Business accounting inventory farm, the cornerstone of effective farm management, provides a comprehensive approach to tracking, valuing, and controlling farm assets. This guide delves into the intricacies of inventory management, cost accounting, valuation, and auditing, empowering farmers with the knowledge to optimize their operations and maximize profitability.

From understanding the importance of inventory management to leveraging technology for efficient tracking, this guide covers all aspects of business accounting inventory farm, ensuring that farmers have the tools and strategies they need to succeed.

Inventory Management in Farm Accounting

Inventory management is crucial for farm accounting as it provides an accurate representation of the farm’s assets and financial position. It involves tracking and managing various types of inventory, such as livestock, crops, feed, and supplies.

Types of Inventory Tracked on Farms

Farms track different types of inventory, including:

- Livestock:Animals raised for breeding, dairy, or meat production.

- Crops:Plants grown for food, fiber, or other commercial purposes.

- Feed:Food for livestock, such as hay, grain, and supplements.

- Supplies:Materials used in farm operations, such as fertilizers, pesticides, and equipment.

Methods of Tracking and Managing Inventory, Business accounting inventory farm

Various methods are used to track and manage inventory on farms, including:

- Physical Counts:Regularly counting inventory to determine its quantity and value.

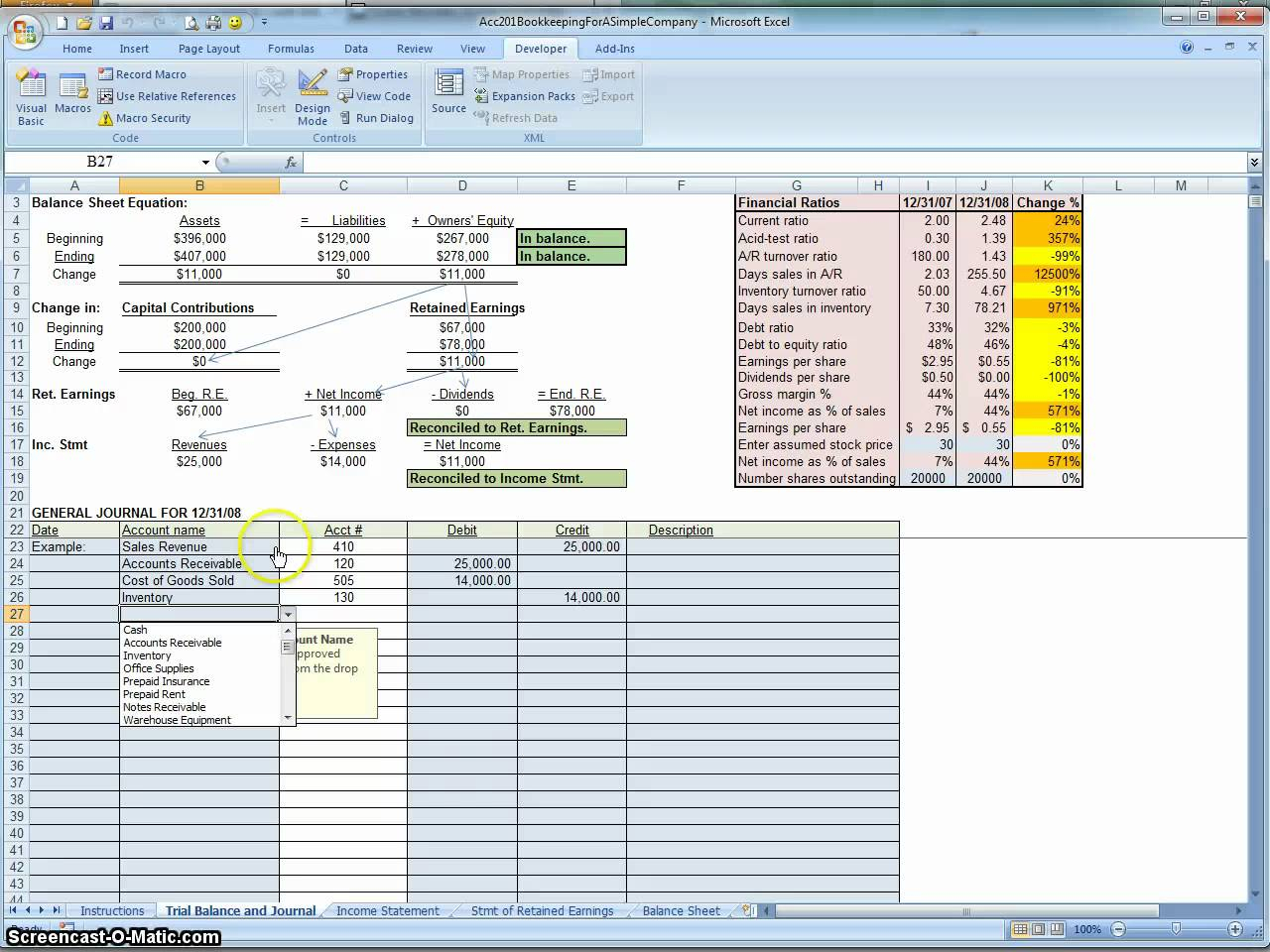

- Inventory Management Software:Computerized systems that track inventory levels, costs, and other related data.

- RFID (Radio Frequency Identification):Electronic tags attached to inventory items that allow for automatic tracking and identification.

Accounting for Inventory Costs

Inventory costs represent a crucial aspect of farm accounting, significantly impacting profitability and financial decision-making. Understanding the methods used to account for inventory costs is essential for accurate financial reporting and informed management.

Methods for Accounting for Inventory Costs

- Specific Identification:Each inventory item is uniquely identified and tracked, allowing for the assignment of specific costs to each item sold.

- First-In, First-Out (FIFO):Assumes that the oldest inventory items are sold first, resulting in the recognition of earlier purchase costs as expenses.

- Last-In, First-Out (LIFO):Assumes that the most recently purchased inventory items are sold first, leading to the recognition of later purchase costs as expenses.

- Weighted Average:Calculates an average cost per unit based on all inventory items available for sale, regardless of their purchase date.

The choice of inventory costing method depends on various factors, including the nature of the inventory items, the volume of transactions, and the desired level of accuracy in cost assignment.

Impact of Inventory Costs on Farm Profitability

Inventory costs play a significant role in determining farm profitability by influencing:

- Cost of Goods Sold:Inventory costs are a major component of the cost of goods sold, which directly affects gross profit margins.

- Tax Liability:The method used to account for inventory costs can impact the timing and amount of tax liability.

- Financial Ratios:Inventory costs influence financial ratios such as inventory turnover and gross profit margin, which are used to assess the efficiency and profitability of the farm.

Examples of Inventory Cost Calculation on Farms

On a dairy farm, the following inventory costs may be considered:

- Feed:Cost of purchased feed and homegrown feed.

- Veterinary Supplies:Medications, vaccines, and other medical expenses.

- Equipment:Depreciation on milking equipment, tractors, and other farm machinery.

- Livestock:Purchase price or breeding costs of dairy cows.

By accurately accounting for these inventory costs, farmers can gain valuable insights into their financial performance and make informed decisions to optimize profitability.

Inventory Valuation and Reporting

Inventory valuation and reporting are critical components of farm accounting. The valuation method used will impact the financial statements and the profitability of the farm.

There are several different methods that can be used to value inventory. The most common methods are:

- First-in, first-out (FIFO)

- Last-in, first-out (LIFO)

- Average cost

Each of these methods has its own advantages and disadvantages. The FIFO method assumes that the oldest inventory is sold first. The LIFO method assumes that the newest inventory is sold first. The average cost method assumes that the cost of inventory is the average of the cost of all inventory on hand.

The requirements for reporting inventory on financial statements are set by the Financial Accounting Standards Board (FASB). FASB requires that inventory be reported at the lower of cost or market value. This means that the inventory cannot be reported at a value that is higher than its cost or its market value.

Inventory is typically reported on farm financial statements in the current assets section of the balance sheet. The inventory is usually listed at its cost or market value, whichever is lower.

Inventory Control and Auditing

Inventory control and auditing are essential components of farm accounting. Effective inventory management helps farms optimize their inventory levels, reduce waste, and improve profitability. Inventory audits, on the other hand, provide assurance that the inventory records are accurate and reliable.

Inventory Control Methods

There are several methods used to control inventory on farms:

- Periodic Inventory System:This system involves physically counting the inventory at regular intervals, such as monthly or quarterly.

- Perpetual Inventory System:This system tracks inventory levels continuously, updating them with each transaction.

- Just-in-Time (JIT) Inventory System:This system aims to minimize inventory levels by receiving inventory only when needed for production or sale.

- First-In, First-Out (FIFO) Inventory System:This system assumes that the oldest inventory is sold first.

- Last-In, First-Out (LIFO) Inventory System:This system assumes that the most recent inventory is sold first.

Importance of Inventory Audits

Inventory audits are crucial for several reasons:

- Accuracy of Financial Statements:Inventory is a significant asset for farms, and accurate inventory records are essential for reliable financial statements.

- Detection of Errors and Fraud:Inventory audits can help detect errors in inventory records, as well as instances of fraud or theft.

- Compliance with Regulations:Many farms are required to comply with regulations that mandate regular inventory audits.

Inventory Audit Procedures on Farms

Inventory audits on farms typically involve the following procedures:

- Physical Verification:The inventory is physically counted and compared to the inventory records.

- Reconciliation:Any discrepancies between the physical count and the records are investigated and reconciled.

- Valuation:The inventory is valued using an appropriate method, such as cost or market value.

- Reporting:The results of the inventory audit are reported to management and, if necessary, to external stakeholders.

Technology and Inventory Management

Technology plays a vital role in modern inventory management, streamlining processes and improving efficiency. Farms are increasingly adopting software and systems to enhance their inventory control.

Software and Systems for Inventory Management on Farms

- Farm Management Software:Comprehensive software that integrates inventory management with other farm operations, such as crop planning, livestock tracking, and financial reporting.

- Inventory Management Systems:Specialized software that focuses on inventory tracking, valuation, and reporting.

- Barcode and RFID Systems:Automated systems that use barcodes or radio frequency identification (RFID) tags to track inventory items.

- Cloud-Based Inventory Management:Web-based platforms that provide remote access to inventory data and management tools.

Benefits of Using Technology for Inventory Management

- Improved Accuracy:Automated systems minimize errors in inventory tracking and data entry.

- Real-Time Visibility:Technology provides up-to-date inventory information, enabling farms to make informed decisions.

- Reduced Costs:Technology helps optimize inventory levels, reducing waste and storage costs.

- Enhanced Efficiency:Automated processes save time and labor, freeing up farm personnel for other tasks.

- Improved Compliance:Technology facilitates record-keeping and reporting, ensuring compliance with regulatory requirements.

Closure

In conclusion, business accounting inventory farm is an essential aspect of modern farm management. By embracing the principles Artikeld in this guide, farmers can gain a clear understanding of their inventory, optimize their operations, and make informed decisions that drive profitability and long-term success.

General Inquiries: Business Accounting Inventory Farm

What are the key benefits of implementing a business accounting inventory farm system?

Improved inventory accuracy, reduced costs, enhanced decision-making, and increased profitability.

How can technology assist in managing farm inventory?

Software and systems can automate tracking, streamline data collection, and provide real-time insights into inventory levels.

What are the different methods used to value inventory on farms?

Average cost, FIFO (first-in, first-out), and LIFO (last-in, first-out) are common valuation methods.

wohnroom.biz.id BUSINESS INVENTORY

wohnroom.biz.id BUSINESS INVENTORY