The business acquisition inventory, an essential tool in the acquisition process, provides a comprehensive overview of a target business’s assets, liabilities, and operations. By conducting a thorough inventory, acquirers can gain valuable insights into the target’s financial health, operational efficiency, and overall value, enabling them to make informed decisions and mitigate risks.

This guide delves into the intricacies of business acquisition inventory, exploring its components, processes, and best practices. It also examines the role of due diligence in ensuring a successful acquisition and highlights the impact of technology tools in streamlining the inventory process.

Overview of Business Acquisition Inventory

A business acquisition inventory is a comprehensive list of all the assets and liabilities of a business that is being acquired. It is used to determine the value of the business and to ensure that the buyer is aware of all the risks and liabilities involved in the acquisition.

Conducting a business acquisition inventory is an important step in the acquisition process. It can help to identify any potential problems with the business, and it can also help to ensure that the buyer is getting a fair price for the business.

Purpose of a Business Acquisition Inventory

- To determine the value of the business.

- To identify any potential problems with the business.

- To ensure that the buyer is getting a fair price for the business.

Importance of a Business Acquisition Inventory

- Can help to avoid costly surprises after the acquisition.

- Can help to ensure that the buyer is making an informed decision about the acquisition.

- Can help to protect the buyer from legal liability.

Components of Business Acquisition Inventory

A business acquisition inventory is a comprehensive list of all the assets and liabilities of a target business. It is used to evaluate the target business’s financial health and to determine its purchase price.

The key components of a business acquisition inventory include:

- Assets:Assets are anything of value that the target business owns. This includes physical assets, such as inventory, equipment, and real estate, as well as intangible assets, such as patents, trademarks, and goodwill.

- Liabilities:Liabilities are debts that the target business owes. This includes accounts payable, notes payable, and taxes payable.

- Equity:Equity is the difference between the target business’s assets and liabilities. It represents the ownership interest in the business.

Each of these components is important in evaluating a target business. The assets and liabilities provide a snapshot of the business’s financial health, while the equity provides insight into the ownership structure.

Assets

The assets of a target business can be divided into two categories: current assets and non-current assets.

- Current assetsare assets that can be easily converted into cash. This includes inventory, accounts receivable, and cash on hand.

- Non-current assetsare assets that cannot be easily converted into cash. This includes equipment, real estate, and investments.

The current assets of a target business are important because they provide a measure of the business’s liquidity. The non-current assets are important because they provide a measure of the business’s long-term value.

Liabilities

The liabilities of a target business can be divided into two categories: current liabilities and non-current liabilities.

- Current liabilitiesare debts that are due within one year. This includes accounts payable, notes payable, and taxes payable.

- Non-current liabilitiesare debts that are due more than one year from now. This includes long-term debt and deferred taxes.

The current liabilities of a target business are important because they provide a measure of the business’s short-term financial obligations. The non-current liabilities are important because they provide a measure of the business’s long-term financial obligations.

Equity

The equity of a target business is the difference between the business’s assets and liabilities. It represents the ownership interest in the business.

The equity of a target business is important because it provides insight into the ownership structure of the business. It also provides a measure of the business’s financial stability.

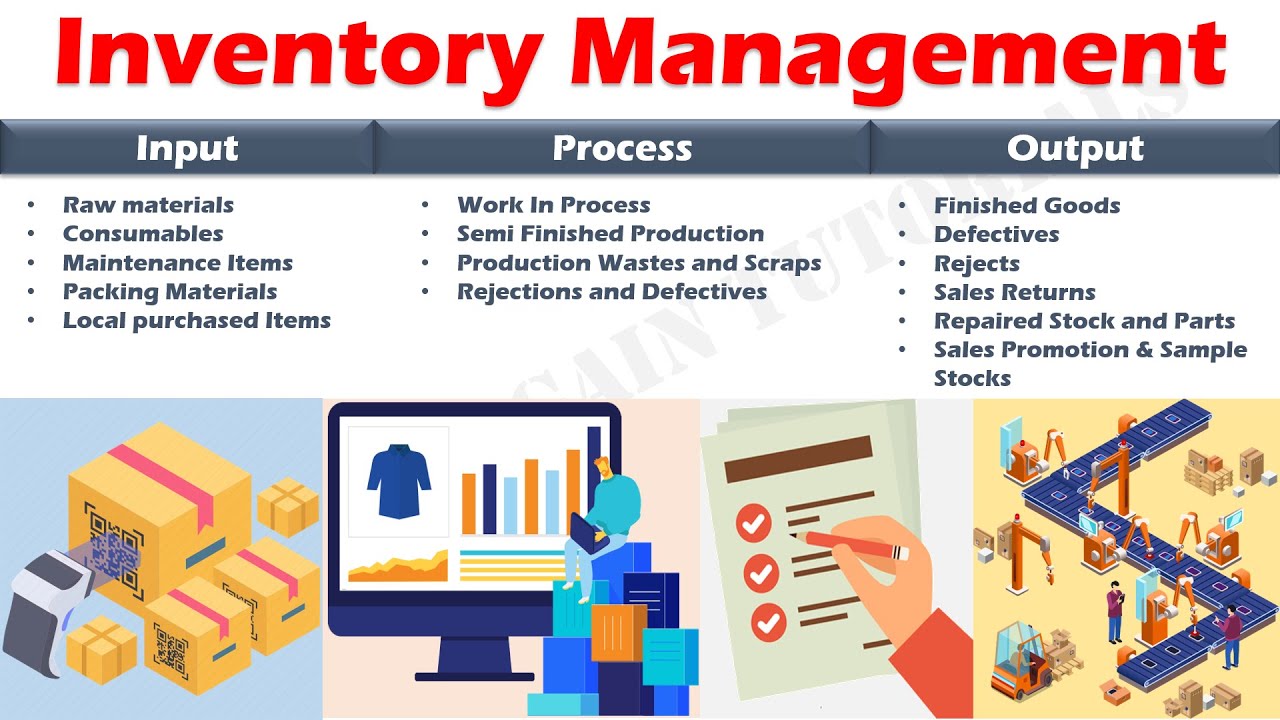

Process of Conducting Business Acquisition Inventory

Conducting a business acquisition inventory involves a structured process to gather, analyze, and document information about the assets and liabilities of the target business. This process is crucial for determining the fair value of the business and ensuring a smooth transition during the acquisition.

Steps Involved in Conducting a Business Acquisition Inventory

- Planning and Preparation:Define the scope of the inventory, establish a timeline, and assemble a team with relevant expertise.

- Data Gathering:Collect financial statements, tax returns, contracts, and other relevant documents from the target business.

- Asset Identification and Valuation:Identify and assess the value of all tangible and intangible assets, including property, equipment, inventory, and intellectual property.

- Liability Assessment:Review financial statements and legal documents to identify and evaluate all potential liabilities, such as debts, warranties, and environmental obligations.

- Documentation and Reporting:Prepare a detailed inventory report that summarizes the findings, including the valuation of assets and liabilities, and any adjustments or recommendations.

Guidance on Gathering and Analyzing Relevant Data

Gathering and analyzing relevant data is critical for an accurate business acquisition inventory. Here are some guidelines:

- Use multiple sources:Collect data from various sources, such as financial statements, tax returns, and interviews with management, to ensure completeness and accuracy.

- Verify and validate data:Scrutinize the data for inconsistencies and errors, and seek independent verification when necessary.

- Apply industry benchmarks:Compare the target business’s financial and operational data to industry averages to assess its performance and identify potential red flags.

- Consider qualitative factors:Take into account qualitative factors, such as market conditions, customer relationships, and management capabilities, to supplement the quantitative data.

- Document the process:Keep a record of all data sources, assumptions, and calculations made during the inventory process to ensure transparency and auditability.

Types of Business Acquisition Inventories

Business acquisition inventories vary in their scope and purpose. The selection of an appropriate type depends on the specific objectives of the acquisition and the resources available.

Physical Inventory

A physical inventory involves counting and documenting the physical assets of the target business. This includes tangible assets such as inventory, equipment, and real estate.

- Advantages:Provides a detailed and accurate representation of the physical assets, allowing for precise valuation.

- Disadvantages:Time-consuming and labor-intensive, potentially disrupting the target business’s operations.

Financial Inventory

A financial inventory reviews the financial records of the target business to assess its financial health and performance. This includes analyzing balance sheets, income statements, and cash flow statements.

- Advantages:Provides insights into the target business’s financial position, profitability, and cash flow.

- Disadvantages:May not fully capture all assets and liabilities, relies on the accuracy of financial records.

Operational Inventory

An operational inventory evaluates the target business’s operations, including its processes, systems, and management team. This involves assessing the efficiency, effectiveness, and potential risks associated with the business’s operations.

- Advantages:Provides a comprehensive understanding of the target business’s operational capabilities and potential areas for improvement.

- Disadvantages:Can be subjective and difficult to quantify, requires access to detailed operational data.

Market Inventory

A market inventory assesses the target business’s market position, including its customer base, competitors, and industry trends. This involves analyzing market share, customer demographics, and competitive dynamics.

- Advantages:Provides insights into the target business’s market potential and growth opportunities.

- Disadvantages:Can be influenced by external factors beyond the target business’s control, requires access to market research and industry data.

Common Challenges in Business Acquisition Inventory

Conducting a business acquisition inventory can be a complex and challenging process. Here are some common challenges that may be encountered:

Data Accuracy and Availability:Obtaining accurate and complete data on the target company’s assets and liabilities can be difficult, especially if the target company is privately held or has poor record-keeping practices.

Strategies to Overcome Challenges

- Thorough Due Diligence:Conduct a comprehensive due diligence process to gather as much data as possible from various sources, including financial statements, tax returns, and interviews with key personnel.

- External Validation:Engage external experts, such as accountants or appraisers, to validate the data and provide an independent assessment of the target company’s assets and liabilities.

- Assumptions and Estimates:When data is unavailable or incomplete, make reasonable assumptions and estimates based on industry benchmarks and other available information.

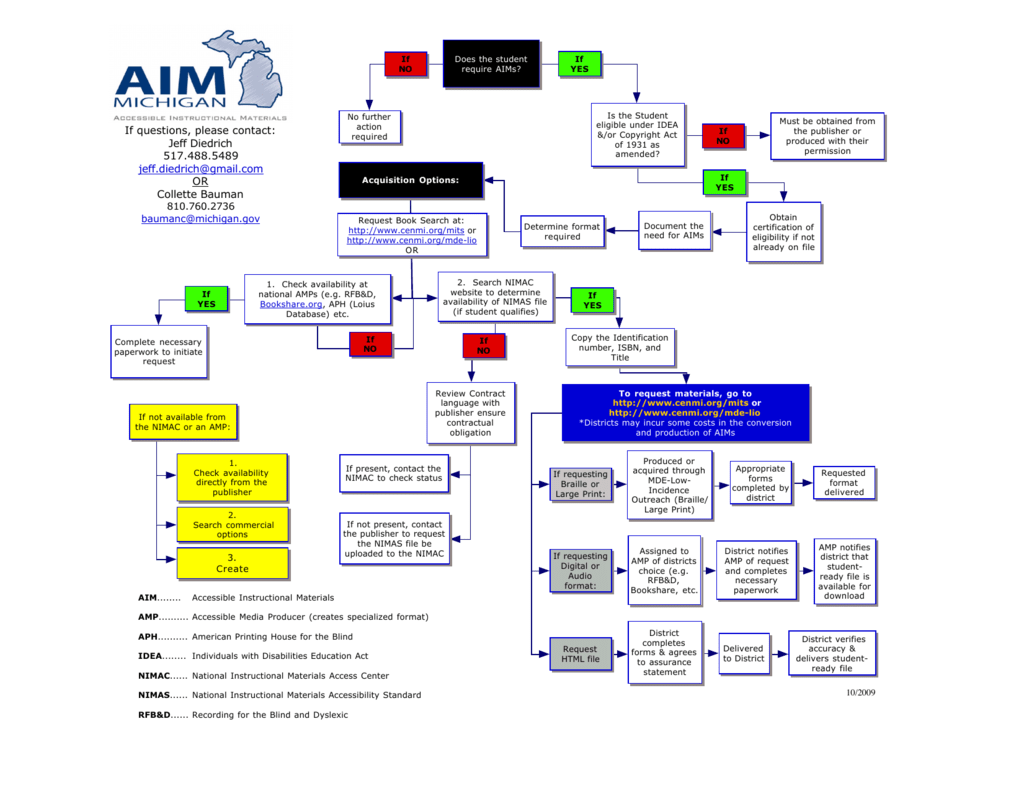

Role of Due Diligence in Business Acquisition Inventory

Due diligence is a critical step in the business acquisition inventory process, as it allows the acquiring company to assess the target company’s inventory and ensure its accuracy and completeness.

During due diligence, the acquiring company should focus on the following key areas:

Inventory Valuation

- Reviewing the target company’s inventory valuation methods and ensuring they are consistent with industry standards.

- Verifying the accuracy of the inventory counts and ensuring they are supported by appropriate documentation.

- Assessing the condition of the inventory and identifying any obsolete or damaged items.

Inventory Management

- Evaluating the target company’s inventory management practices and identifying any areas for improvement.

- Reviewing the target company’s inventory turnover ratio and identifying any trends or concerns.

- Assessing the target company’s inventory storage and handling procedures.

Inventory Control

- Reviewing the target company’s inventory control systems and ensuring they are adequate to prevent theft or loss.

- Verifying the accuracy of the target company’s inventory records and identifying any discrepancies.

- Assessing the target company’s inventory insurance coverage and ensuring it is adequate.

Best Practices for Business Acquisition Inventory

Conducting a thorough and effective business acquisition inventory is crucial for a successful transaction. Best practices include meticulous planning, stakeholder involvement, data accuracy, and leveraging technology.

A well-executed inventory process ensures a comprehensive understanding of the target company’s assets, liabilities, and operations. It also facilitates due diligence, valuation, and integration planning.

Planning and Preparation

Prior to commencing the inventory, establish a clear scope, timeline, and budget. Identify key stakeholders and assign responsibilities. Develop a comprehensive checklist to guide the process and ensure consistency.

Data Collection and Verification

Gather data from various sources, including financial statements, contracts, and internal records. Verify the accuracy of the information through independent sources and cross-checking. Consider using automated tools to streamline data collection and reduce errors.

Asset Valuation, Business acquisition inventory

Determine the fair market value of the target company’s assets. Consider using professional appraisers or industry benchmarks to ensure objectivity and accuracy. This valuation is critical for determining the purchase price and negotiating terms.

Integration Planning

The business acquisition inventory provides valuable insights for planning the integration of the target company into the acquiring organization. Identify potential synergies, overlaps, and areas for improvement.

Case Study: XYZ Corporation Acquisition

XYZ Corporation acquired ABC Company in a recent transaction. A comprehensive business acquisition inventory revealed significant synergies in product lines and customer base. This led to the integration of the two companies’ sales and marketing functions, resulting in increased revenue and improved market share.

Impact of Business Acquisition Inventory on Decision-Making

Business acquisition inventory plays a crucial role in decision-making, providing valuable insights into the target business’s operations and financial health. It helps decision-makers assess the target’s strengths, weaknesses, and potential risks.

Assessing Target Business Value

By analyzing the inventory, decision-makers can determine the target’s true worth, considering factors such as inventory turnover, carrying costs, and obsolescence. This information is essential for negotiating a fair price and avoiding overpaying for the target business.

Identifying Potential Risks

Inventory discrepancies, slow-moving items, or obsolete products can indicate operational inefficiencies or hidden problems within the target business. Identifying these issues during the inventory process allows decision-makers to assess potential risks and take appropriate mitigating actions before closing the deal.

Technology Tools for Business Acquisition Inventory

Technology tools can greatly assist in conducting business acquisition inventories by streamlining the process, improving accuracy, and providing real-time insights. These tools offer various features, including automated data collection, centralized documentation, and advanced analytics.

Inventory Management Software

Inventory management software is a comprehensive solution that helps businesses track and manage their inventory in real-time. It can be integrated with other systems, such as accounting and CRM, to provide a holistic view of the business. Inventory management software can automate inventory tracking, generate reports, and provide alerts when stock levels are low.

Data Analytics Tools

Data analytics tools allow businesses to analyze their inventory data to identify trends, patterns, and areas for improvement. These tools can help businesses optimize their inventory levels, reduce waste, and improve profitability. Data analytics tools can also be used to create custom reports and dashboards that provide insights into inventory performance.

Mobile Inventory Apps

Mobile inventory apps allow businesses to conduct inventory counts and manage inventory on the go. These apps typically use barcode scanners to quickly and accurately capture inventory data. Mobile inventory apps can also be used to generate reports, create purchase orders, and track inventory movements.

Benefits of Technology Tools for Business Acquisition Inventory

* Streamlined process:Technology tools can automate many tasks associated with business acquisition inventory, such as data collection and reporting. This can free up time for other tasks and improve efficiency.

Improved accuracy

Technology tools can help to improve the accuracy of business acquisition inventory by eliminating human error.

Real-time insights

Technology tools can provide real-time insights into inventory performance, which can help businesses make better decisions.

Reduced costs

Technology tools can help businesses reduce costs by optimizing inventory levels and reducing waste.

Limitations of Technology Tools for Business Acquisition Inventory

* Cost:Technology tools can be expensive to purchase and implement.

Complexity

Some technology tools can be complex to use, which can require training and support.

Data security

Technology tools can store sensitive data, so it is important to ensure that they are secure.Overall, technology tools can be a valuable asset for businesses conducting business acquisition inventory. These tools can help to streamline the process, improve accuracy, and provide real-time insights.

However, it is important to carefully consider the costs and limitations of these tools before making a decision.

Conclusive Thoughts

In conclusion, a well-executed business acquisition inventory is a cornerstone of successful acquisitions. It provides a roadmap for acquirers to navigate the complexities of target evaluation, enabling them to make strategic decisions and maximize the value of their investments. By embracing best practices, leveraging technology, and conducting thorough due diligence, acquirers can gain a competitive edge and increase their chances of achieving acquisition success.

General Inquiries

What is the purpose of a business acquisition inventory?

A business acquisition inventory provides a detailed snapshot of a target business’s assets, liabilities, and operations, enabling acquirers to assess its financial health, operational efficiency, and overall value.

What are the key components of a business acquisition inventory?

Key components include financial statements, contracts, customer lists, employee information, and operational data, providing a comprehensive overview of the target business.

How does due diligence contribute to the business acquisition inventory process?

Due diligence involves verifying and validating the information gathered during the inventory process, ensuring accuracy and mitigating potential risks associated with the acquisition.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY