of tangible personal property, including business inventory. However, there are some exceptions to this rule. For example, inventory that is purchased for resale is not subject to sales tax. Additionally, businesses may be able to claim a credit for sales tax paid on inventory that is later sold.

Tax Deductions and Credits Available for Inventory Management

There are a number of tax deductions and credits available to businesses that can help reduce the cost of inventory management. These include:

- The cost of goods sold (COGS) deductionallows businesses to deduct the cost of inventory that is sold during the year.

- The inventory tax creditprovides a credit against Kentucky income tax for businesses that maintain a certain level of inventory.

- The research and development (R&D) tax creditprovides a credit against Kentucky income tax for businesses that invest in R&D activities, including the development of new inventory.

Best Practices for Inventory Management and Tax Compliance

Maintaining accurate inventory records is crucial for Kentucky businesses to ensure tax compliance and optimize operations. Implementing best practices for inventory management and tax reporting can help businesses avoid penalties, reduce tax liabilities, and streamline their accounting processes.

The following table summarizes key best practices for inventory management and tax compliance in Kentucky:

| Inventory Tracking Methods | Record-Keeping Requirements | Tax Reporting Obligations |

|---|---|---|

| Periodic Inventory System | Maintain detailed records of purchases, sales, and ending inventory | Report ending inventory value on tax returns |

| Perpetual Inventory System | Continuously update inventory records as transactions occur | Report real-time inventory value on tax returns |

| FIFO (First-In, First-Out) | Assume that the oldest inventory is sold first | May result in higher cost of goods sold (COGS) in inflationary periods |

| LIFO (Last-In, First-Out) | Assume that the most recent inventory is sold first | May result in lower COGS in inflationary periods |

| Weighted Average | Calculates an average cost for all inventory items | Provides a more stable COGS over time |

Kentucky businesses can optimize their inventory management and tax compliance by implementing the following strategies:

- Establish clear inventory policies and procedures.

- Choose an inventory tracking method that aligns with the business’s operations.

- Maintain accurate and up-to-date inventory records.

- Conduct regular inventory counts to verify accuracy.

- Review and reconcile inventory records periodically.

- Use technology to automate inventory management and tax reporting.

- Consult with a tax professional to ensure compliance with Kentucky tax laws.

Resources for Kentucky Businesses on Inventory Management and Taxation: Business Inventory Fiscal Year Tax Kentucky

Kentucky businesses have access to a range of resources to assist with inventory management and taxation compliance. These resources include government agencies, professional organizations, and educational opportunities.

The following list provides an overview of some of the key resources available:

Government Agencies, Business inventory fiscal year tax kentucky

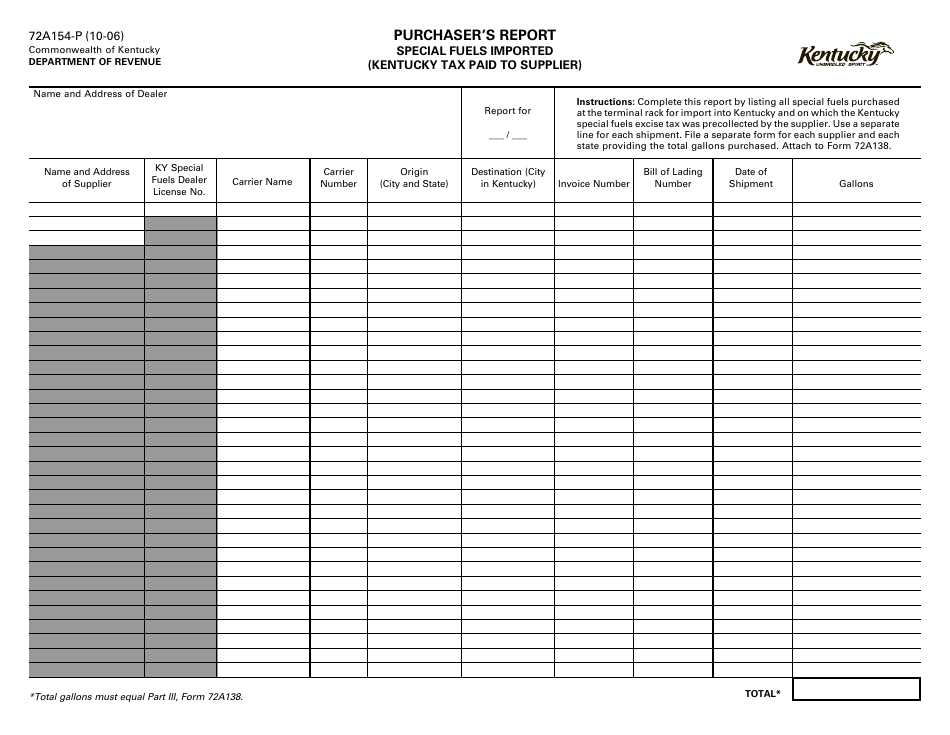

- Kentucky Department of Revenue: The Kentucky Department of Revenue provides information on inventory taxation, including tax rates, exemptions, and filing requirements.

- Kentucky Cabinet for Economic Development: The Kentucky Cabinet for Economic Development offers resources for businesses on inventory management, including best practices and industry trends.

Professional Organizations

- Kentucky Society of Certified Public Accountants (KYCPA): The KYCPA provides educational opportunities and resources for accountants, including webinars and conferences on inventory management and taxation.

- Kentucky Retail Federation: The Kentucky Retail Federation offers resources and advocacy for retailers, including information on inventory management and taxation.

Educational Opportunities

- University of Kentucky Center for Business and Economic Research: The University of Kentucky Center for Business and Economic Research offers workshops and seminars on inventory management and taxation.

- Kentucky Small Business Development Center: The Kentucky Small Business Development Center provides free and low-cost consulting and training on inventory management and taxation.

Final Wrap-Up

By adhering to best practices for inventory management and tax compliance, Kentucky businesses can streamline their operations, reduce tax liabilities, and enhance their overall financial performance. This guide provides a comprehensive overview of these practices, including inventory tracking methods, record-keeping requirements, and tax reporting obligations.

Q&A

What is the significance of inventory management for Kentucky businesses?

Inventory management is crucial for Kentucky businesses to ensure accurate record-keeping, minimize losses, and optimize cash flow.

How does the fiscal year selection impact inventory valuation and tax implications?

The fiscal year selection influences the timing of inventory valuation, which can affect tax obligations and financial reporting.

What are the tax deductions and credits available for inventory management in Kentucky?

Kentucky offers various tax deductions and credits to businesses for inventory-related expenses, such as the cost of goods sold and inventory obsolescence.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY