Business inventory damage claims, a critical aspect of risk management, present a unique set of challenges for organizations. Understanding the causes, prevention methods, and claims filing process is essential for businesses to mitigate losses and ensure business continuity.

From identifying common causes such as fire and theft to implementing proactive measures like proper storage and security systems, this guide provides a comprehensive overview of business inventory damage claims.

Business Inventory Damage Claims

Business inventory damage claims arise when a business experiences loss or damage to its inventory due to various factors. These claims are crucial for businesses to recover the financial losses incurred as a result of damaged inventory.

Inventory damage can occur due to a wide range of events, including natural disasters, accidents, theft, or mishandling during storage or transportation. Understanding the types of inventory damage and the process of filing a claim is essential for businesses to protect their assets and ensure business continuity.

Types of Inventory Damage

- Physical Damage:Damage caused by events such as fire, water, or impact, resulting in physical deterioration or destruction of inventory.

- Spoilage:Damage caused by factors such as temperature fluctuations, humidity, or contamination, leading to the deterioration or loss of inventory value.

- Theft:Loss of inventory due to unauthorized removal or misappropriation by individuals or groups.

- Mishandling:Damage caused by improper handling, storage, or transportation, resulting in breakage, damage, or loss of inventory.

Process of Filing a Business Inventory Damage Claim

- Notification:Promptly notify the insurance provider or carrier of the inventory damage, providing details of the incident and estimated loss.

- Documentation:Gather evidence to support the claim, including photographs, receipts, and documentation of the damaged inventory.

- Assessment:The insurance provider will assess the damage and determine the extent of coverage and the amount of the claim.

- Negotiation:If necessary, negotiate with the insurance provider to ensure a fair settlement that covers the actual losses incurred.

- Settlement:Upon agreement, the insurance provider will issue a settlement payment to the business to compensate for the damaged inventory.

Common Causes of Business Inventory Damage

Inventory damage can occur due to various reasons, leading to significant losses for businesses. Understanding the common causes of inventory damage is crucial for implementing effective preventive measures.

Fire

Fire poses a significant threat to business inventories. Electrical malfunctions, arson, and accidents can ignite fires, resulting in extensive damage to stored goods. Fire can spread rapidly, destroying entire warehouses and their contents.

Water Damage

Water damage can occur due to natural disasters such as floods, storms, or burst pipes. Water can seep into warehouses, damaging inventory through moisture absorption, rust, and mold growth. Water damage can also render goods unsaleable, leading to substantial losses.

Theft

Theft is a common cause of inventory loss. Burglaries, employee theft, and organized crime can result in the loss of valuable inventory items. Inadequate security measures, such as weak locks or lack of surveillance, can increase the risk of theft.

Natural Disasters

Natural disasters such as earthquakes, hurricanes, and tornadoes can cause widespread damage to businesses, including their inventory. These events can lead to structural collapse, flooding, and other hazards that can destroy or damage inventory.

Shipping Accidents

During transportation, inventory is susceptible to damage caused by accidents. Rough handling, improper packaging, and extreme weather conditions can result in damaged goods. Shipping accidents can occur during land, air, or sea transportation.

Methods for Preventing Business Inventory Damage: Business Inventory Damage Claims

Businesses can implement several strategies to prevent inventory damage, safeguarding their assets and minimizing losses.

Proper Storage and Handling Procedures

Establishing clear guidelines for storing and handling inventory is crucial. This includes designating specific storage areas, ensuring proper temperature and humidity control, and implementing FIFO (first-in, first-out) inventory management to prevent older items from deteriorating. Proper packaging and labeling help protect items during storage and transportation.

Documenting and Assessing Business Inventory Damage

Documenting and assessing business inventory damage is crucial for several reasons. First, it provides a record of the damage that can be used to support insurance claims or legal actions. Second, it helps businesses to understand the extent of the damage and to make informed decisions about how to proceed.

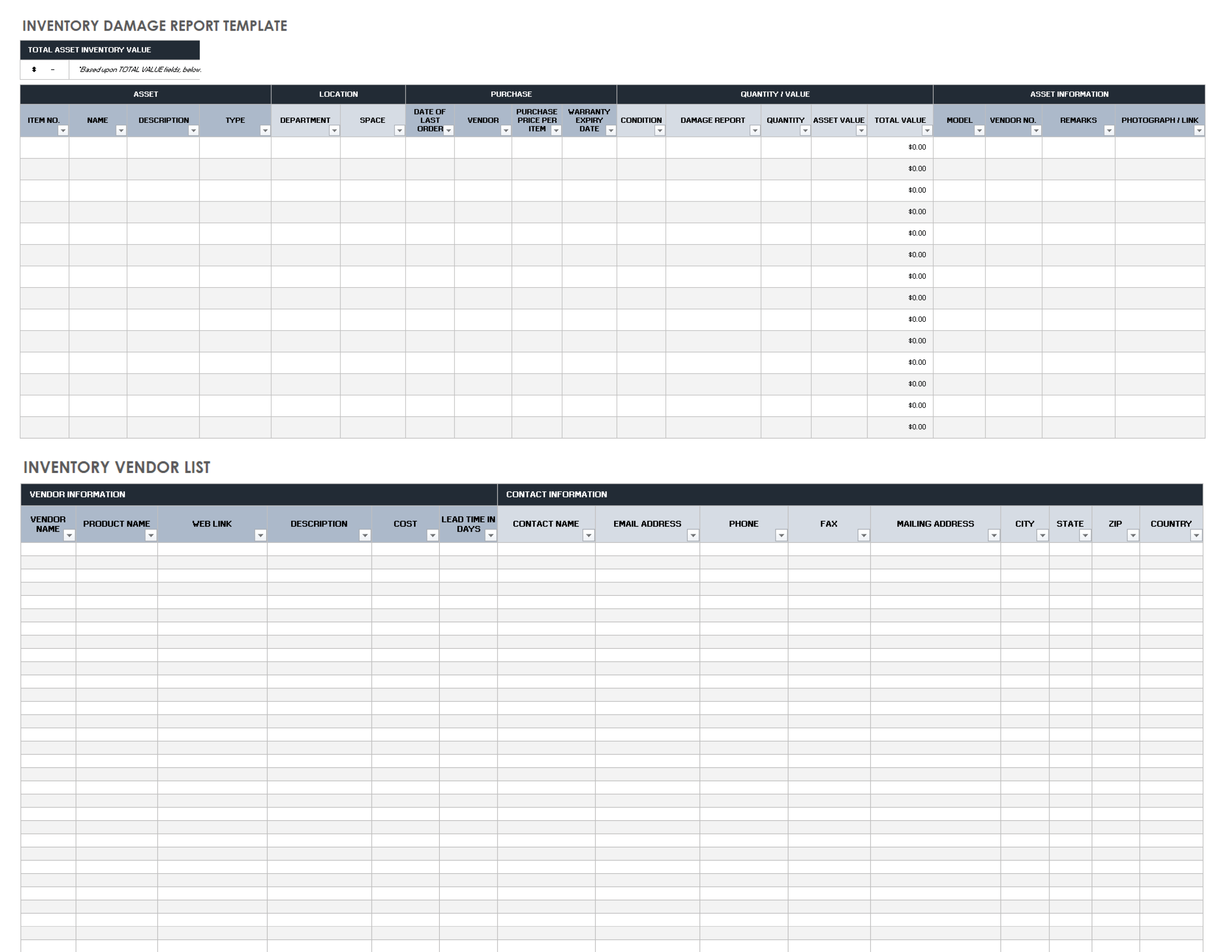

Third, it can help businesses to identify the cause of the damage and to take steps to prevent it from happening again.There are a number of ways to document and assess business inventory damage. One common method is to use a damage assessment form.

These forms typically include a section for recording the date and time of the damage, the location of the damage, a description of the damage, and an estimate of the value of the damaged inventory.Another method for documenting and assessing business inventory damage is to use a digital camera.

Taking pictures of the damage can provide a visual record that can be used to support insurance claims or legal actions.In addition to documenting the damage, it is also important to assess the extent of the damage and to estimate the value of the lost or damaged inventory.

This can be done by using a variety of methods, such as:

- Comparing the damaged inventory to undamaged inventory of the same type

- Using a price list or catalog to determine the value of the damaged inventory

- Consulting with an appraiser or other expert

Once the extent of the damage and the value of the lost or damaged inventory have been assessed, businesses can begin to make decisions about how to proceed. These decisions may include:

- Filing an insurance claim

- Taking legal action against the responsible party

- Replacing the damaged inventory

- Selling the damaged inventory at a reduced price

- Disposing of the damaged inventory

Filing a Business Inventory Damage Claim

When your business’s inventory has been damaged, it’s crucial to file an insurance claim promptly. Here’s a step-by-step guide to help you navigate the process:

Contact Your Insurance Company

Immediately notify your insurance company of the damage. Provide a brief description of the incident, the extent of the damage, and an estimate of the loss.

Gather Necessary Documentation

To support your claim, you’ll need to provide documentation such as:

- Proof of ownership (invoices, purchase orders)

- Inventory records (list of damaged items, quantities, and values)

- Photographs or videos of the damaged inventory

- Estimates for repair or replacement costs

- Witness statements (if applicable)

Submit Your Claim

Complete the insurance claim form and submit it along with the supporting documentation. Provide a detailed description of the damage, including the cause, date, and location.

Cooperate with the Adjuster

The insurance company will assign an adjuster to assess the damage and determine the value of your claim. Cooperate fully with the adjuster by providing access to the damaged inventory and any requested information.

Negotiate and Settle

Once the adjuster has completed their assessment, they will present a settlement offer. Review the offer carefully and negotiate if necessary. If you reach an agreement, the insurance company will issue payment.

Negotiating and Settling Business Inventory Damage Claims

Negotiating with insurance companies for a fair settlement amount for business inventory damage claims requires careful preparation and a strategic approach. Understanding the factors that influence the settlement value and employing effective negotiation techniques can maximize the outcome.

The settlement value is primarily determined by the actual cash value (ACV) of the damaged inventory, which is its market value at the time of loss. Other factors include:

- The extent and severity of the damage

- The terms and conditions of the insurance policy

- The insurer’s assessment of the claim

- The availability of evidence to support the claim

Tips for Negotiating with Insurance Companies

- Gather all relevant documentation, including the insurance policy, inventory records, and damage assessment reports.

- Quantify the loss accurately and provide detailed evidence to support the claim.

- Research the insurance company’s past settlement practices and industry benchmarks.

- Present a clear and organized case, highlighting the key points of the claim.

- Be prepared to negotiate and compromise within reason.

- Consider seeking professional assistance from an insurance adjuster or attorney if necessary.

Case Studies of Business Inventory Damage Claims

Real-world examples of business inventory damage claims provide valuable insights into the causes, documentation, and settlement outcomes of these cases. These case studies illustrate the importance of proper inventory management, risk mitigation, and effective claims handling.

One notable case study involves a manufacturing company that experienced extensive damage to its inventory due to a fire. The company had implemented a comprehensive inventory management system, including regular stock counts and fire safety protocols. However, an electrical malfunction caused a fire that spread rapidly through the warehouse, resulting in significant inventory loss.

Documentation and Assessment, Business inventory damage claims

The company meticulously documented the damage, including detailed photographs, witness statements, and inventory records. This thorough documentation facilitated a prompt and accurate assessment of the claim.

Settlement Outcome

The insurance company acknowledged the company’s proactive inventory management practices and promptly settled the claim. The settlement covered the replacement cost of the damaged inventory, enabling the company to resume operations with minimal disruption.

Best Practices for Business Inventory Damage Claims Management

Effective inventory damage claims management is crucial for businesses to minimize losses and protect their financial well-being. By implementing best practices, businesses can streamline the claims process, reduce claim cycle time, and improve recovery rates.

Key best practices for managing business inventory damage claims include:

- Establish a clear claims process:Develop a step-by-step process that Artikels the steps involved in filing, investigating, and settling claims. This process should be documented and communicated to all relevant stakeholders.

- Train employees on claims handling:Ensure that employees who are responsible for handling claims are adequately trained on the claims process and best practices. This training should cover topics such as claim documentation, investigation techniques, and negotiation strategies.

- Document damage thoroughly:Gather detailed documentation of the damaged inventory, including photographs, videos, and written descriptions. This documentation will serve as evidence to support the claim.

- Investigate claims promptly:Initiate the investigation process as soon as possible after receiving a claim. Conduct a thorough investigation to determine the cause of the damage and assess the extent of the loss.

- Negotiate settlements fairly:Approach claim negotiations with a fair and reasonable mindset. Be prepared to provide evidence to support the claim and negotiate a settlement that is fair to both parties.

- Monitor claim trends:Track and analyze claim data to identify patterns and trends. This information can be used to improve claims management practices and reduce future losses.

By adhering to these best practices, businesses can effectively manage inventory damage claims, minimize financial losses, and protect their bottom line.

Continuous Improvement and Risk Mitigation

To continuously improve claims management and mitigate risk, businesses should:

- Regularly review and update claims processes:As business practices and regulations evolve, it is important to review and update claims processes to ensure they remain effective and efficient.

- Implement risk management strategies:Identify potential risks that could lead to inventory damage and implement strategies to mitigate those risks. This may include measures such as improving inventory storage conditions, implementing quality control measures, and obtaining adequate insurance coverage.

- Seek professional advice:When faced with complex or high-value claims, consider seeking professional advice from an attorney or claims consultant. These experts can provide guidance on claim handling and negotiation strategies.

By implementing these continuous improvement and risk mitigation strategies, businesses can further enhance their ability to effectively manage inventory damage claims and protect their financial interests.

Outcome Summary

By adhering to best practices in inventory damage management, businesses can minimize the impact of unforeseen events and safeguard their valuable assets. Continuous improvement and risk mitigation strategies empower organizations to navigate the complexities of business inventory damage claims with confidence.

FAQ Explained

What are the most common causes of business inventory damage?

Common causes include fire, water damage, theft, natural disasters, and shipping accidents.

How can businesses prevent inventory damage?

Implementing proper storage and handling procedures, installing security systems, and conducting regular inventory audits are effective prevention strategies.

What is the process for filing a business inventory damage claim?

Document the damage thoroughly, assess the extent of loss, and provide detailed information and documentation to the insurance company.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY