Delve into the realm of business inventory exemption, an intricate yet rewarding concept that can empower businesses to optimize their financial strategies. This comprehensive guide unravels the intricacies of this exemption, providing a roadmap for businesses to navigate its requirements and reap its benefits.

From eligibility criteria to valuation methods, documentation requirements, and state variations, this guide equips you with the knowledge to effectively plan and implement business inventory exemption strategies. Embrace the opportunity to maximize your business’s potential and unlock the full benefits of this valuable tax exemption.

Business Inventory Exemption Overview

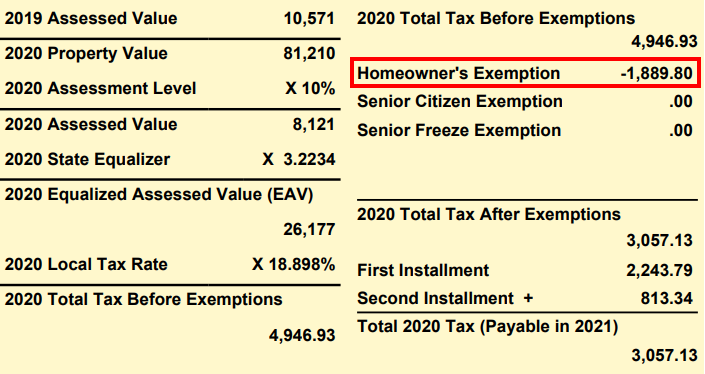

The business inventory exemption is a tax break that allows businesses to avoid paying sales tax on their inventory. This exemption is available to businesses of all sizes, and it can save businesses a significant amount of money.

The purpose of the business inventory exemption is to encourage businesses to invest in inventory. By making it less expensive for businesses to hold inventory, the government hopes to stimulate economic growth. The exemption also helps to level the playing field for businesses that sell products online.

Without the exemption, businesses that sell products online would be at a disadvantage compared to businesses that sell products in brick-and-mortar stores.

Eligible Businesses and Inventory

To be eligible for the business inventory exemption, a business must meet the following criteria:

- The business must be engaged in the sale of tangible personal property.

- The property must be held for sale in the ordinary course of business.

- The property must be located in the state where the business is registered.

The following types of inventory are eligible for the business inventory exemption:

- Raw materials

- Work in progress

- Finished goods

- Supplies

Eligibility Requirements

Businesses may qualify for business inventory exemption if they meet specific eligibility criteria set by the relevant tax authorities. These criteria typically include requirements related to the type of business, the nature of the inventory, and the location of the inventory.

The exemption generally applies to tangible personal property held for sale or lease in the ordinary course of business. This includes raw materials, work-in-progress, and finished goods. However, certain types of inventory may be excluded from the exemption, such as property held for personal use or investment purposes.

Qualifying as a Business

To qualify as a business for the purposes of the business inventory exemption, the entity must generally be engaged in a trade or business and must have a physical presence in the taxing jurisdiction.

- The business must be organized as a sole proprietorship, partnership, limited liability company (LLC), corporation, or other recognized business entity.

- The business must have a physical location, such as a store, warehouse, or office, within the taxing jurisdiction.

- The business must be engaged in the sale or lease of tangible personal property in the ordinary course of its operations.

Excluded Inventory: Business Inventory Exemption

The business inventory exemption does not apply to all types of inventory. Certain inventory items are specifically excluded from the exemption for various reasons.

Inventory items that are excluded from the business inventory exemption generally fall into two categories: inventory held for personal use or consumption and inventory that is not considered to be held for sale in the ordinary course of business.

Inventory Held for Personal Use or Consumption

Inventory held for personal use or consumption is not eligible for the business inventory exemption. This includes inventory that is used by the business owner or employees for their own personal needs, such as office supplies, furniture, and equipment.

Inventory Not Held for Sale in the Ordinary Course of Business

Inventory that is not held for sale in the ordinary course of business is also not eligible for the business inventory exemption. This includes inventory that is held for investment purposes, such as stocks and bonds, or inventory that is held for future use, such as spare parts or supplies.

- Inventory held for investment: This includes stocks, bonds, and other financial instruments that are held for the purpose of generating income or appreciation in value, rather than for sale to customers.

- Inventory held for future use: This includes spare parts, supplies, and other items that are not intended for immediate sale, but rather for use in the business’s operations or for future projects.

- Inventory held for personal use: This includes items that are used by the business owner or employees for their own personal needs, such as office supplies, furniture, and equipment.

- Inventory held for demonstration or display purposes: This includes items that are used to demonstrate the features or functions of a product, but are not intended for sale.

- Inventory held for repair or maintenance: This includes items that are used to repair or maintain the business’s property or equipment, but are not intended for sale.

Valuation Methods

Inventory valuation methods are techniques used to determine the value of inventory for accounting and tax purposes. These methods play a crucial role in calculating the business inventory exemption, as they impact the amount of inventory that qualifies for the exemption.There are several different inventory valuation methods available, each with its advantages and disadvantages.

The most common methods include:

First-In, First-Out (FIFO)

FIFO assumes that the oldest inventory items are sold first. This means that the cost of goods sold is based on the cost of the oldest inventory on hand. FIFO can result in higher cost of goods sold and lower gross profit in periods of rising prices.

However, it also provides a more accurate representation of the current cost of inventory.

Last-In, First-Out (LIFO), Business inventory exemption

LIFO assumes that the most recent inventory items are sold first. This means that the cost of goods sold is based on the cost of the most recent inventory purchased. LIFO can result in lower cost of goods sold and higher gross profit in periods of rising prices.

However, it can also lead to a mismatch between the physical flow of inventory and the cost of goods sold.

Weighted Average Cost

Weighted average cost assigns an average cost to all inventory items on hand. This average cost is calculated by dividing the total cost of inventory by the total number of units on hand. Weighted average cost can provide a more stable cost of goods sold and gross profit over time.

However, it can also be more complex to calculate than FIFO or LIFO.

Specific Identification

Specific identification assigns a specific cost to each inventory item. This method is most accurate but also the most time-consuming and complex to implement.The choice of inventory valuation method depends on a number of factors, including the nature of the business, the inventory turnover rate, and the expected direction of prices.

Documentation and Compliance

To support business inventory exemption claims, businesses must maintain comprehensive documentation and adhere to specific record-keeping requirements. Failure to comply can result in significant consequences.

Documentation Requirements

The following documentation is typically required to support business inventory exemption claims:

- Purchase orders and invoices

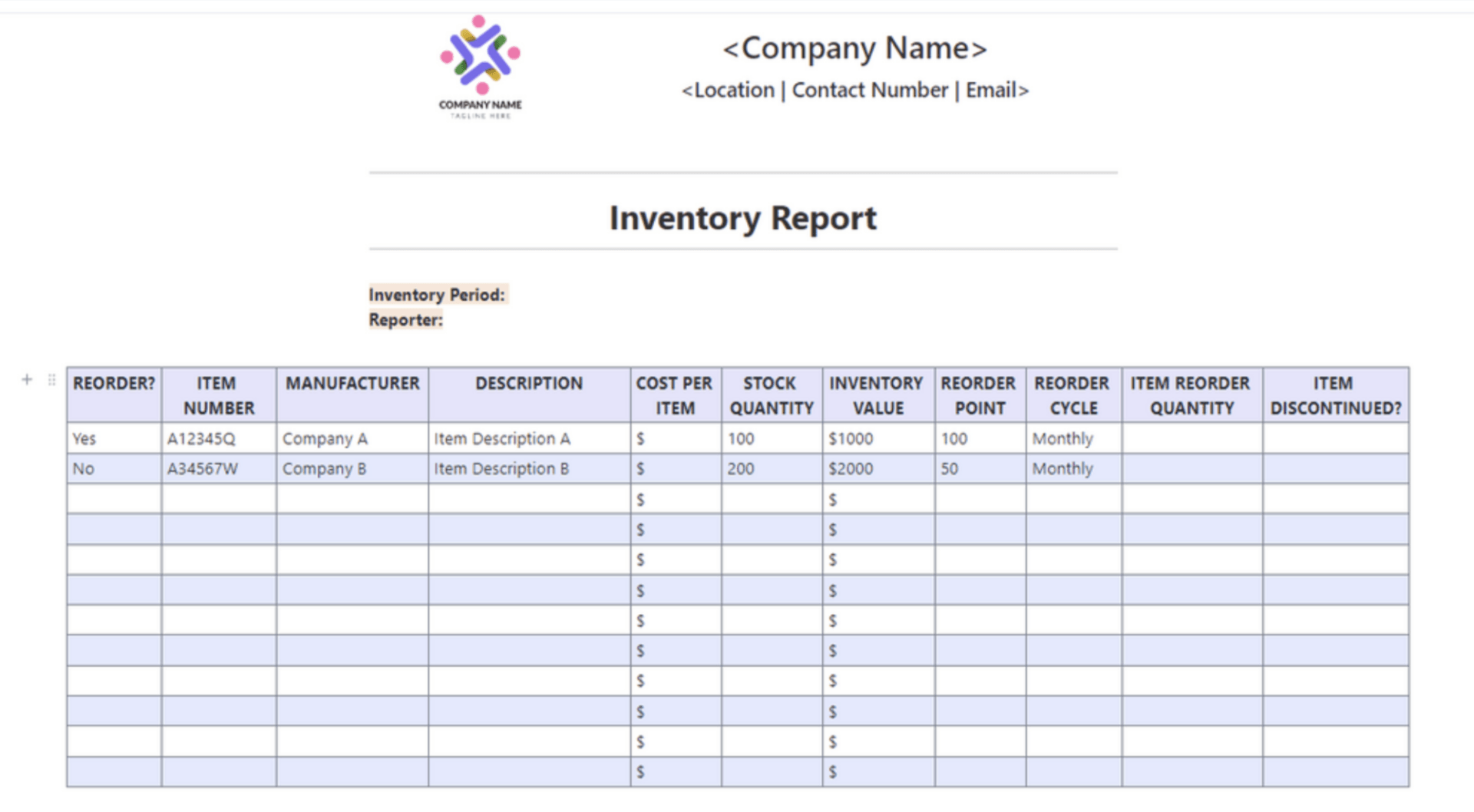

- Inventory records

- Sales records

- Proof of ownership

Record-Keeping Requirements

Businesses claiming the business inventory exemption must maintain detailed records for at least three years, including:

- A physical inventory of all inventory on hand at the end of each tax year

- A record of all inventory purchases and sales

- Documentation supporting the cost or other basis of the inventory

Consequences of Non-Compliance

Failure to comply with the documentation and record-keeping requirements can result in the following consequences:

- Denial of the business inventory exemption

- Assessment of additional taxes and penalties

- Audit by the taxing authority

State and Local Variations

Business inventory exemption laws vary significantly across different states and localities. It’s crucial for businesses to understand these variations to ensure compliance and avoid potential penalties.

State and local governments may impose additional requirements, such as specific filing deadlines, registration procedures, or minimum inventory value thresholds. Failure to comply with these local regulations can result in the loss of the exemption.

Examples of State-Specific Requirements

- In California, businesses must file an annual exemption certificate with the county assessor.

- In New York, inventory held for more than 12 months is not eligible for the exemption.

- In Texas, businesses with inventory valued over $100,000 must file a quarterly inventory report.

Planning and Implementation

Effective planning and implementation are crucial for maximizing the benefits of the business inventory exemption. Here’s how to approach this process:

Establish a Clear Understanding:Thoroughly comprehend the exemption criteria and ensure that your inventory qualifies. Determine the applicable valuation method and document all supporting records.

Strategies for Effective Implementation

- Inventory Management System:Implement a robust inventory management system that accurately tracks inventory levels, valuation, and location.

- Regular Inventory Audits:Conduct periodic audits to verify inventory accuracy and ensure compliance with exemption requirements.

- Employee Training:Educate employees about the exemption and their responsibilities in maintaining compliant inventory records.

- Collaboration with Tax Authorities:Engage with tax authorities to clarify any ambiguities or obtain guidance on specific inventory items.

Maximizing Exemption Benefits

- Identify Eligible Inventory:Carefully review your inventory to identify all items that qualify for the exemption.

- Accurate Valuation:Use the appropriate valuation method and maintain accurate records to substantiate your inventory value.

- Timely Filing:File exemption claims promptly to avoid penalties or interest charges.

Case Study: Successful Implementation

Company A implemented a comprehensive inventory management system that integrated with their accounting software. They conducted regular audits and trained employees on exemption requirements. As a result, they successfully reduced their property tax liability by 15%.

Last Word

In conclusion, business inventory exemption presents a multifaceted opportunity for businesses to optimize their financial strategies. By understanding the eligibility requirements, valuation methods, documentation requirements, and state variations, businesses can effectively harness this exemption to reduce their tax burden and enhance their profitability.

Embrace the guidance provided in this comprehensive guide to unlock the full potential of business inventory exemption and empower your business for success.

Essential FAQs

What is the purpose of business inventory exemption?

Business inventory exemption allows businesses to exclude the value of their inventory from their taxable income, reducing their tax liability.

What types of businesses are eligible for business inventory exemption?

Businesses engaged in the sale of tangible personal property are generally eligible for business inventory exemption.

What types of inventory are excluded from business inventory exemption?

Inventory held for personal use, inventory used in the construction of real property, and inventory held for sale by non-profit organizations are typically excluded from business inventory exemption.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY