The intricate world of business inventory fiscal year tax demands attention, as it presents a captivating landscape of strategies and implications. Understanding the nuances of this subject empowers businesses to navigate the complexities of tax regulations, optimize inventory management, and maximize financial performance.

This comprehensive guide delves into the various accounting methods used to value business inventory for tax purposes, exploring their advantages, disadvantages, and impact on taxable income. We will also uncover the intricacies of inventory valuation methods, including FIFO, LIFO, and weighted average cost, and how they determine the cost of goods sold and ending inventory.

Business Inventory Fiscal Year Tax Accounting Methods

Inventory accounting methods play a crucial role in determining the value of business inventory for tax purposes. The choice of method can significantly impact taxable income and tax liability.

The Internal Revenue Service (IRS) allows businesses to use different accounting methods to value inventory. Each method has its advantages and disadvantages, and the best choice depends on the specific circumstances of the business.

Specific Identification Method

Under the specific identification method, each item of inventory is tracked and assigned a specific cost. This method is most accurate but can be cumbersome and time-consuming to implement, especially for businesses with a large inventory.

Advantages:

- Most accurate method

- Allows for precise tracking of inventory costs

Disadvantages:

- Cumbersome and time-consuming

- May not be practical for businesses with a large inventory

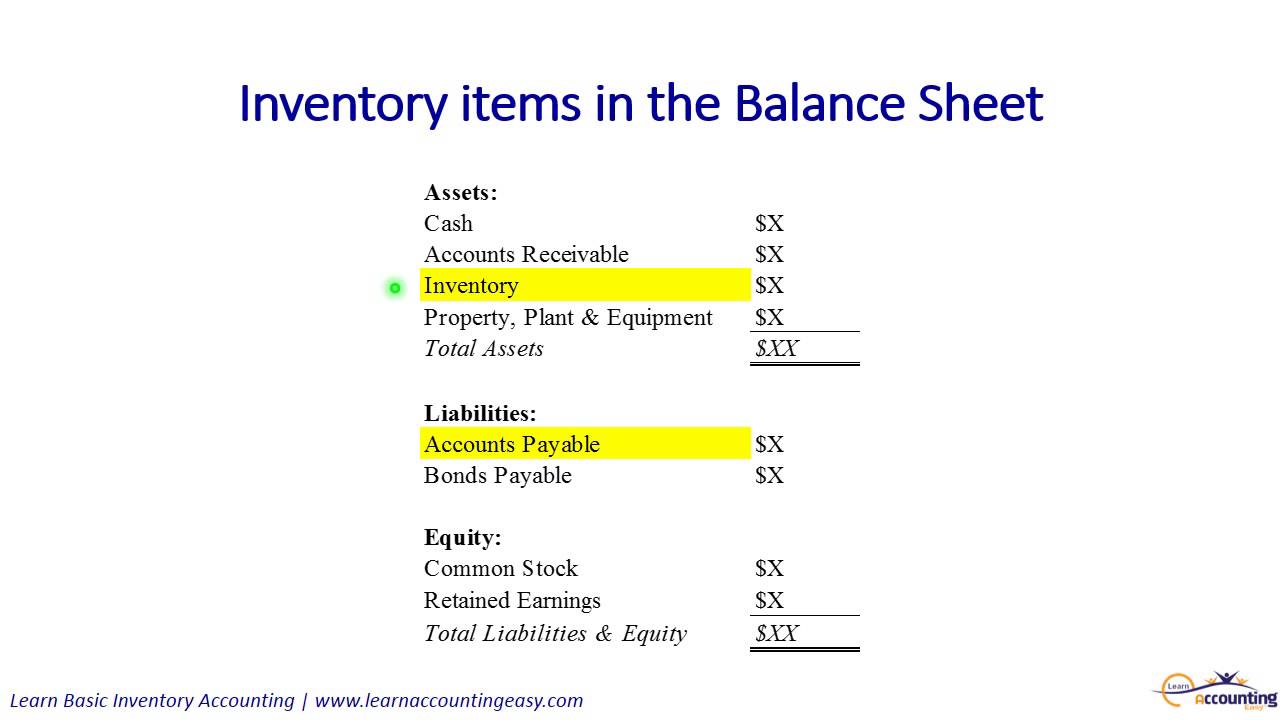

Inventory Valuation Methods

Inventory valuation methods are accounting techniques used to determine the cost of goods sold and ending inventory. These methods play a crucial role in financial reporting as they impact the calculation of gross profit, net income, and other key financial metrics.

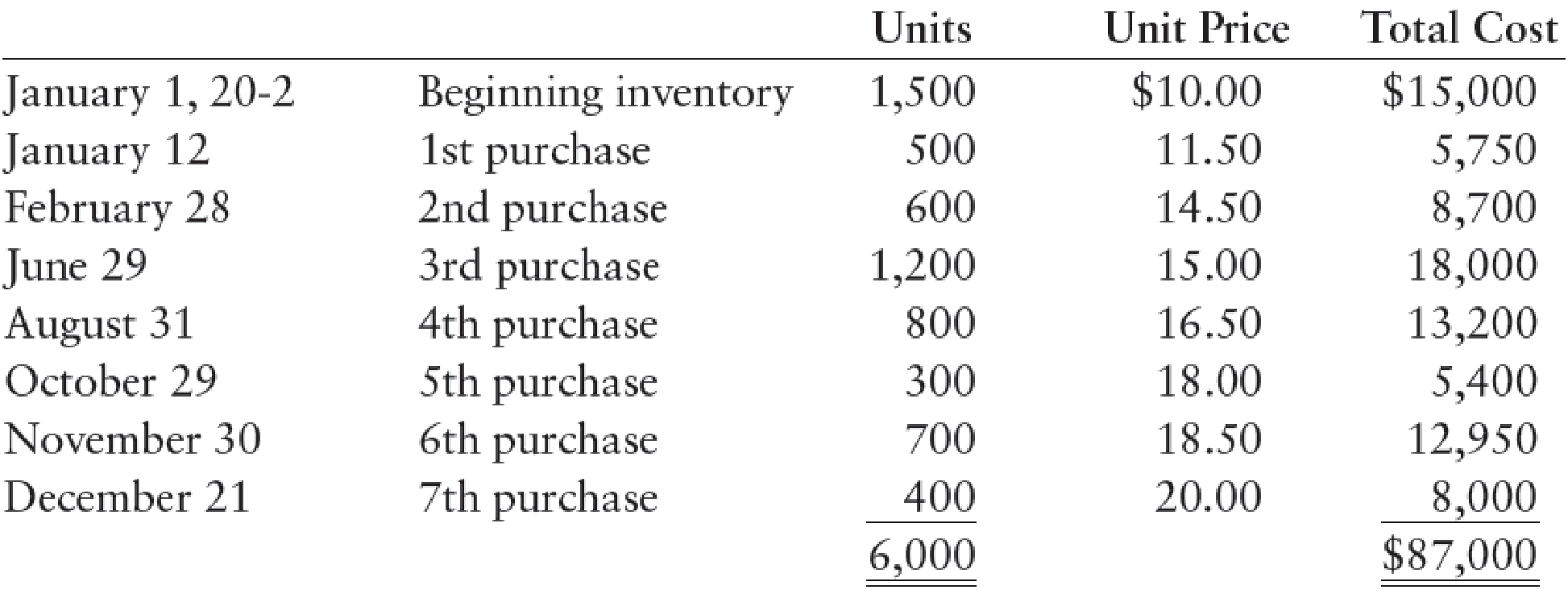

First-In, First-Out (FIFO)

Under the FIFO method, the cost of goods sold is assumed to be the cost of the oldest inventory items purchased. This means that the first items purchased are the first ones sold. As a result, the ending inventory is valued at the cost of the most recently purchased items.

Example:If a company purchases 100 units at $10 per unit and then purchases another 100 units at $12 per unit, and sells 150 units, the cost of goods sold under FIFO would be $1,100 (100 units x $10 + 50 units x $12).

Last-In, First-Out (LIFO)

In contrast to FIFO, the LIFO method assumes that the cost of goods sold is the cost of the most recently purchased inventory items. This means that the last items purchased are the first ones sold. As a result, the ending inventory is valued at the cost of the oldest inventory items.

Example:Using the same example as above, the cost of goods sold under LIFO would be $1,200 (100 units x $12 + 50 units x $10).

Weighted Average Cost

The weighted average cost method calculates the cost of goods sold and ending inventory by taking the average cost of all inventory items available for sale during the period. This method assigns a weighted average cost to each unit sold or held in inventory.

Example:Using the same example as above, the weighted average cost would be $11 per unit ($1,000 total cost / 100 units). The cost of goods sold would be $1,100 (150 units x $11), and the ending inventory would be $110 (100 units x $11).

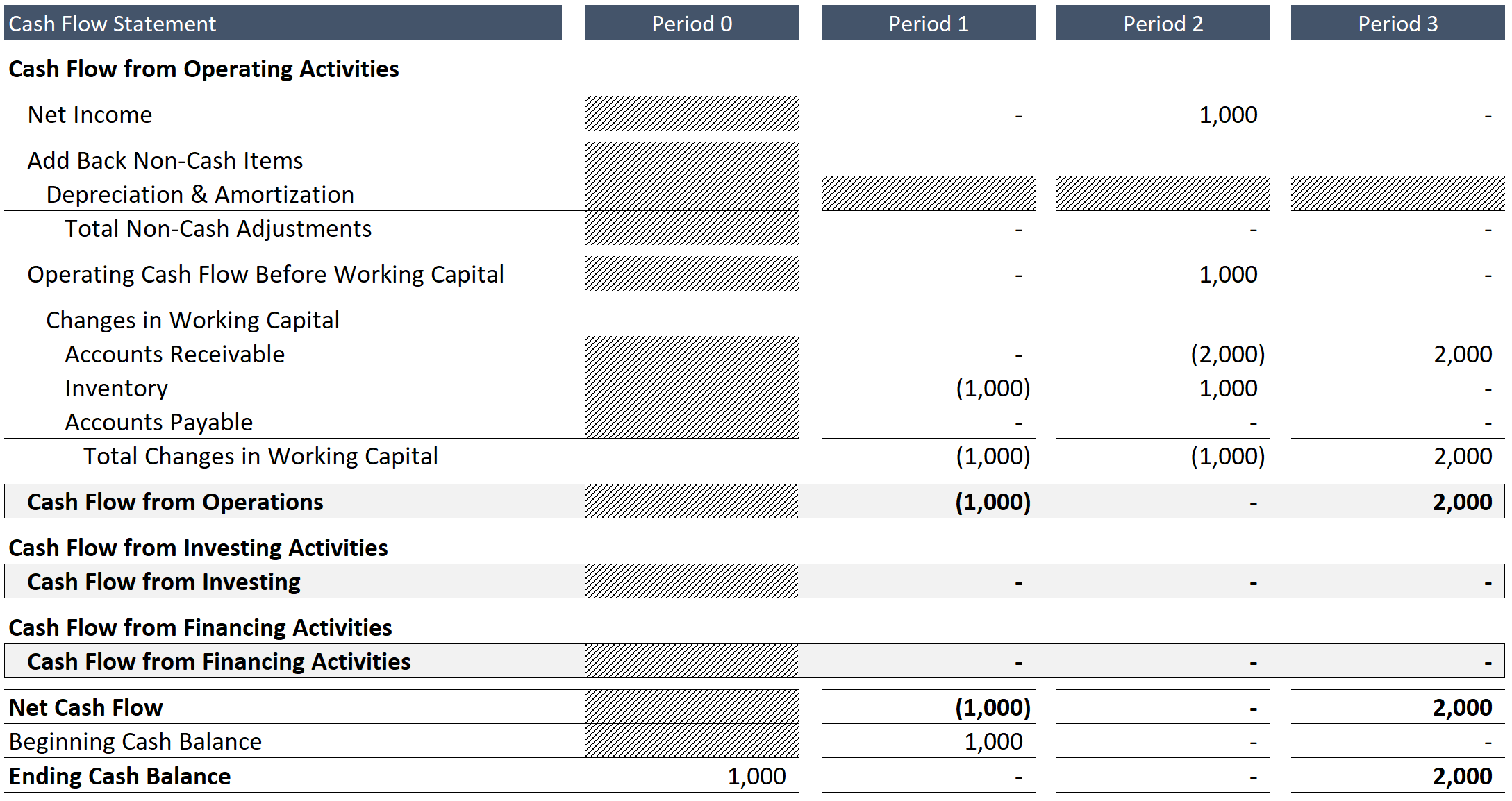

Impact on Financial Statements, Business inventory fiscal year tax

The choice of inventory valuation method can significantly impact financial statements. FIFO tends to result in lower cost of goods sold and higher net income during periods of rising prices, while LIFO has the opposite effect. Weighted average cost provides a more stable cost of goods sold and net income over time.

Tax Implications of Inventory Valuation Methods

The choice of inventory valuation method can have significant tax consequences. Different methods can affect the timing and amount of taxable income, which can impact a business’s tax liability.

Impact on Taxable Income

Inventory valuation methods can affect taxable income in two ways:

- Timing of income recognition:Different methods can result in income being recognized in different periods.

- Amount of income recognized:The cost of goods sold (COGS) is calculated differently under different methods, which can affect the amount of taxable income.

Minimizing Tax Liability

Businesses can use inventory valuation methods to minimize their tax liability by:

- Deferring income recognition:Using a method that defers income recognition can reduce taxable income in the current period.

- Reducing COGS:Using a method that reduces COGS can increase taxable income in the current period, but may result in lower taxable income in future periods.

The choice of inventory valuation method should be made carefully, considering the specific circumstances of the business and its tax goals.

Inventory Management and Tax Planning

Effective inventory management is crucial for minimizing tax liability and optimizing taxable income. Here are some strategies and techniques to consider:

Optimizing Inventory Levels

Maintaining optimal inventory levels can significantly impact tax liability. Holding excessive inventory increases taxable income, while holding too little inventory may result in lost sales and reduced profitability. Businesses should strike a balance to minimize tax liability without compromising business operations.

Inventory Reserves

Inventory reserves allow businesses to reduce taxable income by setting aside a portion of inventory value for potential losses or obsolescence. This technique effectively defers taxes on the reserved amount until the inventory is sold or becomes obsolete.

Other Tax-Saving Techniques

Additional tax-saving techniques related to inventory management include:

- Using the lower of cost or market (LCM) method for inventory valuation

- Adopting a perpetual inventory system for real-time inventory tracking

- Implementing a first-in, first-out (FIFO) inventory flow assumption

- Exploring consignment inventory arrangements to defer tax liability

End of Discussion: Business Inventory Fiscal Year Tax

In conclusion, the interplay between business inventory and fiscal year tax planning presents a wealth of opportunities for businesses to minimize tax liability and enhance profitability. By implementing effective inventory management strategies, leveraging tax-saving techniques, and staying abreast of regulatory updates, businesses can harness the power of this knowledge to achieve long-term financial success.

General Inquiries

What is the most advantageous accounting method for valuing business inventory?

The optimal accounting method depends on the specific circumstances of the business. FIFO (first-in, first-out) is commonly used as it aligns with the natural flow of inventory and can result in lower taxable income in inflationary periods. However, LIFO (last-in, first-out) may be beneficial in deflationary periods as it can reduce taxable income and increase cash flow.

How can businesses optimize inventory levels to reduce taxable income?

Effective inventory management involves maintaining optimal inventory levels to minimize holding costs and reduce the risk of obsolescence. Businesses can utilize inventory forecasting techniques to predict demand and adjust inventory levels accordingly. Additionally, implementing just-in-time inventory systems can help reduce inventory carrying costs and improve cash flow.

What are some tax-saving techniques related to inventory valuation?

Businesses can utilize various tax-saving techniques related to inventory valuation. One common strategy is to establish inventory reserves to reduce taxable income by setting aside funds for potential inventory losses or obsolescence. Additionally, businesses can consider using lower-of-cost-or-market (LCM) method to value inventory, which can result in lower taxable income in certain circumstances.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY