Business beginning inventory definition establishes the cornerstone of precise financial reporting, laying the groundwork for a comprehensive understanding of a company’s assets and financial health. This inventory, meticulously tracked at the commencement of each accounting period, serves as the linchpin for determining the cost of goods sold, profitability, and overall financial performance.

Understanding the concept of beginning inventory is paramount for businesses of all sizes, as it provides a clear picture of the resources available to generate revenue and meet customer demand. By delving into the intricacies of inventory valuation methods, such as FIFO, LIFO, and weighted average cost, businesses can ensure accurate financial statements and make informed decisions that drive growth and profitability.

Definition of Business Beginning Inventory

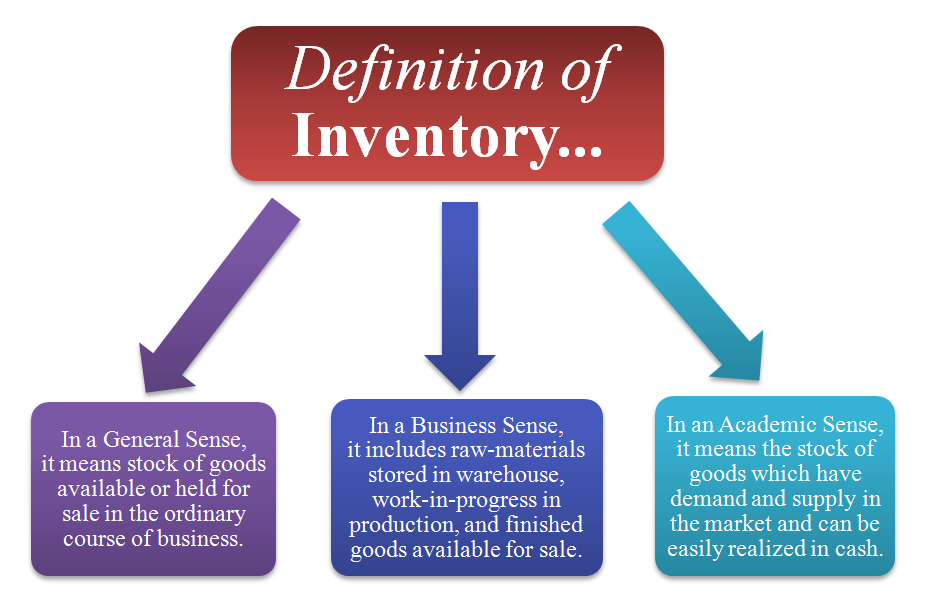

In business accounting, beginning inventory refers to the value of goods on hand at the start of an accounting period. It represents the stock of unsold merchandise or raw materials available at the beginning of a specific period, such as a month or a year.

Tracking beginning inventory is crucial for accurate financial reporting and inventory management.

Importance of Beginning Inventory

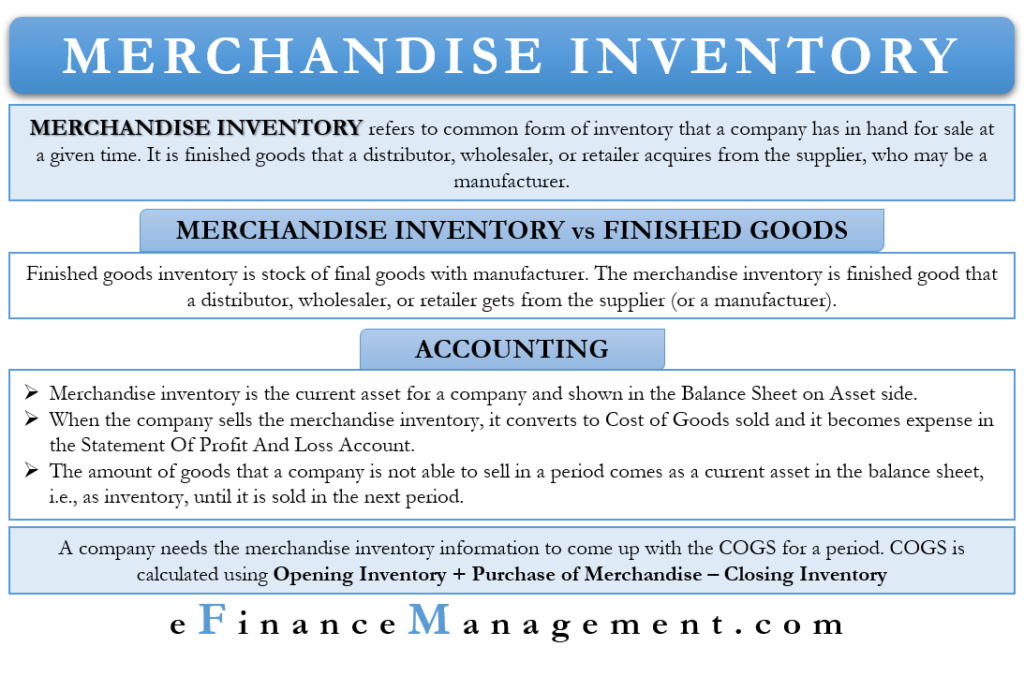

Beginning inventory plays a significant role in the calculation of cost of goods sold (COGS), which is a key component in determining a company’s profitability. COGS is calculated by adding the beginning inventory to purchases made during the period and then subtracting the ending inventory.

Therefore, an accurate beginning inventory value is essential for calculating COGS and, subsequently, gross profit and net income.

Assets Included in Beginning Inventory

Beginning inventory typically includes assets that are held for sale in the ordinary course of business. These assets may include:

- Finished goods: Products that are ready for sale to customers.

- Work-in-process inventory: Partially completed products that are still in the production process.

- Raw materials: Materials used in the production of finished goods.

Methods for Determining Beginning Inventory

Beginning inventory can be determined using two primary methods: the perpetual inventory system and the periodic inventory system.

Perpetual Inventory System

The perpetual inventory system is a continuous record-keeping system that tracks inventory levels in real-time. Every transaction that affects inventory, such as purchases, sales, and returns, is recorded immediately. This system provides up-to-date inventory information, making it easy to determine beginning inventory at any given point in time.

Periodic Inventory System

The periodic inventory system involves physically counting the inventory at specific intervals, typically at the end of a month or quarter. The beginning inventory for a period is determined by adding the ending inventory from the previous period to the net purchases made during the period.

Comparison of Perpetual and Periodic Inventory Systems

The perpetual inventory system provides more accurate and timely inventory information compared to the periodic inventory system. However, it requires more effort and resources to maintain. The periodic inventory system is less costly and time-consuming, but it can result in less accurate inventory information.The choice between the perpetual and periodic inventory systems depends on factors such as the nature of the business, inventory turnover rate, and the need for accurate inventory information.

Valuation of Beginning Inventory: Business Beginning Inventory Definition

The valuation of beginning inventory is a critical aspect of accounting as it affects the calculation of the cost of goods sold and, ultimately, the net income of a company. There are several methods used to value beginning inventory, each with its own advantages and disadvantages.

The choice of valuation method can have a significant impact on the financial statements of a company.

FIFO (First-In, First-Out)

Under the FIFO method, the cost of goods sold is based on the assumption that the oldest inventory is sold first. This means that the beginning inventory is valued at the cost of the oldest units purchased. As a result, the cost of goods sold is higher in periods of rising prices and lower in periods of falling prices.

LIFO (Last-In, First-Out)

Under the LIFO method, the cost of goods sold is based on the assumption that the most recently purchased inventory is sold first. This means that the beginning inventory is valued at the cost of the most recent units purchased.

As a result, the cost of goods sold is lower in periods of rising prices and higher in periods of falling prices.

Weighted Average Cost

Under the weighted average cost method, the cost of goods sold is based on the average cost of all units in inventory. This means that the beginning inventory is valued at the average cost of all units purchased up to the beginning of the period.

As a result, the cost of goods sold is relatively stable regardless of price fluctuations.

Impact of Inventory Valuation Methods on Financial Statements

The choice of inventory valuation method can have a significant impact on the financial statements of a company. For example, in periods of rising prices, the FIFO method will result in a higher cost of goods sold and a lower net income than the LIFO method.

Conversely, in periods of falling prices, the LIFO method will result in a higher cost of goods sold and a lower net income than the FIFO method.

Examples of How Different Valuation Methods Can Affect Inventory Costs and Profitability

Consider the following example: A company purchases 100 units of inventory at a cost of $10 per unit. The company sells 50 units during the period. Under the FIFO method, the cost of goods sold would be $500 (50 units x $10 per unit).

Under the LIFO method, the cost of goods sold would be $400 (50 units x $8 per unit). Under the weighted average cost method, the cost of goods sold would be $450 (50 units x $9 per unit).

As you can see, the choice of inventory valuation method can have a significant impact on the cost of goods sold and, ultimately, the profitability of a company.

Importance of Accurate Beginning Inventory

:max_bytes(150000):strip_icc()/TermDefinitions_Inventory_finalv2-174a95eaeac3409d971256da7ecb164b.jpg)

Accurate beginning inventory records are crucial for maintaining the integrity of a company’s financial statements and making informed business decisions.

Inaccurate beginning inventory can lead to:

- Overstatement or Understatement of Assets:Incorrect beginning inventory can result in overstating or understating the value of assets on the balance sheet.

- Overstatement or Understatement of Expenses:Inaccurate beginning inventory can affect the calculation of cost of goods sold, leading to overstated or understated expenses on the income statement.

For example, if a company underestimates its beginning inventory, it will overstate its cost of goods sold and underestimate its gross profit. This can lead to incorrect financial ratios and mislead management in making decisions regarding pricing, production, and inventory management.

Best Practices for Managing Beginning Inventory

Beginning inventory management is crucial for businesses to maintain accurate financial records and optimize operations. Implementing best practices can help businesses effectively manage their inventory levels, reduce costs, and improve profitability.

Regular Physical Counts, Business beginning inventory definition

Regular physical counts involve manually verifying the quantity of inventory on hand and comparing it to the inventory records. This process helps identify discrepancies between the physical inventory and the records, ensuring accurate inventory data.

Inventory Control Systems

Inventory control systems are software applications that automate inventory management processes, such as tracking inventory levels, managing orders, and generating reports. These systems provide real-time visibility into inventory levels, allowing businesses to make informed decisions about replenishment and avoid stockouts.

Inventory Optimization Techniques

Inventory optimization techniques aim to determine the optimal inventory levels to minimize holding costs while meeting customer demand. These techniques include ABC analysis, which categorizes inventory items based on their value and demand, and just-in-time (JIT) inventory management, which involves holding only the necessary inventory to meet immediate demand.

Summary

In conclusion, business beginning inventory definition is not merely a technical accounting concept but a vital tool for effective financial management. Its accurate determination and management empower businesses to optimize inventory levels, minimize costs, and make strategic decisions that propel them towards long-term success.

By embracing best practices and leveraging technology, businesses can harness the full potential of beginning inventory as a catalyst for financial excellence.

FAQ Section

What is the significance of beginning inventory in financial reporting?

Beginning inventory forms the basis for calculating the cost of goods sold, which is a crucial component in determining a company’s gross profit and net income.

How does the perpetual inventory system differ from the periodic inventory system?

The perpetual inventory system continuously tracks inventory levels throughout the accounting period, while the periodic inventory system determines inventory levels only at specific intervals, such as at the end of a month or quarter.

What are the advantages of using the FIFO inventory valuation method?

FIFO (First-In, First-Out) assumes that the oldest inventory is sold first, resulting in a lower cost of goods sold during periods of rising prices.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY